It took two years for the Federal Reserve's rate hikes to kill the economy...

It took two years for the Federal Reserve's rate hikes to kill the economy...

Back in 1947, the central bank started raising interest rates to combat rampant inflation. It wasn't the kind of inflation we suffered in the 1970s... This was driven by the post-war boom.

Soldiers came home from World War II with more cash than they knew what to do with. The national unemployment rate was under 2%. And manufacturing was shifting back to business as usual.

All of that caused demand for goods to spike while supply remained stagnant... driving inflation way higher.

The Fed's job was an odd one. It had to cool down the economy while most everyone – corporations and households alike – was flush with cash. Those liquid balance sheets meant it wasn't until 1949 that the Fed's actions officially tipped us into a recession. And it was a mild one at that.

It took at least 18 months for higher interest rates to finally eat away at so much extra cash. At that point, companies were no longer able to refinance.

We've talked a lot about how today's economy mirrors the 1940s post-war economy. And today, the next phase seems to be showing up...

Corporations built up their balance sheets during the pandemic. Most paused all unnecessary spending, just in case. Not only that, but the government flooded our economy with stimulus. So when the economy rebounded faster than expected, companies found themselves with more cash than ever before.

That's no longer the case. In fact, there's a credit crisis looming on the horizon. And as we'll explain, it has the potential to set off the next recession...

High interest rates are impacting debt coverage beyond 2025...

High interest rates are impacting debt coverage beyond 2025...

Back in May, we wrote that corporate balance sheets were finally returning to "normal"... down from historically rich levels. Today, things look a little different.

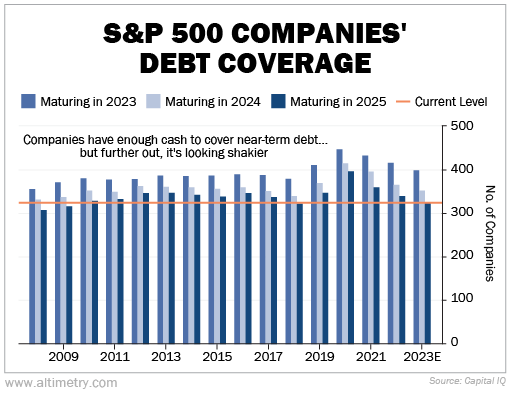

High interest rates are starting to take their toll on corporate balance sheets. You can see this in the chart below. It shows the number of companies in the S&P 500 with enough cash to handle debt coming due in the next three years.

As you can see, most companies still have enough cash to cover this year's debt. But when you look at all maturing debt through 2025, the picture isn't so bright...

Companies now have slightly more cash relative to maturing debt than they did in 2009... though it's a good deal lower than the average over the past 15 years. And that's a change from May, when companies had way more cash.

The more companies with enough cash to cover debt, the less risk there is in the market. Roughly the same number of companies had sufficient cash in 2018 as what we're seeing today. Any lower, and we're getting back to Great Recession territory.

Eventually, something has to give. Companies typically refinance their debt roughly one to two years out. So if they want to refinance this 2025 debt, they need to start soon.

We've been saying for a while that refinancing issues could surface somewhere between the end of 2023 and early 2024. This data only reaffirms our view.

Unemployment still hasn't budged from its safe range. The Fed is prepared to keep interest rates high until that number rises. That's a bad sign for companies that are running out of cash. They might not be able to refinance their 2025 debt maturities.

More and more companies will struggle to refinance...

More and more companies will struggle to refinance...

The credit market is tightening... though the risk of a serious wave of defaults is mitigated by the lack of near-term debt maturities.

At the same time, earnings growth no longer looks like it could help push the market higher. At this point, it appears growth will be on hold and could even fall slightly.

Valuations have elevated after the market rallied to start the year. Earnings growth has turned to shrinking, and credit availability is limited. Overall, there's not much reason for the market to rise.

And investor sentiment is bullish. That increases the risk of an imminent drop if investors get bad news. We could see more volatility in the coming months.

The warning signs are evident, and the Federal Reserve's strategy to combat unemployment by maintaining high interest rates could prove detrimental to cash-strapped companies.

We continue to see a recession looming. Even though the market has been rallying recently, we think it could just as easily start falling with a little more bad credit news.

Regards,

Rob Spivey

August 7, 2023

It took two years for the Federal Reserve's rate hikes to kill the economy...

It took two years for the Federal Reserve's rate hikes to kill the economy...