The dot-com era was like a gold rush...

The dot-com era was like a gold rush...

In the late 1990s, the Internet was the hottest new technology. And all kinds of people entered the scene, hoping to make it big in what looked like a very lucrative market.

Some were incredibly successful...

Jeff Bezos, for instance, created Amazon (AMZN) in 1994. What started as an online bookstore is now one of the biggest e-commerce companies on the planet.

And in 1998, Larry Page and Sergey Brin invented a way to quickly scan the Internet. They called it "Google." Today, it handles more than two-thirds of all Internet search requests worldwide. It's also now a subsidiary of Alphabet (GOOGL), the trillion-dollar tech powerhouse that Page and Brin created in 2015.

Folks tried just about everything to make it big during the dot-com bubble... from digital-currency companies like Flooz.com to gardening supply shop Garden.com.

However, many early Internet companies ended in failure.

Much like during an actual gold rush, the most successful players were the "picks and shovels" companies. These were the companies supporting the popular dot-com names – the ones who built the infrastructure that helped power the Internet. And as the Internet took off, so did they...

Internet hardware maker Cisco Systems (CSCO) is one company that thrived during this period. It specializes in digital-communications technology... and it was one of the first to sell commercial networking routers.

Now, at one point, even Cisco looked like it was doomed to fail when the dot-com bubble burst. Business had tanked. And shares took a nosedive. However, as we'll explain today, that was the perfect time to invest...

Cisco briefly became the biggest company on the planet...

Cisco briefly became the biggest company on the planet...

Its market capitalization hit $550 billion in the 2000s. And its inventory was growing like there was no risk of a slowdown.

In 1997, Cisco carried about $250 million of inventory at any given time. By January 2001, that peaked at over $2.5 billion.

Right around then, the dot-com bubble burst. This led to a steep drop in the stock market. And the technology sector specifically was hit hard...

Many Internet-based companies either failed or drastically downsized their operations.

Cisco's management didn't anticipate the bubble bursting when it did... which posed a huge problem.

It was sitting on billions of dollars' worth of inventory with nobody to buy.

Soon after the bubble burst, management decided not to beat around the bush. It announced some of the worst quarterly results imaginable. Cisco let go 8,500 employees and wrote off about $2.2 billion in inventory.

In other words, management told Wall Street that its inventory was completely worthless.

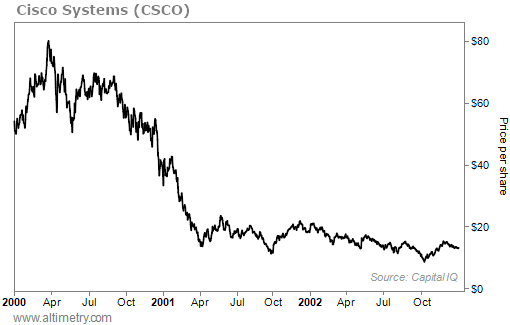

By October 2002, the stock had plummeted 87% from its all-time high...

With so many other Internet companies going under, investors were worried. Most didn't realize what management was actually doing...

Cisco wasn't really in trouble.

The company was taking a "big bath"...

The company was taking a "big bath"...

Since management knew results would disappoint investors no matter what, it decided to make as many write-downs as it possibly could.

Management intentionally made the quarter look as bad as possible. That way, future quarters would look great by comparison.

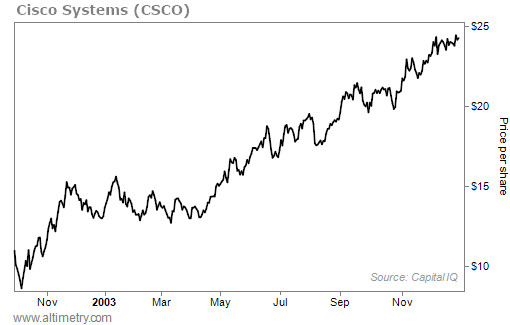

The supply hiccup didn't last too long. Even though the Internet craze slowed way down, router demand picked back up. And because management wrote down its inventory to nearly zero, investors had low expectations.

Even after its write-down, Cisco was able to sell some of its inventory. So starting the very next quarter, the company's earnings results were impressing investors again.

Within a year of its low, Cisco's stock had nearly doubled.

Take a look...

Cisco was able to make itself look way better because it took so many charges all at once.

It's not uncommon for management teams to pull something like this. And investors who can see through the accounting noise could reap the rewards...

Companies still take big baths today...

Companies still take big baths today...

When management knows the company's results are going to disappoint, it'll often do what it can to clean up the business. Many companies took big baths during the Great Recession... and today, we think the setup looks similar.

We expect a recession at some point in 2024. And when the outlook is at its bleakest, companies are very likely to make their bad quarters look even worse.

As with Cisco, this can be a great opportunity to buy stocks for cheap. So be on the lookout for companies that seem to be taking big baths.

It may be a sign that the worst news is behind us... and that huge gains are ahead.

Regards,

Joel Litman

August 8, 2023

P.S. We believe we're about to see a new wave of big baths this year.

As interest-rate hikes work their way through the economy, companies will use the pessimistic outlook to their advantage. And it's a glaring buy signal for investors who are paying attention.

That's why we just released a special report on the "big bath" concept to subscribers of our Hidden Alpha advisory. In it, we reveal four stocks that are promising big-bath candidates.

This could lead to massive profits in upcoming quarters. So make sure you don't miss out. Find out how to get our special report, "The Big Bath 2023 Portfolio," here.

The dot-com era was like a gold rush...

The dot-com era was like a gold rush...