The oil boom will have to wait...

The oil boom will have to wait...

After getting hammered in 2020, crude oil prices have rallied impressively. Since early November, prices have jumped from just $35 per barrel to more than $50 per barrel.

This recovery has made some folks hopeful the shale industry could be back in business.

Equity investors with money tied up in the sector may be eager to recoup their losses. Furthermore, the oil-services industry is hoping for the return of the double-digit shale production growth that drove the decade-long boom.

However, both investors and industry players are going to be disappointed...

Much of this recent rally can be traced back to Saudi Arabia's surprise decision to cut oil production over the next two months. Many industry experts don't believe the production restriction will lead to lasting price increases.

For example, Devon Energy's (DVN) new CEO Rick Muncrief stated publicly he won't let the recent rally in prices sway him into resuming aggressive production growth. He echoes the sentiment of a long list of competing oil executives.

Eventually, the Saudis will likely turn the spigots back on. With another spike in production, prices will fall again.

Instead of production, oil exploration and production (E&P) firms are focused elsewhere.

Operators are still recovering from effects of the coronavirus pandemic and are struggling with shaky finances. As such, many CEOs are forced to use cash flow just to keep the lights on.

Meanwhile, others are prioritizing paying back their creditors. Occidental Petroleum (OXY) CEO Vicki Hollub has stated that debt reduction is her company's principal objective in the near term.

It seems the operative word for oil barons is still "survival," not "growth."

With E&P firms focusing on reducing debt, their suppliers won't be able to do so...

With E&P firms focusing on reducing debt, their suppliers won't be able to do so...

Recent announcements by major E&P CEOs must be music to the ears of debt holders.

With the priority set on managing cash flows and paying down debt, many credit investors will be able to rest easier at night. Investments at a high risk of being worthless just months ago may now be safer.

On the other hand, some credit investors may not be so lucky. In particular, creditors of the suppliers to the space still face high risk. With E&P companies paying down debt to survive, suppliers are left with revenue slashed.

The oilfield-services industry depends on increased E&P budgets to boost profitability. Without these funds, services and suppliers are in lesser demand.

And reduced demand means weaker capacity utilization.

This means not only are oilfield-services companies selling less of what they provide, but E&P firms can push them for thinner and thinner margins on the services they're still buying.

Wildcatters, oil majors, and national oil companies all have the ability to squeeze the margins of their suppliers. For suppliers, size doesn't matter in the current environment.

That's a huge problem for Schlumberger (SLB), one of the world's largest oil equipment and services companies...

That's a huge problem for Schlumberger (SLB), one of the world's largest oil equipment and services companies...

And yet, credit-ratings agencies still view the company as a high-quality, investment grade name. Moody's (MCO) gives Schlumberger a strong "A2" rating.

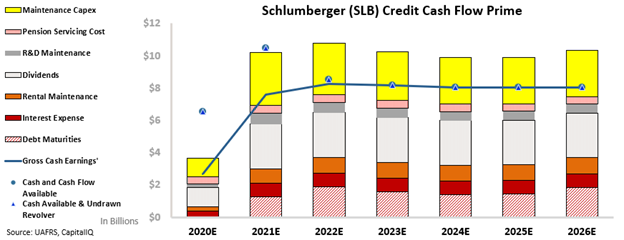

Given the precarious environment, it comes as a shock the ratings agencies still regard Schlumberger so highly, even if it's the biggest player in the space. And when using our Credit Cash Flow Prime ("CCFP") analysis, we can see the company's true credit picture.

In the chart below, the stacked bars show Schlumberger's obligations each year for the next seven years. We compare this to the company's cash flow (blue line) and cash on hand at the beginning of each period (blue dots).

The bottom bars are the hardest costs for Schlumberger to "push off" – including debt maturities and interest expense. The higher bars are obligations that are more flexible, like maintenance capital expenditures ("capex") and pension servicing costs.

Schlumberger is far from the safe credit Moody's believes it is... As you can see, the company's cash flows alone won't be sufficient to handle all of its obligations – including significant debt maturities in each year going forward.

Furthermore, the company will quickly burn through its limited cash on hand if management doesn't take major actions to fix its credit structure.

As a result, Schlumberger will most likely have to refinance its debt...

As a result, Schlumberger will most likely have to refinance its debt...

But the availability of refinancing is far from a guarantee. Schlumberger may have to think hard about reducing its dividend or limiting its capex spend to get by.

While those options are both short-term Band-Aids, they aren't ideal for the company's long-term outlook.

Specifically, if Schlumberger reduces its capex, it will fall behind competitors. Its equipment will be older and less coveted. As a result, when and if oil production demand does return, the company won't be able to demand premium prices.

On the other hand, if it slashes the dividend, Schlumberger will lose a large portion of its equity investors. This could make its market cap plummet.

A lower market cap will increase the scrutiny from the ratings agencies. And that means a ratings downgrade becomes more likely.

Although Schlumberger has so far been able to avoid a ratings downgrade, the writing is on the wall...

Although Schlumberger has so far been able to avoid a ratings downgrade, the writing is on the wall...

With large debt obligations due in each year, the potential for capex limits, dividend reductions, or other drastic cost-cutting measures looks highly likely.

Furthermore, given that its customers are halting production spending, Schlumberger's outlook remains bleak for the foreseeable future.

Thus, we have given the company a much lower rating. We rank Schlumberger as a non-investment-grade "HY1" credit (equivalent to a "Ba2" rating from Moody's).

Investors only relying on Moody's for their bond advice are being lulled into a false sense of security as the situation continues to deteriorate for Schlumberger.

Regards,

Rob Spivey

January 20, 2021

The oil boom will have to wait...

The oil boom will have to wait...