One index's 'reconstitution' can often be a microcap kingmaker...

One index's 'reconstitution' can often be a microcap kingmaker...

Each year, the major stock indexes – from the S&P 500, to the Nasdaq 100, to offerings providers like MSCI – are all "reconstituted."

This is a process when new members are added, and companies that no longer fit the index's criteria are removed. It might be that a name is too small or too big, or that companies merged or were acquired and need to be replaced.

When a company gets added to one of the major indexes, it can lead to a massive move in its stock. Since all investors who track that index will need to own the company's stock, shares usually pop in price.

This can be especially true for the Russell 2000, the small-cap index from provider FTSE Russell. Due to their low trading volume, shares of these companies can jump substantially when they're added to the index. As a bunch of new investors pile in, these stocks rise until supply matches demand.

Late last month, the Russell index reconstitution was completed. And that brought about some interesting statistics that highlight how the market is evolving...

A "barbell" appears to be developing, with a few huge companies and a lot more smaller firms. For the first time ever on the data of the Russell 1000 Index's reconstitution, companies have exceeded a $1 trillion market cap: Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN).

At the same time, the tiniest company in the Russell 2000 was the smallest it has been since 2009 – $86 million Limestone Bancorp (LMST). This is the first time in a decade that a company with a less than $100 million in market cap was in the Russell 2000.

The Russell reconstitution is an example of one of the rare times that institutional investors get involved in the world of microcaps... and how powerful the potential can be if you can identify a microcap stock before Wall Street starts to pay attention.

And when the institutional investors finally get onboard, these stocks pop massively.

The microcap space is the wild west of investing... These stocks are so small, under-covered, and misunderstood that Wall Street doesn't want to do the work to separate the wheat from the chaff.

This means that individual investors can take advantage of this inefficiency... if they know the right stocks to own.

And here at Altimetry, for the first time ever, we've launched a product to let regular folks do just that. Using Uniform Accounting – and all our other tools on fundamental forensics, examination of management alignment and compensation, and deep fundamental – we can find tiny businesses with huge market potential... and the ability to execute on those opportunities.

That means huge upside for these companies' stocks.

Our brand-new Microcap Confidential service is where you can get the full details on which microcap companies have real potential to make 100% to 500% gains or more – and which ones to avoid – using our forensic analysis.

We just put together a presentation explaining the full story. Get the details – and learn how you can access seven of our microcap recommendations – right here.

It's an institution of the pharmaceutical world...

It's an institution of the pharmaceutical world...

First founded in 1876 by a Civil War veteran, Eli Lilly (LLY) has created some of the most important drugs of the 21st century.

In the 1950s, it was the first company to mass-produce the polio vaccine... and it was the first firm to create human insulin to treat diabetes. Today, Lilly is a leading producer of a variety of antidepressants, among other drugs.

Pharmaceutical companies achieve fame for developing landmark drugs, curing a longstanding disease, or raising the quality of living.

Lilly, like all pharma firms, has lived through the cycle of boom and bust revenue related to drug development and production. It's an exceptionally profitable business... but these companies are never worth more than what their next blockbuster brings in.

This is why, for many years, Lilly owned a veterinarian medicine business. This offering created steady cash flows year over year, helped anchor the company's income statement, and diversified revenue sources.

Recently, Lilly decided to spin off its pet medicine business in order to focus on its core offerings. Investors wanted to be able to just value its pharmaceutical business without the extra "noise."

While Lilly decided to spinout the pet medicine, that doesn't refute the skill sets, manufacturing capabilities, and other processes that overlap between the two businesses.

This isn't just true of veterinarian and human medicine, either. Pet and human end markets overlap in many industries, meaning companies that cover one end market often can provide similar offerings to the other.

Today, a popular food-products giant is applying this dual strategy...

General Mills (GIS) is famous for its breakfast foods and snacks. The company makes everything from Lucky Charms and Cheerios cereal to Pillsbury baked goods, Progresso soup, and organic Annie's snacks. It's a dominant force in the world of packaged food.

In 2018 though, General Mills looked to diversify its portfolio away from the breakfast and snack world by acquiring the pet food company Blue Buffalo. This move came partially in response to a trend we mentioned in yesterday's Altimetry Daily Authority: Snack foods are currently under pressure in the U.S. And worse for General Mills, so is breakfast cereal consumption.

With the Blue Buffalo acquisition, General Mills wanted to protect itself from these declining trends... as well as diversify its revenue with an uncorrelated business.

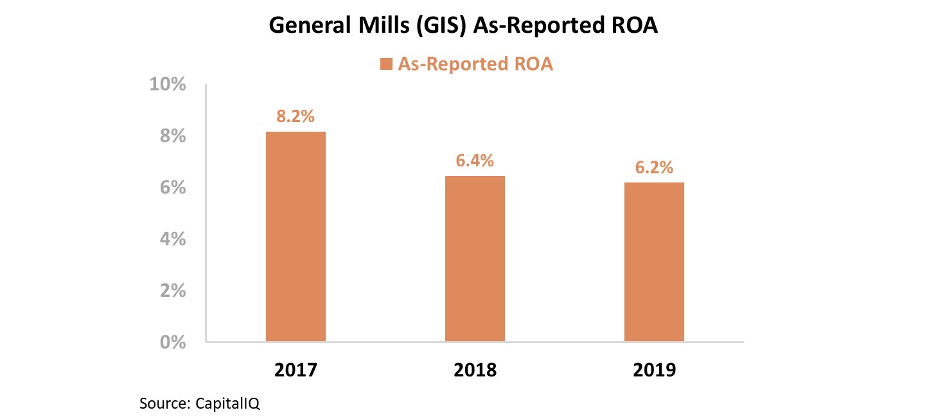

However, by looking at General Mills' as-reported return on assets ("ROA"), it would appear this newest diversification strategy isn't paying off. Over the past three years, General Mills' returns have been flat at 6%... that's half of the corporate average.

When looking at these numbers, it's no wonder investors think General Mills has thrown away capital on a pointless diversification effort. Wall Street knows that most acquisitions bring little to no value for the parent company.

However, Wall Street doesn't have the whole story...

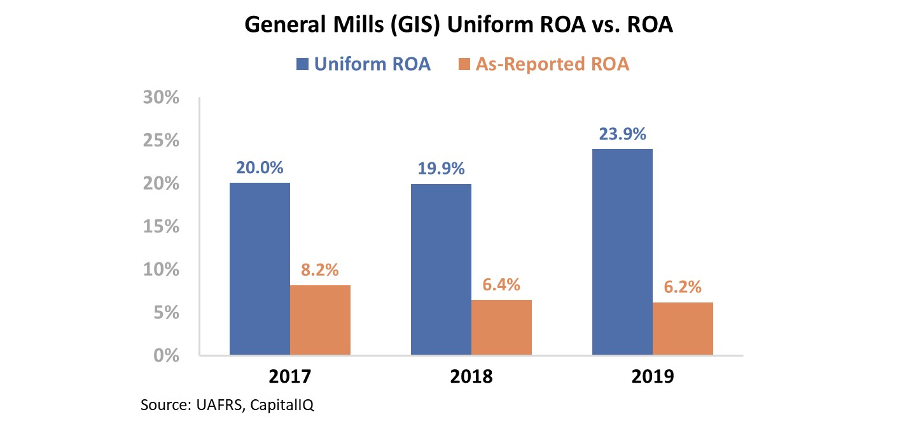

Due to the distortions in GAAP accounting and the way this method treats goodwill, among other accounting issues, General Mills has seen its ROA artificially deflated. After we take this distortion into account, we can see the real picture.

General Mills isn't a firm with returns below corporate averages... Rather, its ROA is both sizable and improving – up to 24% in 2019. Take a look...

Instead of struggling to find its market niche, General Mills has in fact been successfully executing on its diversification strategy... And it's been adding value to shareholders.

The company has been able push through the headwinds of the U.S. snack and breakfast markets, but this has been concealed by GAAP distortions. Without using Uniform metrics, investors would be disappointed with General Mills. But in reality, they should be celebrating its strategy.

Regards,

Joel Litman

July 15, 2020

One index's 'reconstitution' can often be a microcap kingmaker...

One index's 'reconstitution' can often be a microcap kingmaker...