Don't get lulled into a false sense of security...

Don't get lulled into a false sense of security...

While our outlook has been "doom and gloom" for most of the year, stocks have done just fine. The S&P 500 Index regained nearly all of its 2022 losses. It's up 20% this year.

And one well-known strategy – the "60/40" portfolio – has been making headlines this week...

Most folks have probably heard of the 60/40 portfolio. It's one of the most commonly touted approaches to investing... Put 60% of your money in stocks, 40% in bonds, and set it and forget it.

It's supposed to help investors balance the upside potential of stocks with the downside protection and stability of bonds.

The 60/40 strategy is on pace for its best year in more than three decades. A typical portfolio following this approach is up 14% in 2023... and returned 12% in November alone.

Based on these outstanding results, you might think the market is finally getting on firmer ground.

Allow me to disabuse you of that notion.

Today, we'll unpack the recent rally... and explain why investors should still approach the market with caution.

The most intense market rallies often occur in bear markets, not bull markets...

The most intense market rallies often occur in bear markets, not bull markets...

And when that happens, it's easy to lose sight of what's really going on in the economy.

But according to Michael Hartnett, a strategist at Bank of America (BAC), the biggest monthly surges in the 60/40 portfolio often precede pullbacks.

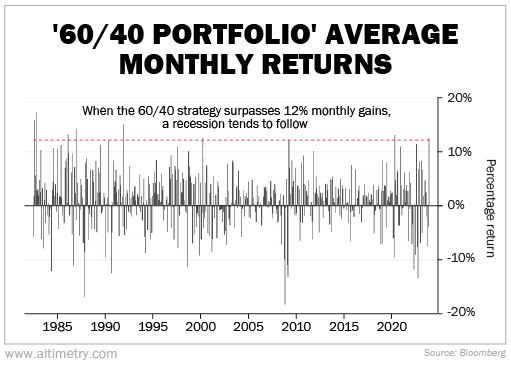

Bloomberg reports that the popular approach has only returned 12% or more in a single month 10 times since 1980. And frequently, it was a sign that the market was nearing a top before a recession.

Take a look...

For instance, the 60/40 portfolio surpassed 12% twice in 1980... right before the worst U.S. recession since World War II. It exceeded that threshold again in 2000, 2008, and 2020.

And now, it's once again above 12% today. That doesn't bode well.

As hopeful as the market's recent surge might feel, it's likely setting the stage for a big downturn. Bloomberg's data shows this pattern has played out time and again... almost exclusively during recessions.

And the reason is simple...

Recessions cause investors to act irrationally...

Recessions cause investors to act irrationally...

Feelings tend to take a backseat during bull markets. When almost everything is going up, you don't have to be too worried about a loss here and there. But when times are less certain, emotions run wild.

Volatility leads investors to panic sell, which leads to even more volatility. This is why pretty much every recession has been preceded by a double-top... a second stock market rally that nearly matches the previous high.

Even though the S&P looks set to end the year with a gain, the economy is not healthy. Banks aren't lending at full capacity... more companies are going bankrupt than they did last year... and folks are facing more debt than ever before.

Today's bear market rally is masking deeper economic challenges. The best 60/40 months have always come when the market is acting irrationally. Don't expect this time to be any different.

Regards,

Rob Spivey

December 13, 2023

Editor's note: Make no mistake – it's time to brace yourself for one of the most bewildering and devastating years in financial history.

It doesn't matter if you have money in the markets or you're hoarding cash. Altimetry founder Joel Litman says one financial crisis threatens your wealth more than anything else today... and the usual crisis playbook won't cut it next year.

He's joining Marc Chaikin, founder of our corporate affiliate Chaikin Analytics, to issue an urgent new prediction... and share a dead-simple way to take advantage (instead of being blindsided). Learn their No. 1 step to take, right here.

Don't get lulled into a false sense of security...

Don't get lulled into a false sense of security...