A Focus on Maslow's hierarchy reveals iceberg companies with 100-times potential...

A Focus on Maslow's hierarchy reveals iceberg companies with 100-times potential...

Some of the greatest stock performers in history have been microcap companies that grew to become megacaps. They generated incredibly high and sustaining earning power over long periods.

The companies that achieve this show an ability to "Fulfill Otherwise Unmet Customer Needs." That research appears in the Return Driven Strategy framework that I built with my longtime friend and colleague, Mark Frigo.

If companies succeed in fulfilling customers' needs in unique ways, it's because they understand those needs at an incredibly deep level. That's where Maslow's hierarchy of needs kicks in.

It's a bit strange that this is the first time I have written about Abraham Maslow and his hierarchy in the Altimetry Daily Authority. His research looms largely in psychology, and I frequently mention his framework when analyzing corporate earning power levels.

Maslow provides a phenomenal perspective for how to assess "human needs." The hierarchy is readily addressable and actionable for business strategy and analysis. It's a pyramid categorizing human needs from the most basic to the highest levels of human aspiration.

If a person can't fulfill their most basic needs, they can't rise to higher levels. People must satisfy their physiological needs first and foremost. Food, water, and air are the most basic of those. The next level of safety and shelter also takes priority. Without these, how can a person focus on anything more enlightening?

The higher levels of need include friendship, love, and belonging, such as being part of a community. The highest levels are about a person's self-esteem and self-actualization.

While it may not be immediately apparent, all these levels require a connection. The better we are connected, the better we achieve those needs.

Human civilization would never have made it so far if every individual or family tried to make it independently. Food, shelter, protection from invaders, and more require staying connected. Historically, ostracization and banishment from a tribe or group meant almost certain death.

Moving up the hierarchy, the need for belongingness and esteem can only come from a loving and supporting group of friends and family. And finally, the highest levels of self-actualization occur when someone is in the best form of oneself, contributing to the lives of others positively.

That all requires being super-connected.

It's no surprise then that one of the biggest stocks of the last decade was a super-connecting company...

It's no surprise then that one of the biggest stocks of the last decade was a super-connecting company...

One of the highest-profit, highest-profile companies of the current day went from startup to megacap in just over 15 years. It has also been on our long conviction list several times. It's been one of our best stock picks.

This company is Meta Platforms (FB), formerly named Facebook.

And the reason for the company's success, despite all its challenges and flaws, is that the company fulfills the need of being super-connected in so many ways. When people think of Facebook, they may think of their Facebook profile and scrolling along their walls.

However, Facebook is just part of Meta's super-connecting ability. Building a profile on Facebook and creating engagement there was just the tip of the iceberg.

I use its product WhatsApp daily. Our firm and our partners are finding new ways of using Instagram as a great way of staying in front of customers and connecting to some unique new areas of the market.

Meta owns Oculus, the virtual reality headset brand that will help guide its users to the metaverse, the company's next project.

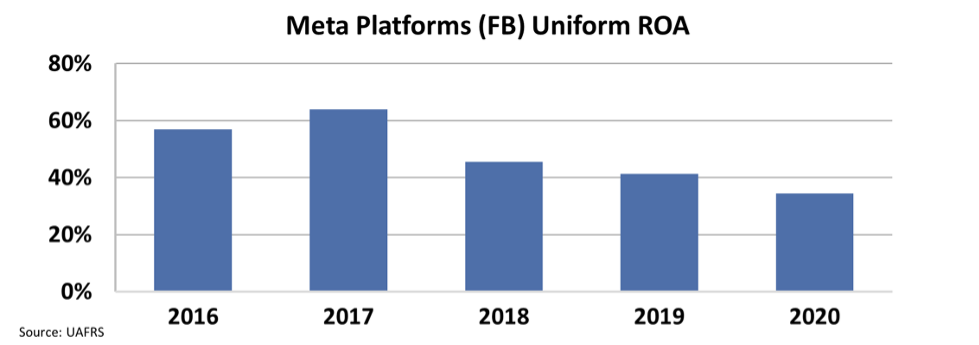

We can call Meta an iceberg stock for this reason... It found that it's profitable to help people stay connected. That's why it has consistently seen returns well above the global average levels of 6% over the past five years. Even during 2020, as the company pivoted its focus and saw regulatory pressures, returns were almost 6 times higher than global averages at 34%.

While many complaints about social media are justified, it still has tremendous uses. When a company can hit so much of Maslow's hierarchy, fulfilling its users' needs, it has the key ingredients for incredible success.

Our goal for Altimetry is not only to identify those companies as great stock picks but to build our firm to be one of those great companies.

And to become truly great, we need an unwavering and disciplined commitment to deeply understanding the needs of our customers and our workforce so that we can best fulfill them.

What does Meta have in common with Alphabet (GOOGL)?

What does Meta have in common with Alphabet (GOOGL)?

Meta's money doesn't come from all the free accounts. Like Alphabet, Meta makes its money under the surface as a massive advertising enterprise.

If you had purchased Meta in 2014, you would be sitting on gains that tower close to 2,000%. But the ship for big profits with Meta has set sail...

That's why at Altimetry, we sift through thousands of companies to identify smaller-sized companies with "hidden businesses." Often, Wall Street misses these companies because they're not looking at what's under the surface.

And we've identified four overlooked stocks following Meta's playbook.

I even give away the full details about one of these companies in my recent presentation... And when you watch the video, you'll get the name and ticker symbol – all free of charge.

View the presentation by clicking right here.

All the best,

Joel

January 28, 2022

A Focus on Maslow's hierarchy reveals iceberg companies with 100-times potential...

A Focus on Maslow's hierarchy reveals iceberg companies with 100-times potential...