The rise of everyday, 'retail' investors has changed the face of trading...

The rise of everyday, 'retail' investors has changed the face of trading...

With widespread access to the Internet, more folks than ever can access investment research and stock ideas. As we said last Thursday, massively popular apps like Robinhood have forced other brokerages to offer commission-free trading in order to compete.

However, it wasn't just Robinhood that drew out these investors in recent years. Business leaders like Elon Musk – CEO of electric-car maker Tesla (TSLA) – have used their bully pulpit on social media to get investors engaged.

Musk has become notorious for his ability to move markets with his tweets. All of these swirling factors crashed together in January, when retail traders pushed GameStop's (GME) stock into a short squeeze.

During the carnage, Musk was tweeting phrases like "GameStonk" ("stonk" being a satirical misspelling of the word "stock," which is favored by the Reddit group WallStreetBets) that fed into the mania. By the end of the bubble, Musk tweeted, "I am become meme, Destroyer of Shorts" – referencing his role in the hype that drove GME shares higher and led to big losses for those who had sold the stock short.

With the rise of the retail investor, Musk has been able to drive investment demand with a tweet in the other direction as well. Tesla's share price plummeted from $760 to less than $700 within minutes when he tweeted, "Tesla stock price is too high, IMO."

And in yet another example of how his cult of personality has moved markets, Tesla announced it had purchased $1.5 billion in bitcoin to further diversify its cash position just last week. This caused the cryptocurrency to soar more than 10% to new highs.

One consequence of the rise of retail investors is the greater market power of popular figures like Musk. Investors need to be aware of greater market volatility now that retail investors have given themselves a seat at the table.

But as we explained last Thursday, there's another side to that same coin...

With more investors trading, wealth managers are set to benefit.

With more investors trading, wealth managers are set to benefit.

Counterintuitively, more retail investors means more demand for wealth managers. The more active interest in the market, the more investors see the need to turn to the experts for financial advice.

This expert knowledge is even more acute in highly illiquid markets like real estate. Investing in real estate requires a huge amount of capital to be properly diversified. Investors also need inside knowledge of local markets to get a good deal.

This is what a wealth-management company like Cohen & Steers (CNS) offers its clients. The company allows individual investors to diversify their money in real estate and other more illiquid assets, without clients having to deal with any of the headache or needed expertise of directly buying.

To get a better look at Cohen & Steers' performance as the market changes, we can look to our Altimeter tool...

To get a better look at Cohen & Steers' performance as the market changes, we can look to our Altimeter tool...

Harnessing the power of Uniform Accounting, the Altimeter breaks down the financials of thousands of U.S.-listed companies and shows users easily digestible grades to rank stocks. By eliminating the distortions in GAAP metrics, Uniform Accounting shows us a much more accurate financial picture.

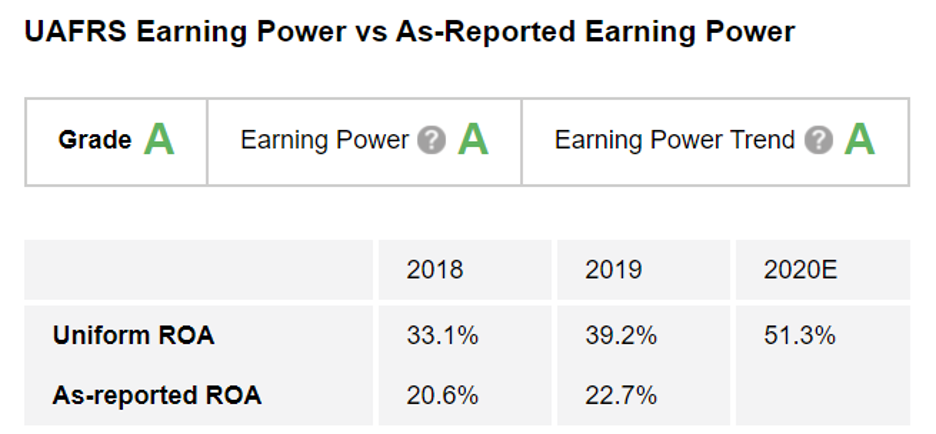

Looking at just the as-reported metrics, Cohen & Steers' return on assets ("ROA") appears to be modest and roughly flat. The company's ROA declined from 27% as recently as 2015 to 21% in 2018, before moving slightly higher to 23% in 2019.

As-reported metrics make it look like a profitable business, yet one under some pressure.

However, we can see a powerful earnings power trend – which represents a company's ability to grow its earnings year over year – once we clean up the GAAP distortions in the accounting. The Altimeter shows that Cohen & Steers has been able to grow its Uniform ROA sizably in recent years – from 33% in 2018 to an estimated 51% in 2020.

For context, the average company in the U.S. has an 11% Uniform ROA, so Cohen & Steers is seeing its earning power rise from 3 times the corporate average to almost 5 times that number.

This strong trend is why the company earns an "A" grade for its Earnings Power and Earnings Power Trend.

Companies like Cohen & Steers are providing value by offering important services to folks looking to take control of their investing... particularly in corners of the market that can benefit from expert advice.

But past performance is only one piece of the puzzle...

But past performance is only one piece of the puzzle...

To get the full picture of whether Cohen & Steers' stock is a good buy, we also need to understand valuations.

Through the power of Uniform Accounting, The Altimeter can also break down the stock's real price-to-earnings (P/E) ratio relative to market averages... as well as what the market expects for the company's earnings growth going forward.

Understanding what the market expects a company to do – and whether the company can do better or worse than that expectation – is how great investors pick stocks.

If a stock has low valuations and low market expectations, it could be poised to move to the upside as the market comes to its senses.

To find out how to gain access to Cohen & Steers' real valuations and its complete grades – and the valuations and grades for all nearly 4,500 companies in The Altimeter database – click here.

Regards,

Rob Spivey

February 18, 2021

The rise of everyday, 'retail' investors has changed the face of trading...

The rise of everyday, 'retail' investors has changed the face of trading...