This e-commerce giant can't catch a break...

This e-commerce giant can't catch a break...

Alibaba (BABA) continues to make headlines, thanks to the drawn-out battle between the U.S. and China on whether it should be publicly listed in the U.S.

The negative news cycle that pervades Alibaba has left its investors disappointed for the most part. The e-commerce stock hasn't been lifted by whatever good news may be trickling through...

Alibaba recently announced its plan to combine its e-commerce units inside mainland China to streamline its business. Meanwhile, it is also creating a new team for operations outside China that now has the freedom to follow different strategic priorities than its domestic counterpart.

These two steps are likely to help Alibaba cut costs while accelerating growth.

Plus, the Chinese government's announcements that it would inject more liquidity into the financial system to support the economy should have sent the stock rocketing higher.

But the company seems to be immune to good news. Given all the regulatory overhang, we aren't surprised.

But there is something else that made Alibaba an unlikely winner from day one...

Alibaba's powerful e-commerce franchise had investors excited with its initial public offering ('IPO') in 2014...

Alibaba's powerful e-commerce franchise had investors excited with its initial public offering ('IPO') in 2014...

However, it would appear any hope for growth is gone.

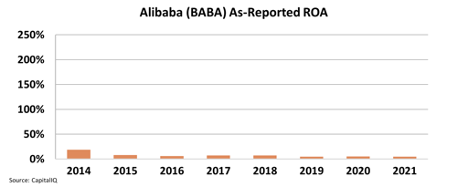

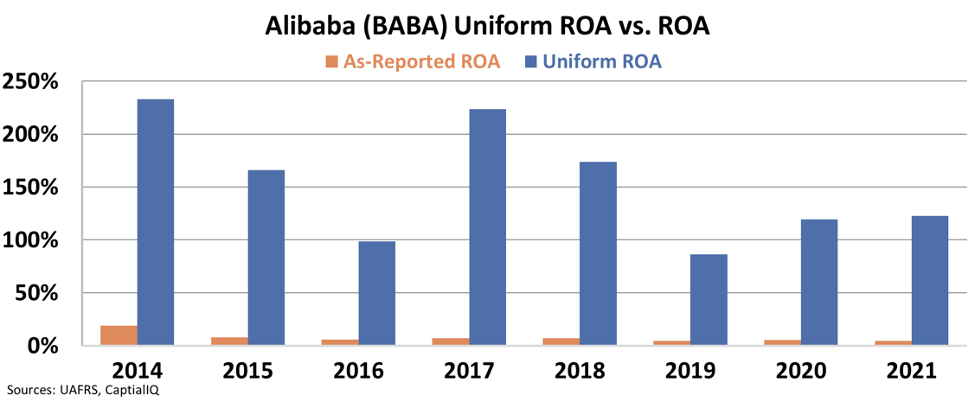

While Alibaba's as-reported return on assets ("ROA") has fallen from 19% in 2014 to a measly 5% in 2021, investors need to look further into why economic productivity appears to be falling.

Alibaba's as-reported asset base is ballooned out with intangible operations, such as goodwill, excess cash, and nonoperating long-term investments. Under Uniform Accounting, these are removed, so the ROA calculation reflects real economic productivity.

The company's Uniform ROA has been north of a staggering 100% almost every year for the past eight years, impressive even compared with similar e-commerce platforms.

See for yourself...

That shows how profitable Alibaba's business model has been.

The company has a massive opportunity to plant its foot in many parts of the world where Amazon (AMZN) isn't dominant. That's why Alibaba also has been able to produce these impressive returns even while growing at more than 20% annually in almost every year from 2015 to today.

But investors who bought Alibaba the day after its IPO in 2014 have only made roughly a 20% return in over seven years, a staggeringly weak return for a company with so much opportunity and earning power.

While the constant negative news cycle has put a constant, considerable load on BABA in the past few years... But there is another more fundamental reason why Alibaba isn't delivering to retail investors who bought the stock in 2014...

Alibaba was already a megacap when it went public...

Alibaba was already a megacap when it went public...

The real sky-high returns weren't made by public investors but by private equity asset managers like SoftBank.

SoftBank was in the stock two decades ago when it first started, making a $20 million bet on the firm being worth more than $50 billion. These kinds of returns make private equity such an exciting field to work in.

This isn't like Amazon, which had its IPO as a microcap at a relatively tiny valuation of $300 million in 1997. The public market got to participate in most of the company's explosive growth story, as its valuation soared to a staggering $1.7 trillion.

That's a more than 4,400 times return for public market investors.

That kind of opportunity in the public markets is why microcaps can be so exciting. We respect a very important concept in investing: Your returns don't always depend on where you end up, and sometimes they depend more on where you begin.

In most cases, large-cap companies have almost no potential to grow 1,000 times or more because they've grown to most of their capacity already.

How to spot tiny companies with great potential...

How to spot tiny companies with great potential...

Investors looking for massive gains need to be looking at the companies that are still flying under the radar, at tiny valuations, that hold the potential to one day become megacaps.

Last Thursday, Joel and I hosted a livestreamed event to talk about the importance of microcaps and how our Microcap Confidential service helps retail investors. To date, our Microcap Confidential portfolio is up more than 50%, with several triple-digit winners!

In our livestreamed webinar, we even disclosed some of our favorite stock-picks that are primed for outsized, compounding growth – for absolutely free. We also gave a big-picture outlook on what we see happening for the broader market in 2022... And we are giving away access to the replay for a very short time.

Make sure you watch our special December presentation while you can! You can view it right here.

Regards,

Rob Spivey

December 21, 2021

This e-commerce giant can't catch a break...

This e-commerce giant can't catch a break...