Airline companies have been forced to evolve...

Airline companies have been forced to evolve...

Since the coronavirus pandemic escalated in March 2020, air travel has fallen off a cliff. This plunge in travel demand was similar to the halt in 2001 after the tragic events of 9/11.

However, with far fewer people traveling as the pandemic drags out, air travel has been slower to recover during the current crisis. Not only has air travel dropped significantly, but airline structures and overall demand has changed as well.

With business travel slowing, airlines must adapt.

As Bloomberg recently highlighted, airlines are taking actions to make business hubs less of a priority. Meanwhile, they're focusing more on travel to places where vacations will be returning. As American Airlines (AAL) Vice President of Network and Schedule Planning Brian Znotins explained...

Given the lack of business demand, we're focusing on leisure travel and providing more service for customers traveling to visit family and friends.

For example, as more folks have made their way to Florida, airlines have added more routes and increased the frequency of flights to the Sunshine State. Now, leisure travelers headed to Florida can find more "point to point" routes without connecting flights through the big "hub and spoke" airports.

Many experts question when (or if) business travel will recover to previous levels. With more people working from home and the proliferation of virtual meetings on platforms such as Zoom, business travel will likely be impaired for some time.

Therefore, we should expect a faster recovery for low-cost consumer airlines compared to the legacy airlines.

Among the low-cost carriers, one company has been traditionally seen as a standout...

Among the low-cost carriers, one company has been traditionally seen as a standout...

Historically, Southwest Airlines (LUV) hasn't focused on the traditional hub-and-spoke business model. In the current environment, that may benefit the company.

That said, as we explained in the February 25 Altimetry Daily Authority, Southwest's historical business model hasn't actually broken the company out of the typical airline mold. Even before the pandemic, Southwest's profitability was consistently below the corporate average.

Looking ahead, while the company's primary focus on personal travel over business travel may increase the speed and trajectory of its recovery, this isn't the only driver...

Southwest's credit structure is the main reason the company has been able to weather any business cycle or "black swan" event thrown its way, like the pandemic.

Many airlines have a habit of staying afloat by borrowing heavily. Southwest remains vigilant in not having any significant debt headwinds that it can't cover through difficult times.

The airline industry is one where bankruptcies are the norm – thus eradicating any value for investors. Simply by surviving, Southwest is sticking by its shareholders.

While many investors believe the strength of Southwest's business model has been the driving factor of the company's success, it actually comes down to the adherence to maintaining great credit.

For a better look, we can examine Southwest's credit through the lens of Uniform Accounting...

For a better look, we can examine Southwest's credit through the lens of Uniform Accounting...

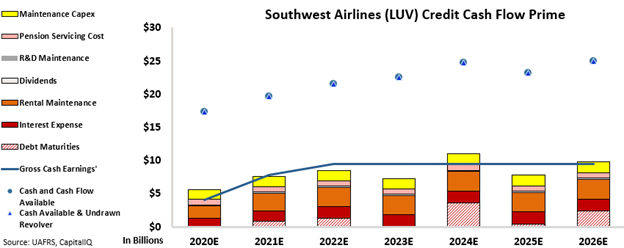

When we remove the accounting distortions inherent in GAAP metrics, we create our Credit Cash Flow Prime ("CCFP") analysis to show how a company's debt structure – and credit risk – breaks down.

In the chart below, the stacked bars represent Southwest's obligations each year for the next five years. These are compared to the company's cash flow (blue line), cash on hand at the beginning of each period (blue dots), and undrawn revolver (blue triangles).

As you can see, Southwest's cash flows should exceed all obligations in almost every year going forward, with only small shortfalls in 2024 and 2026. Furthermore, cash flows and cash on hand should comfortably service all debt obligations through 2026.

Thanks to these strong credit fundamentals, we give Southwest a lower-end investment-grade credit rating of "IG4+"... which corresponds to a less than 2% risk of default over the next five years.

Southwest's credit philosophy has been the main reason why the company has survived through all the challenges it has faced over the years.

The current crisis has been devastating for the industry, with dozens of airlines going bankrupt.

And while Southwest's operating strategy isn't as extraordinary as the experts would have you believe, credit investors should be thankful for management's strict debt discipline... It should help keep the company out of default in the wake of a brutal year for the industry.

Regards,

Rob Spivey

March 2, 2021

Airline companies have been forced to evolve...

Airline companies have been forced to evolve...