Investments in cell service are getting more and more expensive...

Investments in cell service are getting more and more expensive...

And for quite some time now, it has weighed heavily on telecom companies. After all, they have to drop huge sums of money just to keep up with each new generation of cellular technology.

You see, when we progress from one generation of wireless technology to the next – from 3G to 4G to 5G – we have a shorter range of service. While 3G and 4G towers could cover up to 10 miles, 5G towers only cover 1,000 feet.

So, although this next-generation coverage is faster, you need a lot more towers to make the network function.

Lately, that has created some roadblocks for 5G investment...

Though they're crucial for enhancing mobile connectivity, there has been resistance to the build-out of 5G towers... in none other than New York City.

Residents of the Upper East Side neighborhood of Carnegie Hill are fighting to prevent city plans for new 5G towers. Roughly 2,000 curbside towers are to be set up around the city to help maximize cell coverage. Each one is about 32 feet high. And the folks of Carnegie Hill claim they are ugly, brutalist, and have no place in their historical neighborhood.

What looks like a case of NIMBYism – or "not in my back yard" – could be the first battle lines in a pushback of these towers.

Today, we'll discuss how this could actually benefit the companies coughing up billions of dollars each year to invest in this infrastructure...

This pushback may be a blessing in disguise...

This pushback may be a blessing in disguise...

Telecom companies have been spending big to keep up in the 5G race. They've invested billions of dollars to establish their 5G networks all over the U.S. – and especially in highly populated cities like New York.

According to consulting firm McKinsey, the global telecom industry is expected to dish out more than $600 billion in 5G investments between 2022 and 2025. And about $200 billion of that is projected to go toward North America.

At first glance, it may seem like bad news that New York residents are pushing back on the establishment of 5G towers in their neighborhoods.

However, as we said earlier, this may actually be a good thing...

You see, over the past few years, telecom companies have had to invest in 5G to stay in business. Yet, the investments they're making aren't boosting revenue because they can't charge more for better service. To stay competitive, the big network providers compete on price.

So a pushback on 5G infrastructure means these companies will have more cash in their pockets.

Cell-tower real estate investment trusts ("REITs") are another big beneficiary...

Cell-tower real estate investment trusts ("REITs") are another big beneficiary...

Take American Tower (AMT), for instance...

It is a global leader in wireless communication infrastructure. As a REIT, it builds and maintains cell towers. Then, it rents out the space on the towers, as well as the land below them, to major service providers like AT&T (T) and Verizon Communications (VZ).

That means American Tower also has to spend big to keep up in the 5G race.

Since 2019, it has invested at least $1 billion annually on new towers. American Tower investors probably aren't too happy about that, as REITs distribute most of their cash flow as dividends.

And if the company spends too much on new towers, that's less money going toward dividends.

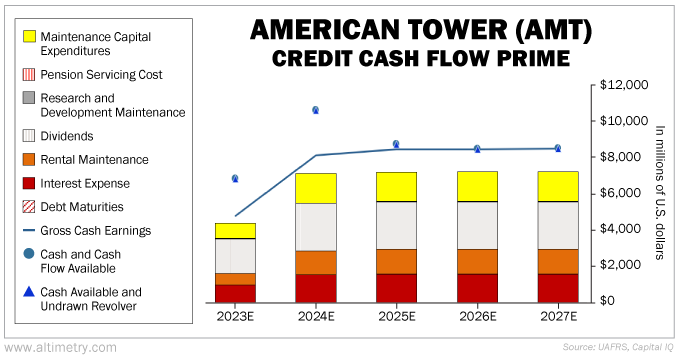

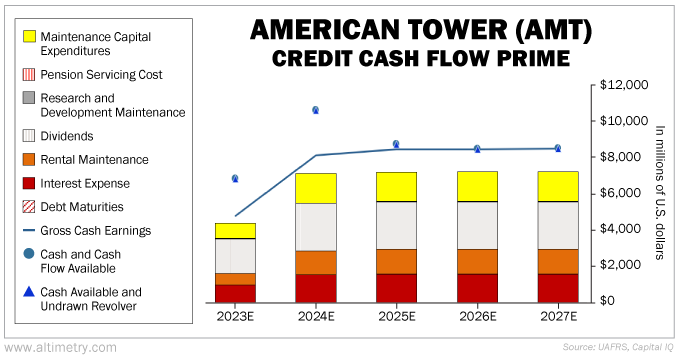

We can use our Credit Cash Flow Prime ("CCFP") analysis to see how much money American Tower actually has to fund its growth and pay shareholders. The CCFP helps us compare a company's obligations with its cash position and expected cash earnings.

In the chart below, the stacked bars represent American Tower's obligations each year for the next five years, including this year. We then compare these obligations with the company's cash flow (the blue line) as well as its cash on hand at the beginning of each period (the blue dots).

Currently, it spends about $2.6 billion per year on capital expenditures (which includes maintenance capex and rental maintenance) and an equal amount on dividend payments.

Take a look...

As you can see, American Tower's obligations are already nearing its cash flow... It only has about a $1 billion buffer today. That means, at best, it could raise its dividend by $1 billion.

However, due to the pushback on 5G towers, the company may spend less on new infrastructure moving forward. This could allow it to increase its dividend.

Ultimately, that's great news for shareholders and American Tower. REITs live and die by their dividends. So if American Tower is able to divert more money toward investors, its stock could get a boost, too.

We suggest keeping an eye on this stock, as we may see upside in both its share price and dividend yield going forward.

Regards,

Joel Litman

August 24, 2023

Investments in cell service are getting more and more expensive...

Investments in cell service are getting more and more expensive...