Whenever there is money, there is an attempt to steal it...

Whenever there is money, there is an attempt to steal it...

We are enamored with keeping up with the latest scandal as a society, especially when it's a big one.

It's a bit twisted, but it's impressive to have the distinction of being a participant in the single largest financial heist of all time.

When it comes to doing something bigger than ever, Goldman Sachs (GS) often finds itself in the middle of it. The bank tends to go "big" whenever it does something.

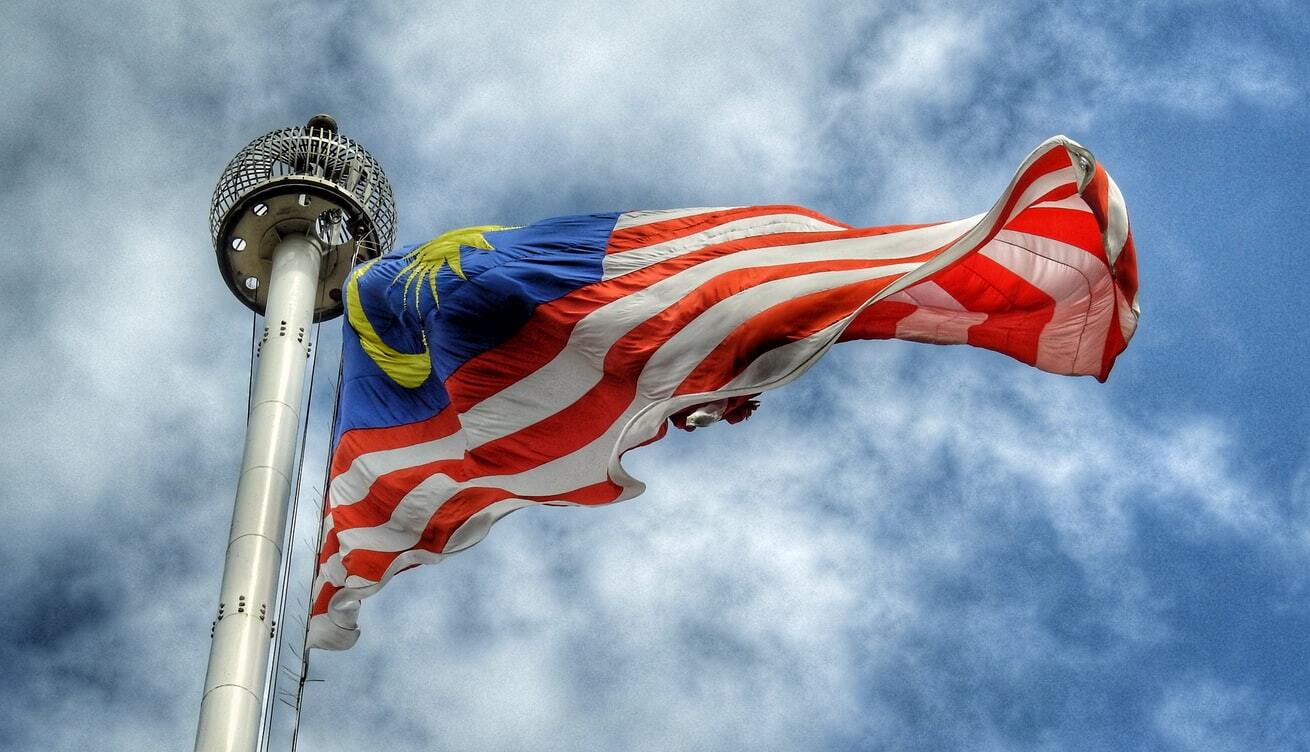

This time around, the epic heist involved the multibillion-dollar looting of funds from 1Malaysia Development Berhad ("1MDB"), a Malaysian government fund.

The scandal emerged from Goldman Sachs helping 1MDB sell around $6.5 billion in bonds –earning $600 million in fees for raising cash.

It's alleged that Goldman Sachs bankers helped launder and spend misappropriated funds. In 2020, the bank paid a $2.5 billion fine for its involvement as well as $3.9 billion to Malaysia for its alleged role.

We're starting to see the fallout...

We're starting to see the fallout...

After a period of disinterest in the big steal, the scandal has resurfaced in the news recently.

After years of delays, former Goldman Sachs executive Roger Ng's trial kicked off in New York at a Brooklyn federal court a few weeks ago. Ng is alleged to have seen millions in ill-gotten gains and kickbacks from the 1MDB scheme.

To no surprise, his attorney maintains that he is innocent, arguing that Goldman Sachs and the U.S. government are trying to place him off as a scapegoat.

Regardless of whether he's found guilty or not, two groups stand to profit greatly from these legal proceedings. Unfortunately for Ng, he is neither one of them.

The first group is all the lawyers involved – they will walk out wealthier. The other is all the people paid to do the legwork required to identify the money trail and journey.

At the heart of this industry is FTI Consulting (FCN). The company has a forensic and litigation consulting segment specializing in financial crimes, particularly crimes like anti-corruption and anti-money laundering, such as those in the 1MDB case.

Is solving crimes a profitable endeavor?

Is solving crimes a profitable endeavor?

As you might imagine, FTI Consulting operates in a very specialized consulting sector, with few competitors capable of offering the right domain expertise.

It also benefits from the fact that when a litigant requires FTI Consulting's services, the services are needed right at that moment. Litigants don't have the luxury of waiting around for another alternative.

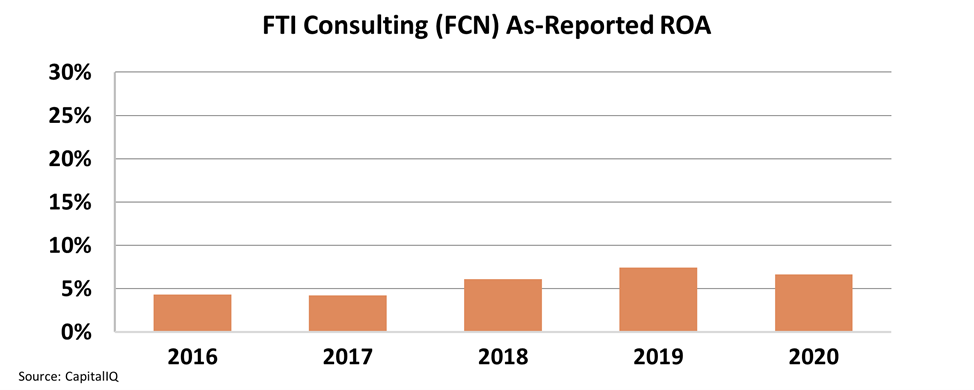

But even as the company is experiencing these sorts of market advantages, the as-reported metrics show a company that isn't doing as well as one might think.

Investors assume a struggling company by looking at the company's as-reported metrics for the last five years. The numbers show a company that has earned a range between 4% and 7% return on assets ("ROA"), which is barely above the cost of capital for the business.

Such a low number might confuse investors on whether FTI Consulting has dropped the ball on such a golden opportunity.

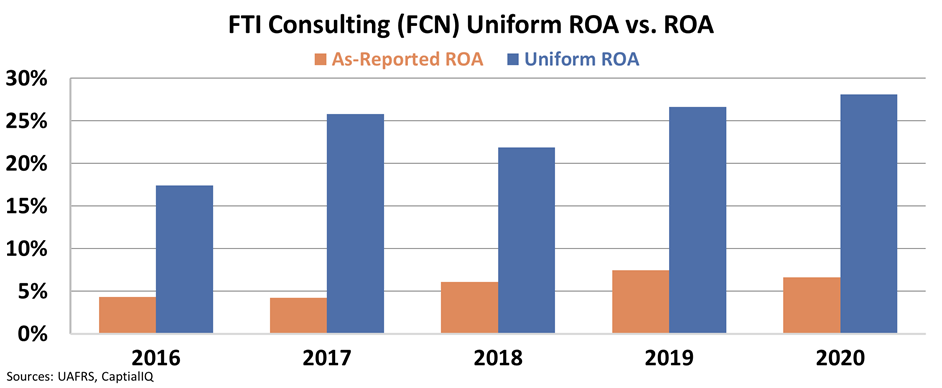

Here at Altimetry, we use our Uniform Accounting framework to account for GAAP-based distortions in financials.

With this Uniform Accounting data, we see a highly profitable company, with an ROA that rose from an already strong 17% in 2016 to a record-breaking 28% for the company... that's 4 times more than the as-reported metrics suggest.

FTI Consulting has captured the golden opportunity presented to the firm. It can charge a premium for its specialized services.

Is FTI Consulting a good stock to buy?

Is FTI Consulting a good stock to buy?

Thanks to Uniform Accounting, while we can see that fraud doesn't pay, policing fraud does in fact pay a strong return...

Here at Altimetry, we use our propriety method of sifting through thousands of publicly traded stocks to discover trends that Wall Street fails to notice.

Our team has a unique investigative skill of uncovering the truth, and we recommended future moonshots like Block (SQ) and Advanced Micro Devices (AMD) well before Wall Street caught on.

And now, my team and I have discovered another group of under-the-radar stocks that we're extremely bullish on.

Click here for the full story.

Regards,

Joel Litman

March 1, 2022

Whenever there is money, there is an attempt to steal it...

Whenever there is money, there is an attempt to steal it...