Its mission is to 'democratize finance'...

Its mission is to 'democratize finance'...

Popular brokerage app Robinhood has become increasingly popular with everyday, "retail" investors since its inception in 2013.

Folks have climbed aboard the platform thanks to Robinhood's easy-to-use interface and commission-free trading, which it offered earlier than traditional brokerage firms.

As a result of Robinhood's massive popularity, the big brokerages have been forced to offer free trades to compete. With easier accessibility to investing due to commission-free trading, there has been increased discussion about the rise of the retail investor... long before the recent trading activity in the stock of video-game retailer GameStop (GME).

However, the army of everyday investors on discussion site Reddit's WallStreetBets forum who pushed GameStop and other stocks into massive short squeezes put a greater focus on the rise of the retail investor.

This emergence brings up an interesting – and initially counterintuitive – aspect...

This emergence brings up an interesting – and initially counterintuitive – aspect...

Industry experts have noted that the surge of retail investors has started to benefit wealth advisers.

Initially, many people believed these everyday investors would contribute to the death of financial advisers.

But the opposite has held true. As more folks begin to participate in financial markets, many realized that they're incapable or unwilling to properly invest their own money.

This is where a financial adviser's value becomes clear. Rather than contributing to the decline of the wealth adviser, the surge of new participants into the stock market has given this profession a new life.

Even lesser-known firms have been caught up in the increased focus on financial advising...

Even lesser-known firms have been caught up in the increased focus on financial advising...

For example, consider BrightSphere Investment Group (BSIG). It offers asset-management solutions with math-driven investing strategies. Users can then tweak these strategies as desired.

Additionally, BrightSphere also offers traditional investment vehicles for "set and forget" investing... so customers can step back and take a less active role.

These vehicles include real estate, private-equity, and "market neutral" products that are designed to perform in both up and down markets.

Despite this innovative two-pronged strategy, BrightSphere still faces stiff competition from well-known investment powerhouses such as BlackRock (BLK), Invesco (IVZ), Blackstone (BX), and AllianceBernstein (AB).

To see if BrightSphere can perform against larger players, we turn to our Altimeter database to look at the numbers...

To see if BrightSphere can perform against larger players, we turn to our Altimeter database to look at the numbers...

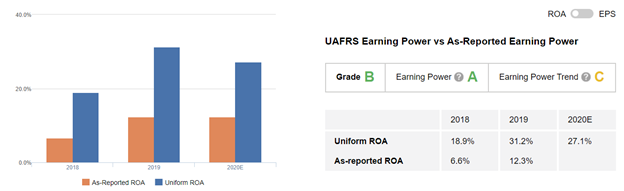

Based on as-reported metrics, the company's returns appear to be weak. Investors might assume BrightSphere is struggling to earn a strong return on assets ("ROA").

However, this assumption only holds using GAAP accounting...

Using the power of Uniform Accounting, The Altimeter shows that BrightSphere has seen robust ROAs. Specifically, ROA expanded from 19% in 2017 to 31% in 2019, before an expected slight decline to 27% last year.

This earns the company an "A" grade for Earning Power. But with lower expectations in improvement for ROA, BrightSphere earns a "C" grade in Earning Power Trend.

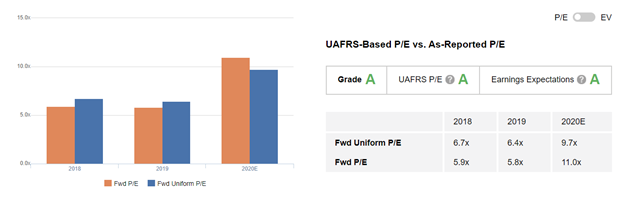

The picture further improves when we turn to valuations...

The picture further improves when we turn to valuations...

Right now, BrightSphere is trading with a price-to-earnings (P/E) ratio below corporate averages of 24 times. The market doesn't expect earnings power to improve as more investors realize they need help with intelligent investing... so BrightSphere gets an "A" grade for Earnings Expectations.

Thanks to the Uniform Accounting "snapshot" of BrightSphere in The Altimeter, we can see that the company has strong returns and improving demand combined with low market expectations.

The as-reported numbers make BrightSphere appear weaker than it actually is. But in reality, the company has good fundamentals... and is primed to take advantage of the changing investing landscape.

Regards,

Rob Spivey

February 11, 2021

P.S. With a subscription to The Altimeter, you can see for yourself how thousands of U.S.-listed stocks grade out. You'll find companies sitting in your own portfolio that could be strong performers... or could be poised for disaster. Learn how to gain access right here.

Its mission is to 'democratize finance'...

Its mission is to 'democratize finance'...