Napoleon Bonaparte's doctors couldn't waste supplies on the dying...

Napoleon Bonaparte's doctors couldn't waste supplies on the dying...

The legendary French general had invaded Egypt at the turn of the 19th century.

It was after Napoleon's resounding victory against the Austrian empire in Italy. And the young commander was seeking more glory to the east.

He convinced the politicians in Paris that sending an army to Egypt would improve France's leverage with the Ottoman Empire in trade negotiations. And the French could also plunder Egypt's historical and scientific riches, while at the same time opening a path for Napoleon to eventually invade British India.

In short order, though, he found himself stuck. His navy had been defeated by the British shortly after the invasion started, and he was stranded. He couldn't get more supplies from France or escape home.

So, in true Napoleonic fashion, he went on the offensive.

The French army marched toward Syria to take on the British-backed Ottoman army. But the army was facing the Middle Eastern heat and limited food... and plague was tearing through the men.

This was the last thing Napoleon expected, coming off his victories in Europe. He would have to keep his fighting force in the best shape possible. And that meant making a choice...

The doctors in the army decided to use their limited supplies on those soldiers they could save – ones they could bring back to fighting form fastest. Anyone who was too sick went to the back of the treatment line.

Despite the calculated strategy, Napoleon ultimately went on to lose the campaign. It was the first time he had to retreat during the Napoleonic Wars. And he did it by abandoning his army and returning to Paris alone.

The story goes that this was the first real example of triage being used in medicine... although in a barbaric way.

In the investing world, a company's credit risk gets treated the same way. The worse off the patient – i.e., the company – the more leery investors get and the more likely they are to pull their money and put it somewhere healthier.

When companies end up with imminent credit risk, investors leave them for dead. And when enough companies go bankrupt, you get a recession.

So if you want to understand how high the risk of a recession is, the first question to answer is... how many companies are graded as "high risk"?

Today, we're taking a deeper look into how much risk U.S. companies have. That'll help us see how likely a recession is from here – and how bad one might be...

Is there going to be a corporate bloodbath?

Is there going to be a corporate bloodbath?

Along with looking at our Credit Cash Flow Prime ("CCFP") analysis, there are a few other ways we gauge corporate health. One is by looking at how much cash companies have on hand relative to near-term obligations.

Right now, the Federal Reserve is trying to push more companies into the "high risk" category. It's raising interest rates to make it harder to borrow more money and to refinance. It's trying to slow down the economy.

But if companies have cash on hand to meet their debt maturities, the Fed's efforts will cool down the economy without doing serious damage.

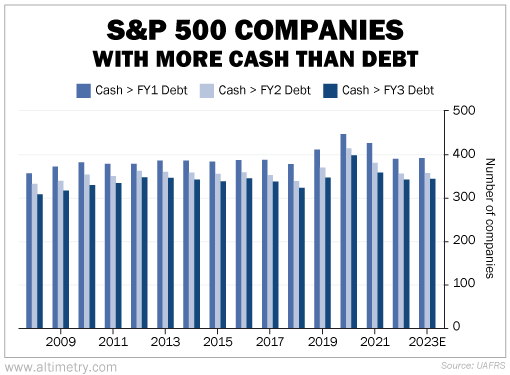

To see what kind of shape companies are in, we can look at how many have more cash than they have debt coming due in each of the next three years.

Take a look...

From 2019 to 2021, many companies scrambled to build enough cash to handle their near-term obligations. They didn't want a cash crunch. In 2020, nine out of every 10 S&P 500 Index companies had more cash on hand than debt coming due in the next 12 months.

For most of the past 15 years, roughly three out of every four companies carried enough cash on hand to cover the next year's debt maturities. And the number of companies that had more cash than debt maturing in the next three years tended to peak at roughly seven out of 10.

Right now, companies aren't holding as much cash as they were at pandemic highs...

Right now, companies aren't holding as much cash as they were at pandemic highs...

But levels are still above average.

Almost four out of every five companies have more cash than debt coming due in the next year. And those with enough cash for the next three years are near normal peak levels.

That's great news. It means that the economy isn't about to get slammed with very sick corporate patients.

The Fed's actions over the past year or so have definitely hurt a lot of weaker companies. Some companies won't be able to refinance their debt now that interest rates are so high and demand is slowing down.

But corporate balance sheets are healthy as a whole. So those sick corporations are going to be fewer and further between than they normally would be as the Fed cranks up rates.

We've been saying a recession is likely looming in late 2023 or early 2024 for some time... but we've been saying for just as long that any recession is likely to be mild.

And within this choppy market, there will be buying opportunities. Take advantage of companies that will be able to weather the storm.

Regards,

Rob Spivey

May 8, 2023

P.S. The Altimetry team believes a recession could hit later this year... But in a little more than a month, an entirely different event is already set to move more than half of the U.S. stock market.

This Wednesday, May 10, at 8 p.m. Eastern time, my colleague and Altimetry founder Joel Litman will share his urgent warning for investors – and detail the critical catalyst that could lead to abnormally large gains and losses.

Joel says this market event will affect more money, more quickly than the Silicon Valley Bank collapse earlier this year. But if you're prepared, you could protect your portfolio from cratering... and potentially earn five times your money in the process.

This event is 100% free to attend. All we ask is that you sign up ahead of time. Reserve your spot for free right here.

Napoleon Bonaparte's doctors couldn't waste supplies on the dying...

Napoleon Bonaparte's doctors couldn't waste supplies on the dying...