A separate medical controversy was brewing amid the coronavirus pandemic...

A separate medical controversy was brewing amid the coronavirus pandemic...

COVID-19, the disease caused by the coronavirus, became one of the leading causes of death in the U.S. last year, third behind heart disease and cancer.

Luckily, treatments and vaccines were developed in a short year-long sprint by the medical community. From a medical standpoint, it has been somewhat solved.

In June 2021, COVID-19 fell to the No. 7 spot for the leading causes of death in the U.S., according to data from the Peterson-KFF health system tracker. One rank above COVID-19, however, sits a disease that had never been solved: Alzheimer's disease. Despite decades of research, it cannot be prevented and cannot be cured. Even cancer and heart disease, if discovered early enough, can be treated. But an Alzheimer's diagnosis only ever ends one way.

As COVID-19 dominates the news cycle, chances are you missed the medical headline millions had been waiting a long time to see. The U.S. Food and Drug Administration's ("FDA") approval of an Alzheimer's drug that doesn't just temporarily improve symptoms but delays clinical cognitive decline.

But Biogen's (BIIB) breakthrough drug aducanumab, marketed as Aduhelm, wasn't met with the medical victory lap you'd expect. And it wasn't because it played second fiddle to the COVID-19 vaccines.

Bad science, bad regulators, or both?

Bad science, bad regulators, or both?

The FDA's approval of Aduhelm was highly questionable.

First off, the drug had been put on a fast-track to passage, which was the same regulatory trick used for the COVID-19 vaccines.

In the latter case, the fast-track process was necessary because of the coronavirus pandemic's direct interference with the entire world order. Alzheimer's is more of a slow burner, lurking in the shadows without directly affecting most people's lives. It isn't the sort of disease that typically prompts the FDA to fast-track a drug.

Second, the FDA failed to prove that Aduhelm leads to clinical benefits. It was able to show that it reduces the presence of Amyloids, abnormal proteins, and "reasonably inferred" that this would slow progression. But this doesn't appear to be true.

It's not the first time this path had been explored. Ten years ago, Pfizer (PFE) poured millions into a prospective drug based on a similar principle but later abandoned the premise.

Aduhelm also has serious potential side effects: the swelling and bleeding of the brain, a condition called Amyloid-related imaging abnormalities ("ARIA"). In trials, Biogen took extensive (and expensive) precautions that are not required for public use of the drug.

Biogen sells the Aduhelm for a mighty $56,000 per year, and the frequent ARIA checkup procedures cost $5,000 each. Insurers are left to decide whether or not the drug is too risky for patients to use. Many insurers have chosen not to cover it under their policies.

The outrage is severe enough that three members of the drug's 11-person advisory board have resigned from the FDA over the agency's controversial decision. There is a live internal investigation into potential conflicts of interest among the scientists who gave the go-ahead.

Biogen had its reasons to push hard for Aduhelm's approval...

Biogen had its reasons to push hard for Aduhelm's approval...

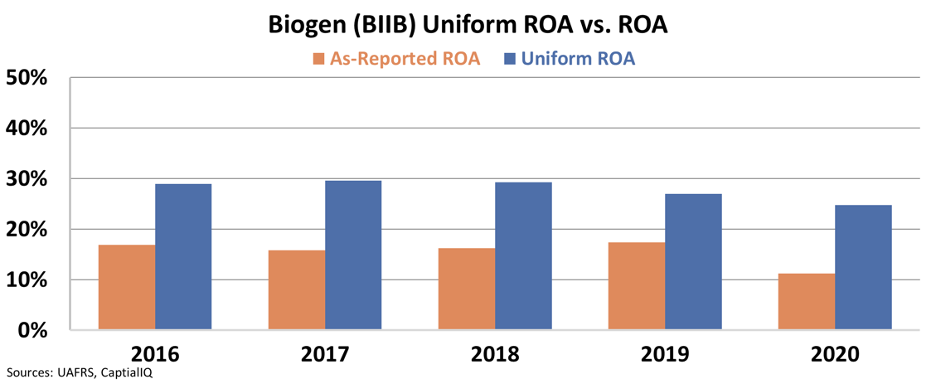

While many are outraged at the news, for Biogen, the urgency is clear. Historically, Biogen's Uniform return on assets ("ROA") has been nearly twice as strong as the as-reported metrics would suggest.

That said, over the past two years, the company's Uniform ROA has started compressing, and it appears this trend is expected to continue.

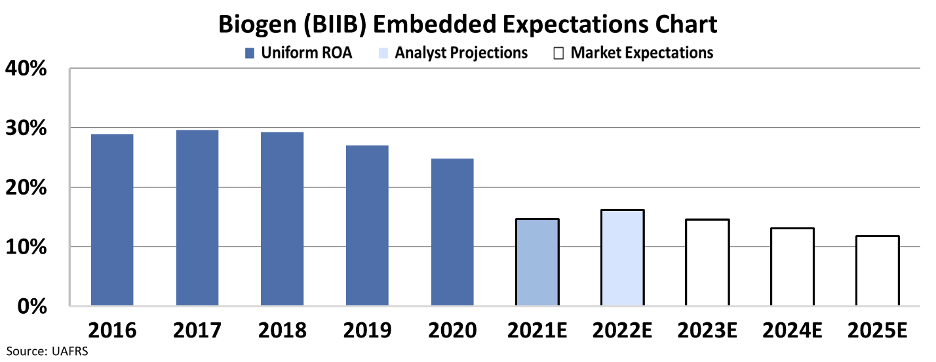

Analysts anticipate Biogen's Uniform ROA to drop off a cliff next year, from a healthy 25% to just 15%.

Amid the Aduhelm controversy, Biogen's share price has backtracked about half of its June 7 pop, which saw the stock appreciate 55% over 48 hours after news of the FDA approval broke.

Although the stock is still about 20% more valuable than three months ago, our embedded expectations analysis shows that the market still expects Biogen's returns to continue falling through 2025, approaching corporate averages.

The trigger for all this may be that Biogen is living through every pharmaceutical company's worst nightmare: generics.

Biogen sells treatments for several neurological disorders, chief of which is multiple sclerosis, commonly referred to as MS. Since its approval in 2013, the company held the rights to exclusively sell TECFIDERA, which successfully prevents MS relapses and reduces the progression of the disease. This year, generic alternatives were allowed to come onto the market.

Without having spent the astronomical research and development dollars that Biogen did, Mumbai-based seller of generics Cipla (NSE: CIPLA) can sell a version of TECFIDERA for a fraction of Biogen's price.

Biogen is looking for a replacement drug in its lineup because otherwise, as analysts predict, it would be dead in the water.

Had Aduhelm walked swiftly through the approval process without controversy, it would have attracted every single Alzheimer's patient, of which there are millions.

If every new Alzheimer's patient elected to take the drug, it would triple its revenue to around $40 billion. It's the type of pharma success story that investors lust after. But given the public scrutiny and limited insurance coverage, Biogen is unlikely to see such gains.

Although the end of this story is yet to be written, it appears that Biogen may have made its bed by pushing so hard for the passage of Aduhelm.

While Biogen has a tough road ahead, we have used our Uniform Accounting framework to analyze the pharmaceutical and health care industries.

We've identified several companies in and around the health care industry with more promising futures...

We've identified several companies in and around the health care industry with more promising futures...

This is why, in our Altimetry's High Alpha service, we have used our Uniform Accounting framework to boil down three compelling health care ideas that we like right now.

All these names are up by double-digits since our initial recommendation, primed for big upside... But the market hasn't realized it yet.

To learn more about High Alpha – and find out how to gain instant access to these recommendations and more, click here.

Regards,

Rob Spivey

August 18, 2021

A separate medical controversy was brewing amid the coronavirus pandemic...

A separate medical controversy was brewing amid the coronavirus pandemic...