We asked for your thoughts on innovations you've seen as a result of the coronavirus pandemic...

We asked for your thoughts on innovations you've seen as a result of the coronavirus pandemic...

On Monday, we discussed how businesses have been forced to innovate to counter the disruptions from the pandemic. We asked readers to submit examples of innovation they've witnessed... and we received some interesting comments. As reader Robert S. (no, not Altimetry Director of Research Rob Spivey) writes...

I have no idea what is going on in other places in the U.S. or even maybe around the world, but in Houston, TX it is almost impossible to find a bicycle, they are completely sold out!

While bikes aren't in and of themselves an innovation of the pandemic, the comment makes sense.

Innovation isn't just about changing things... it's about changing processes and adopting new solutions.

With gyms closed around the world and Pelotons sold out for months in advance, people are trying to figure out ways to work out and stay active. Biking is a great option... and it's booming all across the U.S. According to the National Association of City Transport Officials, American cities are seeing an "explosion in cycling."

And with mass-transit ridership declining, essential workers still need a way to get to work – many are turning to biking as an option.

Sometimes, the most disruptive innovations look at ways to repurpose existing products.

And consider the bike itself... It was an innovation driven by necessity, 200 years ago.

After the massive Tambora volcano in Indonesia erupted in 1815, the ash and other particulates it threw into the stratosphere caused global cooling. It was so severe that 1816 was termed the "Year Without a Summer."

It was such a climatic issue that it caused widespread crop failures and famine. In June, six inches of snow fell in New England, and frost was observed throughout the year in many agricultural areas.

Because of the famine, livestock died in droves... including horses. To find an alternative to riding a horse, German inventor Karl Drais created the "velocipede" (or "hobby horse"), a two-wheeled machine people could ride from place to place. It's the invention that eventually became the bike.

Another reader, Matt from North Carolina, sent us a great example of necessity causing a modern innovation...

Computer-based learning will revolutionize education and the COVID19 school shutdowns have jump started this secular trend... Using an iPad, our daughter [logs on to an] Internet site and right away saw a tailored education school work plan for her current week of 1st grade.

The teacher was able to remotely grade our daughter's work, perform online chat sessions and even take over her screen to demonstrate math. Our daughter is just as busy as when she was going to school every day, getting more comfortable using technology for learning and the teacher only needs to work half the amount of time to get the same result.

Of course, with everyone sheltering at home, a major concern has been how this is going to affect the educational development of students who'd otherwise be in school.

Schools have been working impressively to find solutions to this, with a big focus on online education solutions that allow collaborative remote learning.

In this month's issue of Altimetry's Hidden Alpha, published last Monday, we highlighted one company that's at the heart of this innovation... and is likely to be a big winner in the months ahead as schools are forced to adapt to an online learning environment.

Our position is already off to a great start... we're already up more than 50% since our recommendation.

You can gain immediate access to that name – and the rest of the recommendations from our "Your Home, Your Castle" theme on the businesses poised for big gains as society changes from the pandemic – with a subscription to Hidden Alpha. Learn more here.

For many years, one software firm topped our ideas list...

For many years, one software firm topped our ideas list...

It was a cybersecurity company with massively underappreciated value in a growing market.

In an age where cybersecurity is becoming as important (if not more important) than physical security measures, being a "best in class" security provider is a great value proposition.

That's exactly what Palo Alto Networks (PANW) has done for years. Its firewall software options are some of the strongest around, and most consumers and businesses understand cybersecurity isn't the place to settle for second best.

And yet, like many other companies we've discussed here at Altimetry Daily Authority, Palo Alto Networks' value proposition didn't appear to translate to real profit.

Similar to many other software firms, the company appeared to be losing money despite massive annual sales growth and a formidable competitive moat. But we saw this as just another case of as-reported metrics failing to show a company's real profitability.

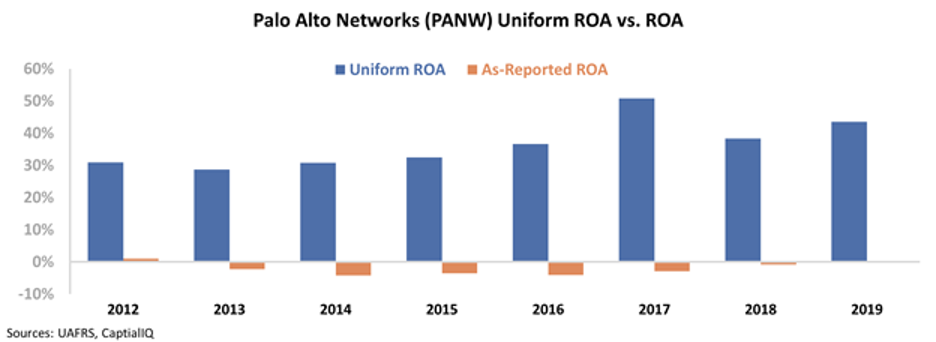

For years, the Uniform Accounting metrics matched the economic reality for Palo Alto Networks. Rather than losing money every year, the company was growing its profitability.

By 2017, Palo Alto Networks' Uniform return on assets ("ROA") had reached 50%, and the market finally started to understand the company's real value.

Over the next few years, as-reported valuations converged with our expectations, and we eventually moved on from one of our favorite misunderstood companies.

Once in a while, another business with a similar story will come around...

Today, let's look at another software company that also has completely misunderstood returns.

This one provides the back-end for large insurance companies around the world. Of course, the demand for insurance isn't going away any time soon, but the real value of this firm is that it's cornered its very niche market.

Over the past 20 years, Guidewire Software (GWRE) has built itself into a "one-stop shop" software provider for the insurance industry. It provides the software behind insurance claims, billing, and policy viewing, as well as cloud-based underwriting software.

Since it was founded in 2001, Guidewire has focused on continually growing to capture more of its niche market share.

Using either as-reported or Uniform metrics, Guidewire's growth trajectory is obvious. Since going public in 2012, the company has grown by an average of more than 25% per year.

Yet despite all of its great offerings, growth, and its stable business-to-business sales model, Guidewire looks like a struggling company.

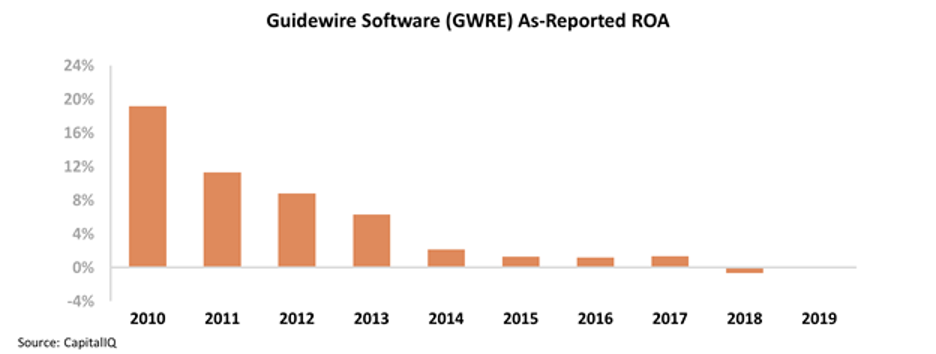

Over the past decade, the firm's as-reported ROA has dwindled from robust, near-20% levels to nearly nothing in recent years.

This trend makes it look like all of Guidewire's growth efforts have been in vain – rather than growing a profitable business, the extra scale has eaten at the company's returns.

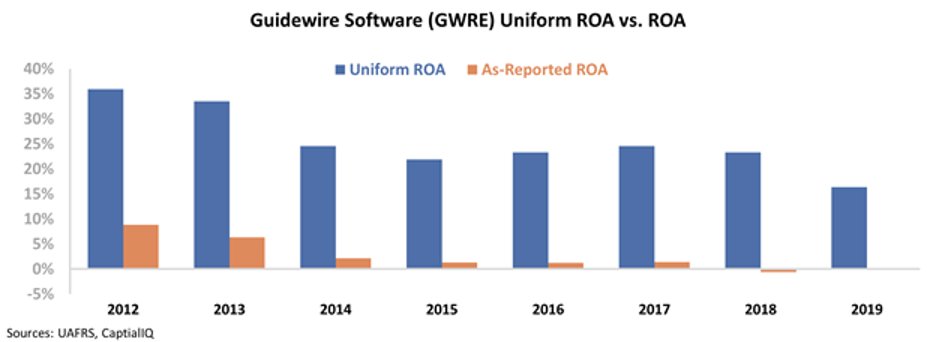

However, much like with Palo Alto Networks, as-reported profitability metrics fail to tell the full story.

Using Uniform Accounting to look at Guidewire's real profitability, we can see that the company was still profitable last year.

After cleaning up the traditional financial statements for inconsistencies and misleading accounting – including the standard treatment of non-cash stock option expenses, research and development (R&D), and excess cash – Guidewire's true profitability becomes clear.

While the company's Uniform ROA has faded slightly in recent years, the effect of growth is far less drastic than as-reported metrics would have you believe. Last year, the company's Uniform ROA was still 16% – more than twice the long-term average for a U.S. corporation.

Furthermore, it's important to remember that each year, Guidewire grows its asset base by an average of 25%... meaning those returns are compounding.

That return has come under pressure in 2020, as the company's Uniform ROA is forecast to decline to 7% thanks to spending and competitive trends. It's not entirely clear sailing for Guidewire... And at a high Uniform price-to-earnings (P/E) ratio of 95, the market is certainly pricing the company for continued growth.

Guidewire's impressive growth and historically solid returns alone don't automatically make the stock a buy. Market expectations are important for understanding this.

But with its as-reported ROA so low – much like Palo Alto Networks before it – investors who aren't looking at the Uniform Accounting data may not understand what the market is really thinking.

Regards,

Joel Litman

May 15, 2020

We asked for your thoughts on innovations you've seen as a result of the coronavirus pandemic...

We asked for your thoughts on innovations you've seen as a result of the coronavirus pandemic...