Across the globe, the rate of coronavirus vaccination has varied widely...

Across the globe, the rate of coronavirus vaccination has varied widely...

Epidemiologists talk about a target vaccination rate of around 75% to reach herd immunity for the disease.

Today, more than 20% of the U.S. population is fully vaccinated. At the current pace, the U.S. will reach 70% to 80% vaccinated between late July and late August.

And the U.S. is ahead of the pack. The only two countries of any significant size with a higher vaccination rate are Israel at 55%, and Chile at 25%. The U.K. stands at more than 10%, and most of Europe is well behind those levels.

And that's for the developed world. Much of the developing world is significantly delayed for rollout, with shipping delays and difficulty accessing vaccines.

Inconsistent vaccination rates mean international travel could continue to suffer...

Inconsistent vaccination rates mean international travel could continue to suffer...

Now that vaccines are starting to roll out in developed nations – particularly in countries like the U.S. – people are starting to count down to the light at the end of the tunnel. Folks are ready to leave home and move around again.

But until global vaccination levels get significantly higher, governments may keep travel barriers raised. Folks looking to cross international borders might want to temper their enthusiasm.

As Bloomberg explained recently, some major tourist destinations in Europe – such as France, Italy, and Spain – won't reach herd immunity levels for more than two years at current vaccination rates.

That might mean a significant amount of life lost... as well as serious continued economic hardship if the countries remain closed until they reach those levels of immunity.

It's something I'm watching with particular interest, since I'm planning a potential European trip with my family through June and July. I've joined the flood of people checking online travel sites like Kayak to try to find reservations (specifically, ones that are fully refundable).

While my trip certainly isn't the most important thing to worry about, it does highlight some of the economic implications even as the pandemic hopefully winds down.

And if international travel is delayed, legacy air carriers will continue to face big headwinds...

And if international travel is delayed, legacy air carriers will continue to face big headwinds...

One airline company that's particularly exposed to international travel in Europe is London-based International Consolidated Airlines Group (IAG.L) – also known as just IAG.

You might not have heard of IAG, but you'll likely recognize its brands. It owns major European carriers likes British Airways ("BA"), Spain's Iberia, and Ireland's Aer Lingus.

BA is IAG's largest brand by far. Along with Aer Lingus, the carrier will be hard-hit if international travel remains on pause.

Heathrow and London's other airports are BA's lifeblood. Without international travel, BA can't make money. Its revenue fell roughly 66% from 2019 to 2020.

Additionally, Aer Lingus is a conduit for U.S. travelers on a budget to get to Europe – connecting through Dublin or Shannon in Ireland. Aer Lingus saw revenue fall more than 75% from 2019 to 2020.

So, with ongoing concerns about delays in international travel, it's no surprise that the market remains spooked over IAG...

So, with ongoing concerns about delays in international travel, it's no surprise that the market remains spooked over IAG...

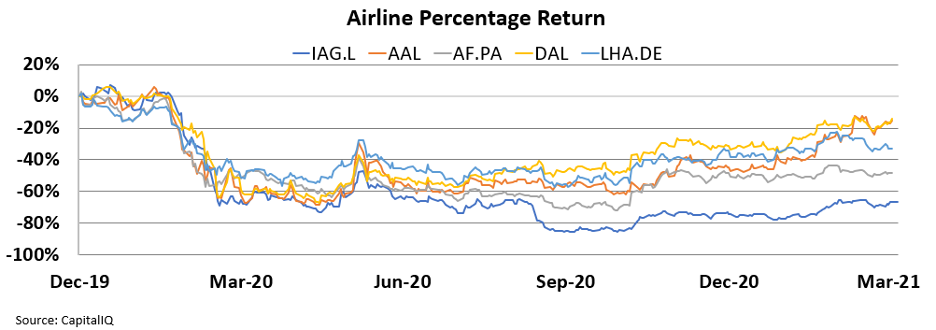

The company's stock price recovery has lagged that of its peers. Specifically, as many peers have seen their stocks recover to being down "only" 15% to 50% since the end of 2019, IAG.L shares are down 67% over the same time frame. Take a look...

Even with this poor performance, some investors may see IAG as an interesting buying opportunity.

After all, if BA and the company's other well-capitalized airlines can survive the pandemic, they should be primed to come roaring back.

But before running off to pound the 'buy' button, we need to understand the market's expectations...

But before running off to pound the 'buy' button, we need to understand the market's expectations...

If the market is already pricing in a big recovery, IAG.L shares might have limited upside. On the other hand, if the market is pricing IAG for the worst-case scenario but the company's airlines recover, the stock could be poised for big upside.

To better understand what the market is pricing in, we can use Uniform Accounting.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions only come out as garbage. Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. Here, we use the current stock price to determine what returns the market expects.

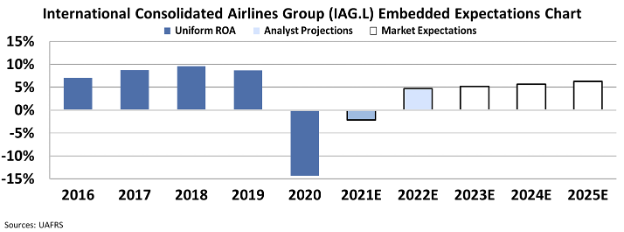

The chart below shows IAG's historical corporate performance levels in terms of Uniform return on assets ("ROA") and asset growth (dark blue bars) versus what sell-side analysts think the company is going to do for its next fiscal year and fiscal year 2022 (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, IAG saw consistent, high-double-digit Uniform ROAs in recent years before the pandemic struck and returns cratered.

At current valuations, the market is pricing the company as if its profitability won't reach those levels again – staying around 5% in the years ahead.

IAG may be facing a long slog of a recovery. But considering the low investor expectations, the market may already be pricing in a worst-case scenario.

When the news regarding vaccine distribution does start to improve, IAG could be a strong recovery story in the battered travel industry... and it certainly isn't priced to be.

I know I'll be cheering for it, and hoping it miraculously happens before mid-June.

Regards,

Rob Spivey

April 14, 2021

Across the globe, the rate of coronavirus vaccination has varied widely...

Across the globe, the rate of coronavirus vaccination has varied widely...