The demand for upmarket goods is back from its break...

The demand for upmarket goods is back from its break...

Most people know that when the economy slows, the least-essential industries are hit the hardest.

But as the economy roars back from the difficulties of the last 15 months, we're seeing a different pattern in the luxury market. New winners are emerging.

During the height of the coronavirus pandemic, folks with cash in the stock market found their shares soaring. But the typical set of niceties enjoyed by the wealthy like travel, clubbing, and fine dining weren't possible with social-distancing measures and stay-at-home orders.

With extra cash and nowhere to spend it, wealthy people made other big-ticket purchases. The markets for expensive cars and luxury homes ballooned.

But, as we ride out the tail end of the pandemic, we now see a surge in smaller-ticket luxury spending.

Consultancy firm Bain & Company believes there is a 30% chance that 2021 global sales in the physical goods luxury market will meet or exceed 2019 levels.

But not all companies in this space will recover so quickly.

Through our research, we can see that one feature may be key in separating the winners from the losers.

This luxury goods giant has the right idea...

This luxury goods giant has the right idea...

That feature controls the supply chain, and the well-known conglomerate of high-end brands LVMH Moët Hennessy Louis Vuitton (LVMUY) has been building it for decades.

By owning its supply chain, LVMH can cut out profit-seeking intermediaries that would typically reduce margins.

This is important for a relatively low-volume producer like LVMH.

To illustrate this, consider a higher-volume, lower-market peer like Macy's (M). Macy's cares less about low margins because it pushes so much volume.

In 2019, LVMH had margins three times larger than Macy's. It did this by leaning on its prestigious brand image to charge more for its products and control downstream costs.

This is all thanks to a decades-long strategy of acquiring companies in its supply chain. Unfortunately, this is an expensive endeavor, and only the largest players can sustain such a vertical business model.

To be where it is today, LVMH needed to become the quintessential brand destination for the wealthy.

The Paris-based company has acquired a fantastic luxury portfolio of products, ranging from alcohol, fashion, perfumes, watches to luxury yachts.

LVMH owns brands like Belvedere Vodka and Dom Pérignon champagne; Christian Dior, Louis Vuitton, and Marc Jacobs in fashion; Fenty Beauty and Givenchy in perfume and cosmetics; and TAG Heuer and Bulgari in jewelry and watches.

All of the factories, mining operations, and distribution channels that make the dream come true are under one umbrella.

CEO and Chairman Bernard Arnault couldn't be happier, as he trades blows with Amazon's (AMZN) CEO Jeff Bezos for the title of the richest man in the world.

The result of all this is that LVMH never needs to worry about a particular brand falling out of style. The portfolio approach will ride out the growing spending by the wealthy as the economy roars back to life.

Even the company's as-reported metrics understate how profitable the strategy is.

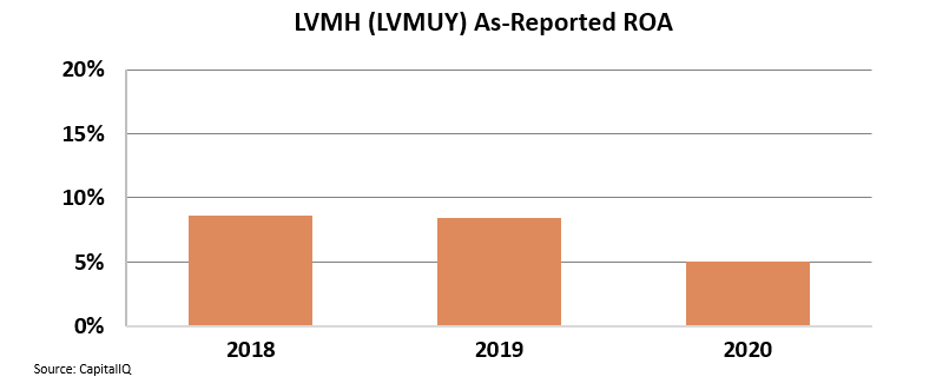

LVMH's as-reported return on assets ("ROA") in 2018 was nearly 9%, and in 2020 it declined to roughly 5%, barely above the cost of capital.

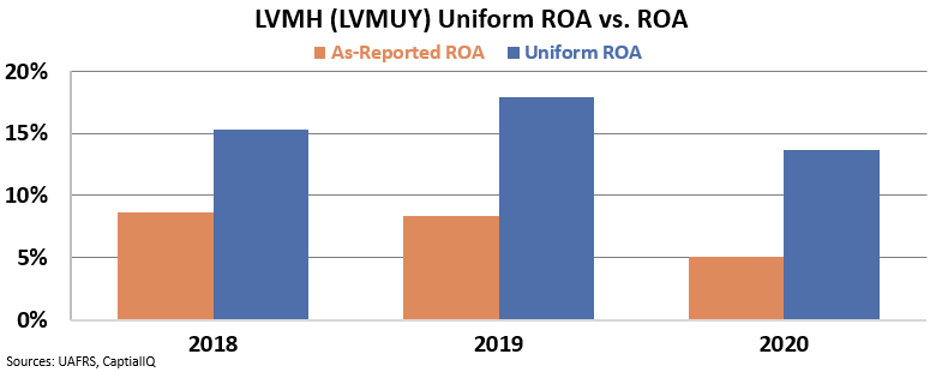

When we clean up the financial statements using Uniform Accounting, we can see that the company isn't a near cost-of-capital business. Specifically, LVMH was able to generate robust returns.

And while as-reported ROA was impacted during the pandemic, returns grew from 15.3% to 18% during a normal operating period.

Operating its supply chain, controlling a diverse set of well-known brands, and posting impressive financial performance makes LVMH a great business case.

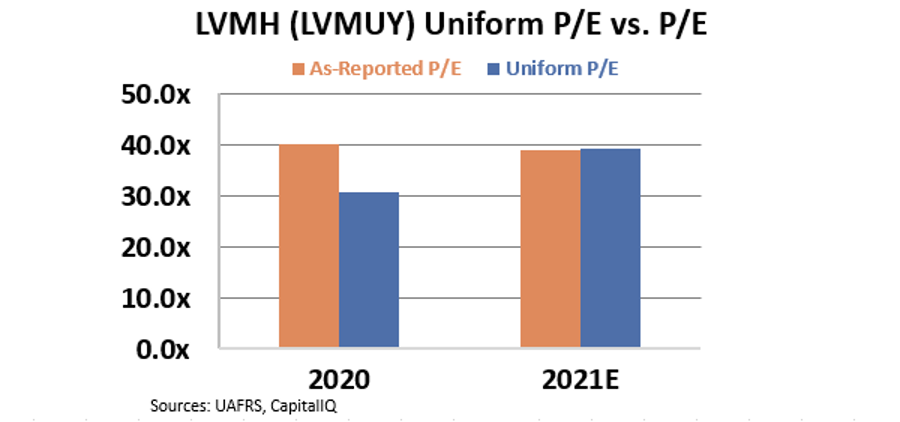

We aren't alone in recognizing this. Fashion executives and Wall Street investors alike are aware that LVMH has a brilliant and resilient strategy.

The company is valued at almost 39 times its Uniform Earnings. This is well above the corporate average of 20 times, making LVMH expensive to buy as a stock pick.

While LVMH doesn't look compelling because of its expensive valuations, there are other 'Survive and Thrive' candidates...

While LVMH doesn't look compelling because of its expensive valuations, there are other 'Survive and Thrive' candidates...

To put it plainly, a great company may not always be a great buying opportunity. But a great company is always a great learning opportunity.

While LVMH isn't a buy right now, we've identified seven different businesses poised for big gains, including five that are within buy range. While this group of stocks is up 31% right now, we believe the gains are just getting started.

For more information on Hidden Alpha – and to learn how to gain access to the full list of recommendations – click here.

Regards,

Rob Spivey

Jun 30, 2021

The demand for upmarket goods is back from its break...

The demand for upmarket goods is back from its break...