New stories of cyberattacks emerge every day...

New stories of cyberattacks emerge every day...

Earlier this week, Hillel Yaffe Medical Center in Israel was knocked offline by a ransomware attack for over a day... and it could have cost patient lives.

There are even cyberattacks meant to poison people's drinking water by targeting a water treatment facility... That almost happened in Florida in February.

For these reasons, U.S. Homeland Security is increasingly concerned about "killware" than ransomware.

Cybersecurity is fast becoming an essential area for every government, company, and individual in the world to be aware of.

The most startling part about cyberattacks isn't their ubiquity, though. It's how little these thieves appear to value the data that they're stealing. Things that we view as priceless, they price for pennies.

It only costs $4 to buy someone's Social Security on the dark web, where hackers can buy and sell personal data. That means that it's not just massive criminal syndicates who can afford to ruin someone's life. It's anyone who knows how to wander into a dark corner of the Internet.

This has meant a heightened focus on investing in cybersecurity companies...

This has meant a heightened focus on investing in cybersecurity companies...

There are companies on the front lines, employed by other companies and governments to protect their customers' or citizens' data.

Palo Alto Networks (PANW) helps install firewalls to prevent hackers from accessing systems. Fortinet (FTNT) creates secured hardware to make it harder to penetrate through network switches, and monitors who can go in and out of networks.

CrowdStrike (CRWD) offers software solutions to protect a company's cloud computing and essential workflows.

And Rapid7 (RPD) provides dashboards that allow companies to monitor their system vulnerabilities and malicious behavior.

With so much money being thrown around in the space, investors naturally are excited to invest. They see that many companies will pay pretty much anything to keep hackers at bay.

But just because a company is in high demand doesn't mean its stock will go higher. Many cyber companies are classic examples of that...

Take Rapid7, for example. This company looks well-positioned since its products can act as a command center to defend against cyberthreats. Companies will want this, but the market may already know that is the case.

By using our Embedded Expectations Analysis ("EEA") framework, we can get a good sense of exactly what the market is anticipating for Rapid7 over the next few years.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, with our Embedded Expectations Framework, we use the current stock price to determine what returns the market expects.

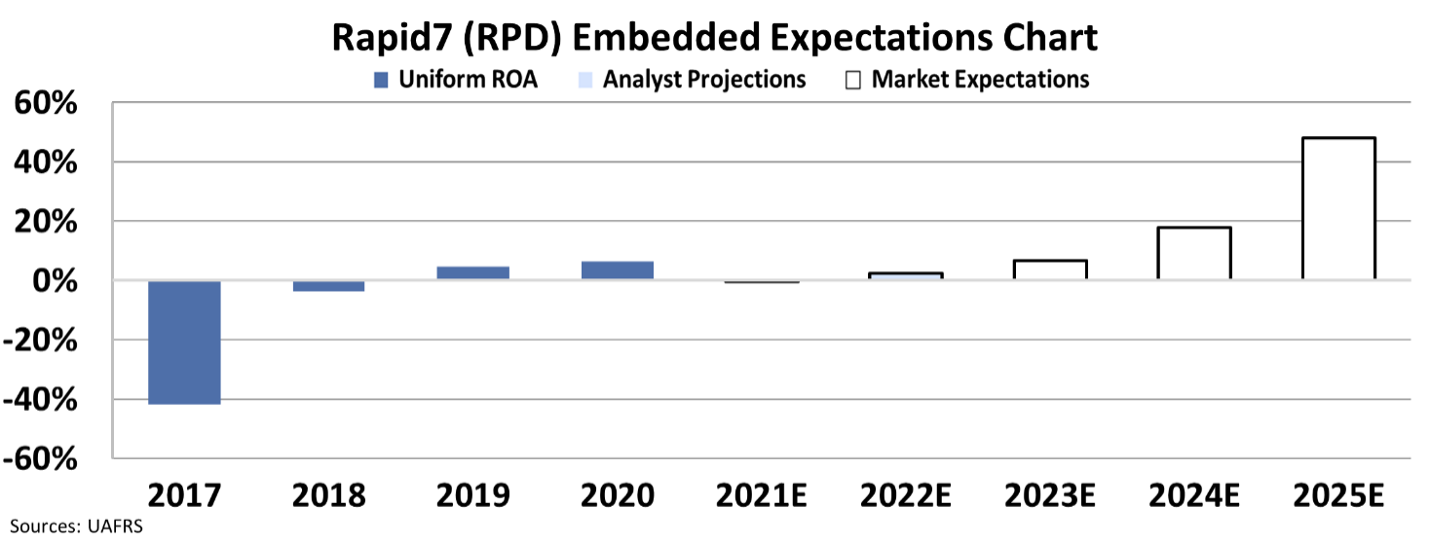

In the chart below, the dark blue bars represent Rapid7's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift over the next five years.

Rapid7 just turned profitable in 2019 and 2020, as people started to adopt its software.

However, the market is clearly getting ahead of itself. In the next five years, Rapid7 is priced for returns to explode from 6% in 2020 to almost 50% by 2025, which would be nearly impossible for any company, no matter how good the industry tailwinds.

Those are staggeringly high expectations, and Wall Street analysts don't expect Rapid7's profitability to rise above its 2020 levels anytime soon.

And as with so many cybersecurity companies, investors are already pricing in a massive surge in demand.

But not all cybersecurity companies are priced this way...

But not all cybersecurity companies are priced this way...

We have found one cybersecurity company with proprietary technology that helps its clients to combat cyberthreats.

Airbnb (ABNB), Mastercard (MA), Morgan Stanley (MS), Experian (EXPN), PayPal (PYPL), and dozens of other major companies use this little-known cybersecurity company's services.

But this tiny tech company from California receives virtually no Wall Street coverage... and that represents a huge opportunity for investors who buy today.

As the market catches on, this company is even more compelling than the overvalued companies like Rapid7... And we think this cyber stock could have upwards of 380% upside by the end of the year.

I just put the finishing touches on a brand-new video presentation where I detail this company in full. You can watch it right here.

Regards,

Joel Litman

October 15, 2021

New stories of cyberattacks emerge every day...

New stories of cyberattacks emerge every day...