We might not be in a recession just yet...

We might not be in a recession just yet...

But a bastion of economic health is showing signs of wear.

When the Federal Reserve raises interest rates to cool the economy, the first thing you see is a slowdown in big-ticket purchases.

After all, folks are less willing to buy a house or a car if mortgages and auto loans are more expensive.

Home-improvement retail, on the other hand, tends to be more resilient. Even as the economy slows down, folks still find the cash to invest in their homes. As a result, we don't see a pullback in these sales until much further down the line.

That's why it's so important to watch home-improvement retailers. They can tell us a lot about the state of the economy... Folks don't tend to spend a lot of money on optional do-it-yourself projects when times are tough.

And unfortunately, the industry just got its worst news in years.

Home Depot (HD), the No. 1 home-improvement retailer in the U.S., missed earnings by nearly 3% in its most recent quarter.

On top of that, revenue seriously disappointed investors. It came in at $37 billion... a full $1 billion lower than expected. It was Home Depot's worst revenue miss in roughly two decades.

And even though its competitor Lowe's (LOW) reported higher-than-expected earnings, both companies cut their full-year sales outlooks.

Customers are holding off on big projects and focusing more on smaller ones. That's hurting home-improvement retailers. Investors are already worried there could be more pressure – but they don't understand just how bad things could get.

As we'll show you, this could be the beginning of a tough downturn for the entire home-improvement industry... and for the broader economy.

Home-improvement companies were top performers during the pandemic...

Home-improvement companies were top performers during the pandemic...

Most folks were working remotely, and they had far fewer places to spend their money. They couldn't go out to dinner, meet up with friends, or take vacations.

So instead, they started renovating their homes and making themselves more comfortable in the place they spent the most time. (This is part of a trend we call the "at-home revolution.")

Some created in-home offices, while others wanted their pools and outdoor living areas fixed up.

It was a major boon for the entire industry. Americans flocked to stores like Home Depot and Lowe's.

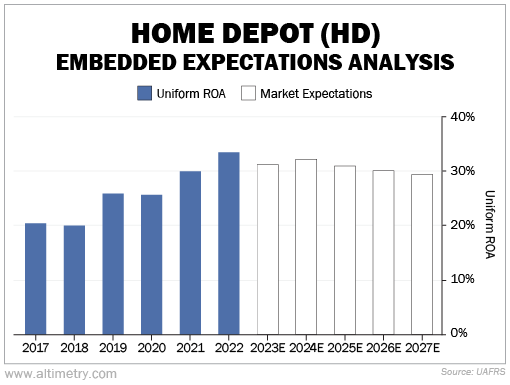

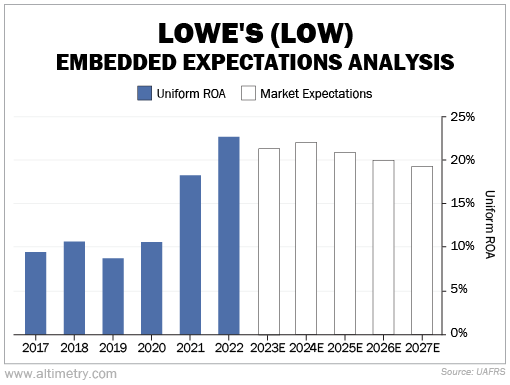

Thanks to the incredible demand and relatively stable operational costs, both companies' Uniform return on assets ("ROA") soared. Between 2019 and 2022, Home Depot's Uniform ROA jumped from 26% to 34%. Lowe's surged from 9% to 23% over the same period.

But today, things aren't so rosy...

Home Depot's earnings miss was just the beginning...

Home Depot's earnings miss was just the beginning...

Both companies are forecasting worse results as we head toward a recession.

These companies outperformed over the past few years. Their business models stayed the same... and yet, profitability was above average for both of them.

Now, sales are slowing down. Profits are likely to do the same. However, the market doesn't seem too worried.

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At today's stock prices, the market expects Home Depot's Uniform ROA to stay above pre-pandemic levels for the foreseeable future.

Take a look..

And it's the same story for Lowe's...

These businesses exceeded expectations over the past few years, when everyone was stuck in lockdown and investing in their homes.

And even though we're no longer in the midst of a global pandemic, the market thinks they can keep performing at those levels.

Investors may be in for a rude awakening...

Investors may be in for a rude awakening...

Folks seem to be tightening their budgets even more today.

Big purchases were some of the first things consumers cut back on. Now, home-improvement spending is starting to slow.

Interest rates are clearly weighing on consumers. And that burden will only grow heavier the closer we get to a recession. So these expectations seem too high...

The market isn't pricing in any real slowdown for either of these companies.

And if there's a substantial pullback in spending or a further fall in profitability, that could be an issue for investors... Home Depot is the first major home-improvement retailer to show weakness. Lowe's is probably not too far behind.

Don't be surprised if other "stable" parts of the economy start showing signs of weakness, too.

Be aware of the potential downside in shares and keep a close eye on where these businesses are headed. They may hint at how close we are to a recession.

Regards,

Rob Spivey

June 6, 2023

We might not be in a recession just yet...

We might not be in a recession just yet...