Keeping interest rates low has an overlooked consequence...

Keeping interest rates low has an overlooked consequence...

The U.S. Federal Reserve is remaining vigilant in its focus on minimizing unemployment and maximizing economic activity.

That means the central bank isn't losing sleep over inflation, which is the natural consequence of such monetary policy. Fed Chairman Jerome Powell remains convinced that the inflationary pressures are "transitory" and that kinks in the supply chain are driving prices higher more significantly than his dovish policies.

Although that view has received a lot of pushback from inflation-minded analysts, the data supports that interest rates will remain low... at least for a while longer.

This will affect American lives in countless ways. But the most dramatic relates to the single most important thing we own: our homes.

Over the past year, it seems like we've been hearing nonstop chatter about skyrocketing home prices. Our analyst team has had countless conversations about what's driving it, whether it's temporary or a bubble, and how it compares with the 2008 financial crisis.

An August article in the New York Times highlighted the surge in home prices with Zillow's (Z) data. The average home in Dallas sold for more than $300,000 in June of this year, up from about $260,000 a year earlier. Even that modest 15% bump is one of the least severe examples we've seen in major markets. And it has local regulators sitting on the edge of their seats.

The seemingly never-ending tight inventories, supply chain problems, and homebuilder backlogs mean that prices will stay high in the near term and potentially keep rising.

In our view, the "At-Home Revolution" has been the primary driver. But Dallas local officials are worried that the low interest rates might be the overlooked culprit.

Low interest rates naturally influence home prices. Because most people buy homes on loan, lower rates mean people can afford more expensive homes with the same cash outlay, giving dealers, brokerages, and homebuilders room to raise prices.

Regardless of what the main driver might be, none of these factors are going anywhere, so don't expect homes to become cheap again any time soon.

We called this trend last year and stumbled upon a home-run company...

We called this trend last year and stumbled upon a home-run company...

Naturally, the real estate brokerage industry has been one of the biggest winners of this surge in demand and prices.

Brokers and agents can easily charge beefier fees without selling nicer homes, since homes are worth more every day. There has never been a better time to be a real estate broker.

Last year, because we knew this trend was long-lasting and profound, we sought to find the brokerage that was best set up for investor returns. Our pick wasn't just good... It was a home run.

We recommended eXp World (EXPI) to our Microcap Confidential subscribers when the stock was trading at just $7.34 per share. When it doubled just over a month later, we told readers to close half their position... and then, on February 8, suggested they again close half their remaining position. That's because the stock had risen 859% since our recommendation from seven months earlier... and we've still been telling readers to hold on to the stock.

Why eXp World isn't just a typical brokerage...

Why eXp World isn't just a typical brokerage...

Real estate platform eXp World has an impressive business model. It offers a tech-enabled platform for real estate brokers to break away from legacy brokerage houses like Coldwell Banker or RE/MAX (RMAX). Brokers love it because it handles the backend operations, such as marketing and website management.

It allows brokers to focus on what they do best, working with their clients and helping homes change hands.

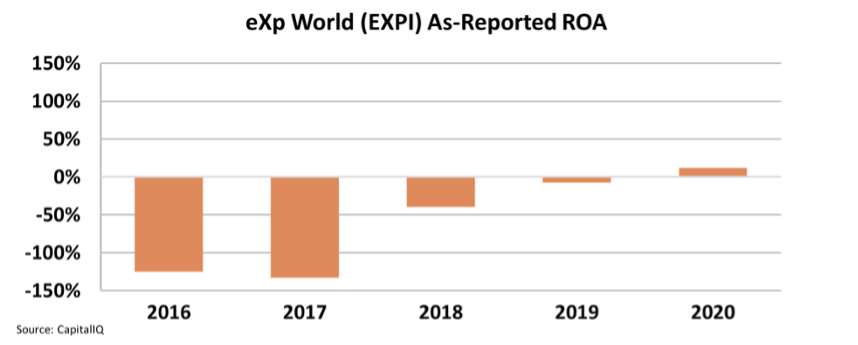

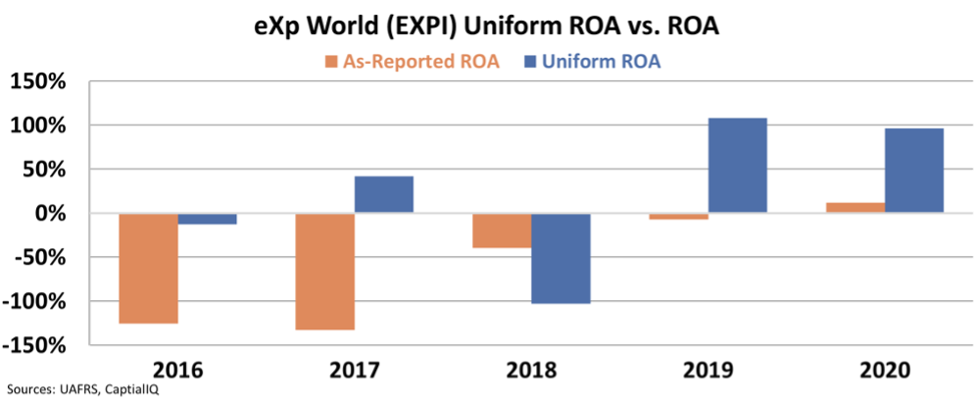

But if you looked at eXp's as-reported metrics, you would never see any economic value in the business.

This real estate company finished last year with an as-reported return on assets ("ROA") of 11%, even during the best time ever to be in the brokerage business. That's less than the corporate average of 12%.

It isn't just details lost in the accounting fog… Sometimes, it's the entire story...

It isn't just details lost in the accounting fog… Sometimes, it's the entire story...

The lackluster profitability isn't a symptom of eXp World's management team or any other structural factor that should make investors look away.

It is primarily because of how the Generally Accepted Accounting Principles ("GAAP") account for stock option expense, which has nothing to do with a company's operations. Once we adjust for this and look for more than 100 other potential adjustments, we see a completely different profitability picture.

While as-reported ROA lingered below the corporate average, Uniform ROA was more than 100% even back in 2019, before the pandemic! That gave us the signals to see what the market was missing.

This is just another example of how a company's brilliance might be lost due to bad GAAP accounting.

After its astounding run in 2020 and 2021, its valuations seem to have caught up with its potential.

Is eXp World still a good stock to buy today?

Is eXp World still a good stock to buy today?

Even though shareholders might not experience annual 800% returns moving forward, there are plenty of reasons to believe that eXp's future remains bright.

eXp World is still extremely productive, and it continues to take market share from legacy players.

That's why we continue to hold it in our Microcap Confidential portfolio.

Still, Microcap Confidential has many other names in it that we think have similar upside to eXp World and just haven't yet been discovered by the market.

To find out how to gain access to our other favorite microcap picks that can become multibagger opportunities – just like eXp World – click here.

Regards,

Joel Litman,

September 21, 2021

Keeping interest rates low has an overlooked consequence...

Keeping interest rates low has an overlooked consequence...