What appeared to be a summer reopening is quickly slamming shut with the uptick in COVID-19 cases...

What appeared to be a summer reopening is quickly slamming shut with the uptick in COVID-19 cases...

As summer draws to an end, many folks seek to squeeze in a final vacation over the coming Labor Day weekend.

But with the delta variant of the coronavirus spreading rampantly around the country, some might be worried they'll face restrictions or infection.

Bloomberg offers a useful tool on "International Travel During COVID-19: Where Can You Go and Which Destinations Are Still Sealed Off." It allows users to check where they can travel easily and see which destinations are sealed off.

The Bloomberg tool visualizes how easy travel is to different countries by using different colored emoji faces based on a myriad of data. The tool incorporates several factors, such as travel restrictions, local vaccination rates, and business and leisure openness.

Masked green faces, for example, signify better travel conditions. Masked yellow and red faces mean moderate and worse conditions, respectively. Grey unmasked faces represent a destination entirely sealed off to foreign travelers.

In hindsight, I believe my family and I were fortunate to choose the exact right moment to travel internationally this summer when we flew to Italy, France, and Spain in June.

I have been under the impression that travel has become much more cumbersome due to resurging virus concerns and reimposed restrictions. Tracking this report certainly reinforced my thinking.

As I've come back to check over the past few weeks, it certainly feels like more and more of the masked faces have turned yellow or red, indicating greater restrictions, or grey, meaning the destination is closed off altogether.

Among 35 major business and tourism destinations tracked by the Bloomberg tool, 11 are more accessible to travelers from New York City, with another 15 available but with significant restrictions.

More than a quarter of destinations from New York City are completely closed off. Some of those major ports of entry include Sydney, Tokyo, and Shanghai, to name a few.

So, if you're thinking of making an impromptu voyage for the coming holiday... make sure to do your research first!

New restrictions are not only a big disappointment for travelers but also investors betting on the global reopening...

New restrictions are not only a big disappointment for travelers but also investors betting on the global reopening...

One of the big themes we've been talking about here at Altimetry for more than a year is what we call "Survive and Thrive." The idea centers around finding companies that will weather the pandemic and then benefit from a global economic reopening.

The past two months have placed the theme on hold for many of these companies. That's as many countries grapple with continued coronavirus outbreaks.

With travel plans, one of the biggest industries impacted by the uptick in cases has been the airline industry, particularly the big airlines, which make most of their money on international flights.

But just because many are now under delta-related pressure doesn't mean they're about to fall back to the precipice of bankruptcy, as we saw when the global pandemic first began.

One example of a firm staying strong is Delta Air Lines (DAL). The large American carrier makes most of its revenue from the front end of the cabin, especially on international flights.

With restrictions now hindering international travel once again, one might wonder if Delta and its peers will be facing tough cost-cutting decisions and looking for government handouts as they were back in March 2020.

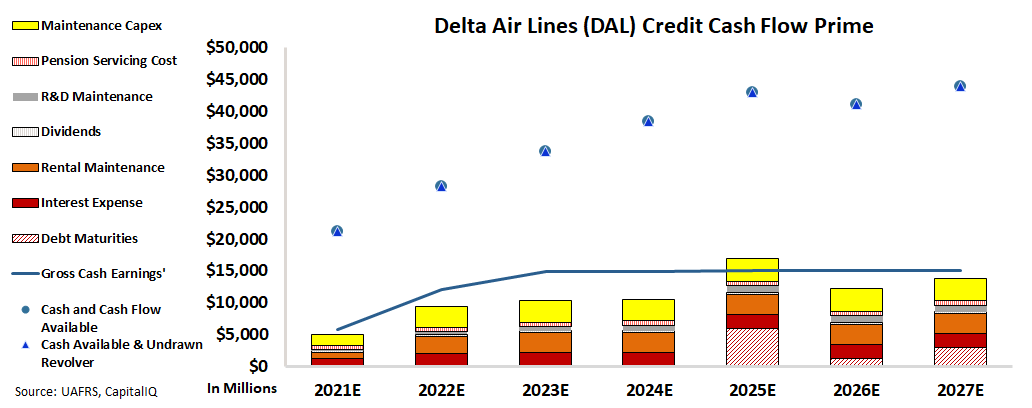

Fortunately, we have an easy way to check, just by looking at our Credit Cash Flow Prime ("CCFP") analysis, which can get at the heart of Delta's true credit risk.

In the chart below, the stacked bars represent the company's obligations each year for the next five years. We compare these obligations against cash flow (blue line) as well as the cash on hand at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

While the airliner's stock price has fallen from $50 a share in early 2021 to its current price of around $41, the CCFP shows that its cash flows will cover most of its obligations over the next few years, as the travel industry continues to recover.

Even if this recovery takes longer than is currently forecast, Delta's massive cash balances and limited debt maturities until 2025 provide plenty of flexibility, along with the reason for investors to be confident the company is "money good."

In other words, investors have little reason to fear Delta will be unable to pay back its debts, which makes it a classic example of a "Survive and Thrive" idea.

At Altimetry, we have identified several 'Survive and Thrive' names in the vein of Delta Air Lines...

At Altimetry, we have identified several 'Survive and Thrive' names in the vein of Delta Air Lines...

When analyzing potential candidates for the theme, we've focused on finding companies that the market isn't yet pricing the recovery for yet.

Our "Survive and Thrive" recommendations possess the fundamentals, business strategy, and favorable market dynamics to propel them to take off like rocket ships with the economic reopening. In fact, in our Altimetry's Hidden Alpha newsletter, the average return among our "Survive and Thrive" picks is nearly 40%!

To learn more about Hidden Alpha – and how to gain access to our upcoming September issue, publishing next week – click here.

Regards,

Rob Spivey

September 1, 2021

What appeared to be a summer reopening is quickly slamming shut with the uptick in COVID-19 cases...

What appeared to be a summer reopening is quickly slamming shut with the uptick in COVID-19 cases...