There's more to reaching net-zero than saving the environment…

There's more to reaching net-zero than saving the environment…

As new climate reports and data continue to flow in, government officials, management teams, and consumers alike have realized the necessity of getting the world off fossil fuels.

While governments can create regulations and drive investments to nudge us in the right direction, the buck stops with what private companies are willing to do.

This is a challenge because these initiatives, often bucketed as "ESG" (which stands for environmental, social, and governance), require heavy upfront investments without a clear benefit to investors.

That may be why Tesla (TSLA) became such a blockbuster success.

Through its electric cars, Tesla didn't just invent an ESG-oriented product that consumers preferred to non-ESG alternatives. It deduced a way to generate hundreds of billions of dollars of incremental investor value in the process.

It's no surprise that electric vehicles have been a central part of the global conversation on reaching net zero.

Electrifying our transportation network, however, is only one part of the puzzle. There is another, bigger fish to fry: Getting the utility industry off fossil fuels.

To illustrate this, consider that light-duty vehicles, where the bulk of the electrification dollars have been flowing, contribute about 17% of U.S. emissions.

Electricity generation, however, generates 25% of emissions.

That's before we consider the incremental effect of electrifying our transportation network, which is expected to increase nationwide electricity consumption by a quarter.

Meeting the net-zero emissions goal will be virtually impossible until the power generation industry goes renewable...

Meeting the net-zero emissions goal will be virtually impossible until the power generation industry goes renewable...

Not all green energy sources are created equal.

There are plenty of reservations about how hydroelectric power plants cause massive disruptions to their surrounding ecosystems, and the perceived harms of nuclear energy have kept its relevance muted. The industry has consolidated around wind and solar because they seem less disruptive...

However, an August article published by The Wall Street Journal implies that wind and solar have problems, but of a different variety: They aren't economical for the producers of renewable energy infrastructure.

The article highlighted how Vestas Wind Systems (CSE: VWS) and General Electric (GE), two of the largest wind turbine makers, see weaker profitability from their wind power investments.

The article attributes inconsistent subsidies, transportation costs, and raw material costs for the anemic profits.

But whenever any well-reputed newspaper declares that "people aren't making money on some new technology/business model," our antenna pops up. That is, after all, what we look at as our "bread and butter" when finding hidden gems.

Let's put The Wall Street Journal's claims about the renewable energy business to the test...

Let's put The Wall Street Journal's claims about the renewable energy business to the test...

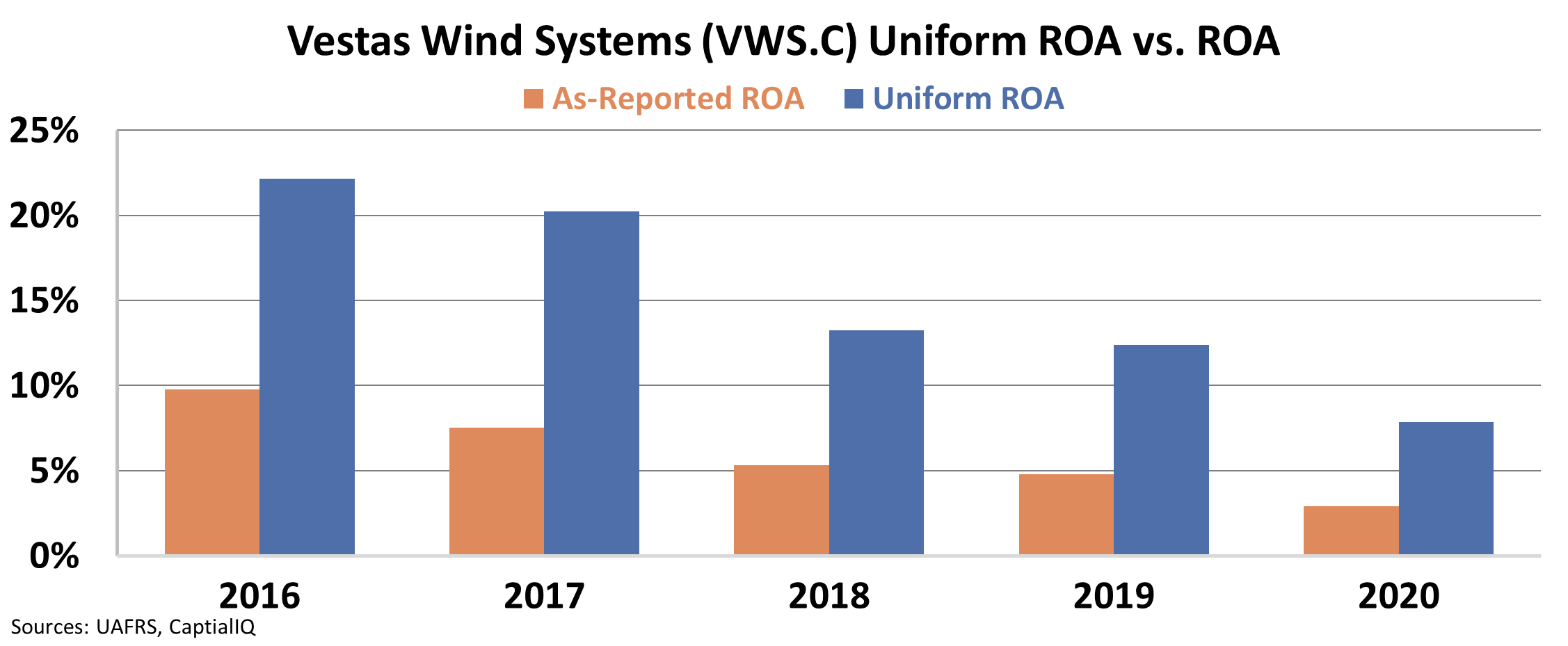

Vestas Wind Systems is the world's largest producer of wind turbines, generating more than $17 billion in revenue. A deeper look at its financials on a Uniform Accounting basis shows that the as-reported data is misleading.

Vestas' return on assets ("ROA") has been declining in recent years. But that's because 2020 and 2021 were tough for investment. This is understandable as utility companies deferred their capital expenditure (investments made into maintaining, upgrading, or expanding their physical infrastructure) en masse.

Additionally, increases in material and logistics costs put further incremental pressure on Vestas.

If you looked at the company's as-reported metrics, you'd think these pressures make Vestas look just as mediocre as other utility supply chain companies. That is likely what reporters are looking at, too.

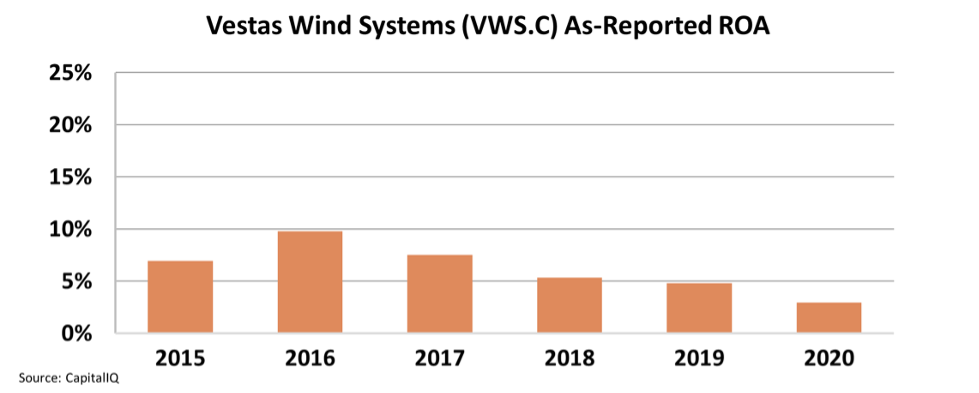

Take a look at Vestas' as-reported ROA:

As you can see, it would appear that Vestas has been unable to break 10% ROA and has been below the cost of capital since 2018.

This makes its historical profitability trends similar to the oil and gas drilling industry suppliers, such as Baker Hughes (BKR) and Petrofac (LSE: PFC). Both of these companies, which sell oil rigs, components, and services to drillers, have also seen ROAs fall less than the cost of capital in recent years.

An investor might ask: Why invest in new technology if, even after government subsidies and widespread social support, it cannot prove more profitable than the industry it is trying to disrupt?

Vestas is more profitable than its oil and gas stablemates...

Vestas is more profitable than its oil and gas stablemates...

Whether it is a consequence of subsidies or a stronger business model, the reality is that Vestas' Uniform ROA has been consistently higher than the cost of capital, even in 2020.

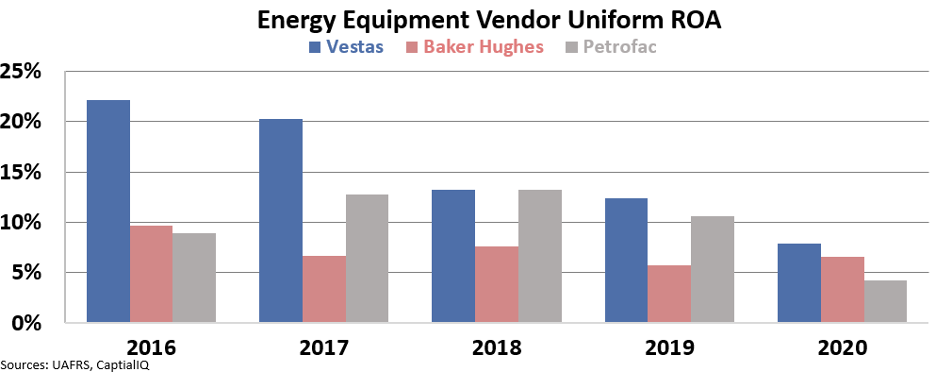

The difference becomes even more clear when comparing Vestas to its stablemates.

While Vestas doesn't compete directly with Baker Hughes or Petrofac, these companies play a similar role in the oil and gas space to what Vestas does in the wind energy space. As you can see below, Vestas boasts the better economic profitability among these three companies.

This once again demonstrates how as-reported metrics can distort the story.

There is more an investor needs to do before choosing to invest...

There is more an investor needs to do before choosing to invest...

After finding a more profitable company than its competitors with greater growth potential, you need to identify if the market is already pricing that profitability and growth into today's stock price.

That is why here at Altimetry, we use our Embedded Expectations Analysis framework to quantify this question.

When combining this framework with everything else that Uniform Accounting has to offer, we can hand-pick the best large-cap stocks in the investing universe. We then publish our ideas in Altimetry's Hidden Alpha newsletter.

Click here to join the other investors who have been using Hidden Alpha to get ahead of the market.

Regards,

Joel Litman

October 6, 2021

There's more to reaching net-zero than saving the environment…

There's more to reaching net-zero than saving the environment…