Teaching has brought me back to my roots...

Teaching has brought me back to my roots...

As some of my readers know, I have recently taught an immersive short-term course at DePaul University. Alongside that, I am also teaching a 12-week advanced accounting class remotely.

It's been many years since I formally practiced accounting. When I was asked to teach it, I was unsure. But I'm glad I agreed because I've found it a rewarding opportunity for myself and hopefully my students as well.

It gets me back to the foundation of accounting and affirms the idea, "If you really want to learn something, learn it to teach it."

I'm teaching from the 14th edition of an accounting textbook... but why are there 14 editions? It's because accounting is constantly changing.

And it reminds me of why we do Uniform accounting. Generally accepted accounting principles ("GAAP") and International Financial Reporting Standards ("IFRS") accounting standards are a fog that most investors can't see through. All of the changes make it even harder to extract real conclusions from the financial statements.

Both GAAP and IFRS say, "Financials should be useful for the users of the financials." And yet neither does. Their effort is to appease everyone, but the irony is that they end up appeasing no one.

We created Uniform Accounting to generate better insights for investors, managers, and consultants...

We created Uniform Accounting to generate better insights for investors, managers, and consultants...

The first five weeks of the course are all about mergers and acquisition consulting, and it reminds me how unbelievably troubling mergers and acquisitions (M&A) accounting is.

Issues like partial year accounting make it very noisy and difficult to interpret accurately. For example, GAAP says things like: "The buyer didn't legally own the acquired company until December 30... So we will add the two companies' assets together for the full year, but only include earnings for one day."

I am frequently mind-blown when I see things like this show up in the financials of multibillion-dollar corporations. The logic above means an acquiring company will be forced to take on all the purchase liabilities but none of the benefits, which makes little sense.

The accounting figures published may appease the regulators, but they don't tell a fair story about the company or provide useful information for investors like you or me.

This company is a victim of bad acquisition accounting...

This company is a victim of bad acquisition accounting...

Oracle (ORCL) is a long-time serial acquirer.

It started as a database company but then acquired a massive software stack that uses its databases. It's bought companies like Siebel, Hyperion, and PeopleSoft, among others.

Oracle then started acquiring the hardware behind databases with its famed Sun Microsystems acquisition in 2010.

The result is a corporate technology empire that serves customers far beyond their data center needs, generating $40 billion in annual revenues.

Partial-year adjustments were a major problem when it had massive acquisitions like NetSuite in 2016.

These acquisitions have created noise in the company's cash flows. The company spent $7 billion on the acquisition, which closed in November, halfway through its fiscal year (which ends in May).

This didn't just cause earnings to be understated that year...

This didn't just cause earnings to be understated that year...

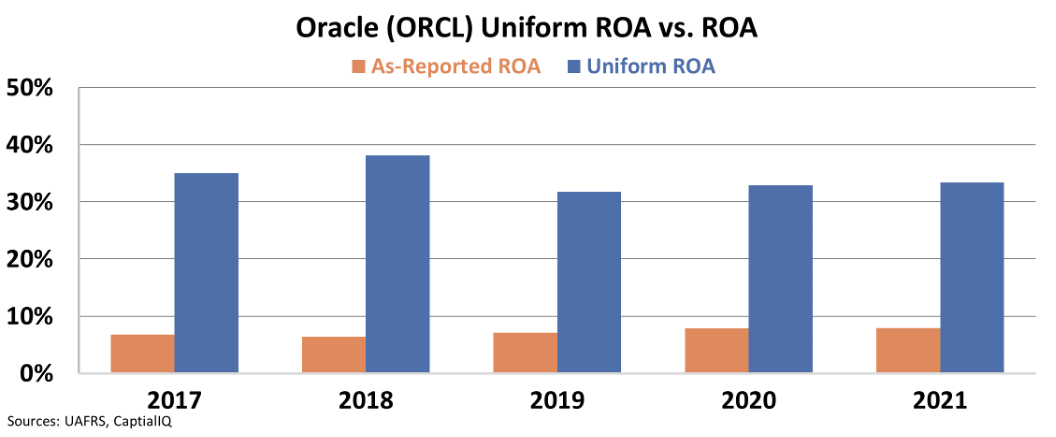

Under acquisition accounting, the transaction added billions of dollars of goodwill and intangibles, although Netsuite's assets were only worth $1.2 billion. This massively distorts the return on assets ("ROA"), the figure commonly used to measure corporate performance, for many years past the acquisition.

Oracle had to forgo NetSuite's earnings before it was acquired while massively inflating its asset base for that period.

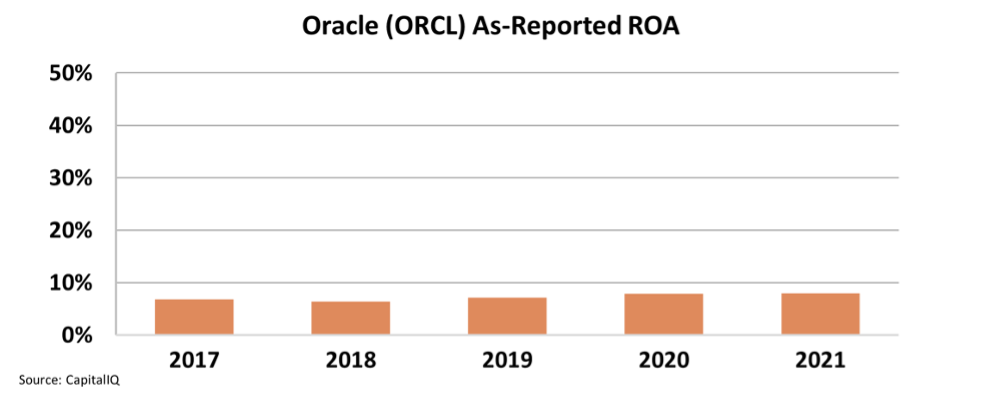

The compounding effects of dozens of large acquisitions have caused as-reported ROA to linger between 6% and 8% for the past five years. It makes the acquisitions look like a waste of time and money.

This is what most investors probably see...

Uniform Accounting fixes this accounting issue. In contrast, it shows the company's profitability is much stronger, consistently north of 30% each year.

See for yourself...

This shouldn't come as a surprise to anyone. Oracle built a powerful platform that's used all over the business world, with high switching costs and loyal customers. It was only able to do this thanks to its savvy acquisition strategy.

That's a strategy that investors should like, not run from...

That's a strategy that investors should like, not run from...

But if they're looking at the wrong numbers, they can't be blamed for staying away from the stock.

That is why I've worked for so many years to bring Uniform Accounting to my students and hundreds of thousands of investors worldwide.

And my work can help your portfolio too.

Our Hidden Alpha newsletter has identified a list of large-cap and megacap companies that present fantastic setups for investors, informed by Uniform Accounting and the other tools at the disposal of my team here at Altimetry.

These massive companies are hiding in plain sight, led by brilliant management teams yet severely undervalued.

In this month's recent issue of Altimetry's Hidden Alpha, we found a traditional large-cap health care company that is set to become a high-growth pharmaceutical company... and its stock price is on course to nearly double from its value today...

To learn more about the upside on this stock recommendation and our Hidden Alpha newsletter – click here.

Regards,

Joel Litman

November 2, 2021

Teaching has brought me back to my roots...

Teaching has brought me back to my roots...