Moderna's (MRNA) CEO sold $400m in stock...

Moderna's (MRNA) CEO sold $400m in stock...

The media has been making a huge deal about stories of corporate insiders selling their stocks during specific selling windows, which is both legal and very typical.

For CEOs or founders, selling their own stock has historically been viewed negatively, like the executive has lost faith in their company.

Insider selling activity has been overly exaggerated and is often misinterpreted.

There are several reasons why a CEO or founder might sell their shares, most of them being neither bearish signals nor illegal.

The Securities and Exchange Commission ("SEC") allows legal insider trading through a 10b5-1 program. Under the program, executives can purchase or sell a fixed number of shares based on a prescheduled trading plan.

10b5-1 has improved the transparency of executive trading activities. As a result, investors now have better oversight into executives' intentions and sentiments.

Moderna continues to boost returns despite insider selling...

Moderna continues to boost returns despite insider selling...

Moderna has been in the headlines a lot recently, except this time, the media isn't talking about vaccine efficacy.

The major outlets have all been making a huge deal about Moderna's CEO and founder, Stéphane Bancel, selling more than $400 million worth of company stock since the pandemic began.

On the surface, it could be an alarming signal to investors, as it looks like the founder is grabbing cash while the stock is hot.

But, if you dig deeper, it becomes clear that selling $400 million was the prudent, if not slightly conservative, thing for him to do.

You see, Bancel still owns a whopping $2.6 billion of stock. Even for a founder, there's nothing wrong with a little smart portfolio management.

Plus, Moderna still seems to be trending in the right direction.

Moderna had its breakthrough success by rapidly developing its two-dose COVID-19 vaccine. Its shots became the second-most used vaccine in the U.S, after pharma giant Pfizer's (PFE) vaccine.

Let's look at The Altimeter to see Moderna's performance...

Let's look at The Altimeter to see Moderna's performance...

Moderna was one of the biggest winners in the piping-hot biotech space over the last two years.

The company was able to develop one of the strongest COVID-19 vaccines rapidly, and it was able to go to market in less than a year.

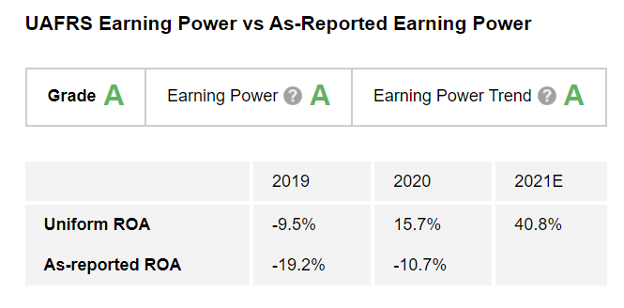

The Altimeter shows just how great Moderna performed, thanks to its vaccine.

The company's Uniform return on assets ("ROA") inflected from negative 9.5% in 2019 to nearly 16% in 2020, before it even had a chance to start distributing its vaccines. While 2021 figures are still being finalized, Uniform ROA is expected to reach nearly 41%.

With such strong returns, Moderna earns an "A" grade for Earning Power and Earning Power Trend, giving the company an "A" grade for Performance.

Does this mean Moderna is a buy?

Does this mean Moderna is a buy?

An investor might see Moderna's Performance grade and automatically think that this biotech company is a good investment. But this doesn't factor in whether the market might already be pricing this in.

We also need to be mindful of valuations to understand if the market already knows how profitable Moderna is.

Even after the Bancel offloaded $400 million in MRNA stock, it’s still up more than 600% since the pandemic began. It's a sign that investors were keen to ride the vaccine development wave early.

There are other emerging developments among health care companies...

There are other emerging developments among health care companies...

In fact, we've only scratched the surface of a brewing revolution that could make the extraordinary medical advances we've already accomplished look like child's play.

Right now, we're on the verge of a complete disruption of the $12 trillion health care industry. And we found five stocks with tremendous upside in this corner of the market.

It could mean billions of dollars in pure profit for the companies involved. And for you, it could mean a series of 250%... 500%... even 1,000% gains...

Click here to learn more.

Regards,

Rob Spivey

April 7, 2022

Moderna's (MRNA) CEO sold $400m in stock...

Moderna's (MRNA) CEO sold $400m in stock...