Tiger Global hit a rough patch recently...

Tiger Global hit a rough patch recently...

Last year, it lost its entire $38 million investment in fraudulent crypto exchange FTX. It wrote down a $147 million ByteDance investment by about 30%. And earlier this year, it marked down its entire venture-capital ("VC") portfolio by 33%.

Tiger Global is known for its tech investments... It's run by Chase Coleman III, a "Tiger Cub" whose team became incredibly rich by making big bets on tech and VC.

Tiger Global was an early investor in tech startups like music-streaming service Spotify Technology (SPOT), TikTok owner ByteDance, and social media giant Facebook – now Meta Platforms (META).

Investors are used to Tiger Global investing in VC projects. Yet, with a tough environment hurting the fund's usual strategy, Coleman finally decided to try something new.

He's investing in private equity ("PE") with one of the most dominant players... Apollo Global Management (APO). Tiger Global's $1 billion bet makes it the fifth-largest non-insider shareholder.

Today, we'll take a closer look at why Apollo caught Tiger Global's interest... and why it could be a refreshing change of pace.

Like Tiger, Apollo had a horrible 2022...

Like Tiger, Apollo had a horrible 2022...

Its net income fell to negative $4.7 billion, the company's worst performance ever. Rising interest rates caused more than $12 billion in losses.

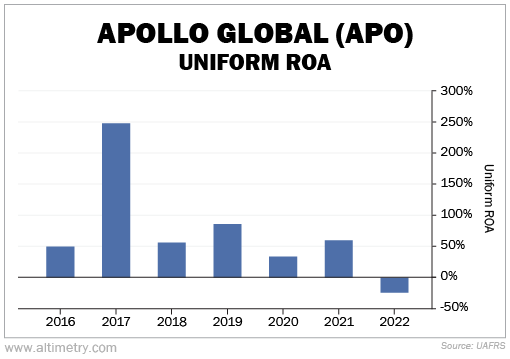

And Uniform return on assets ("ROA") followed suit.

Apollo's returns are typically above 30%... sometimes much higher. Uniform ROA was 60% in 2021. However, last year's losses caused it to plunge to negative 24%...

Coleman wasn't distracted by Apollo's poor 2022 performance. He was thinking about how great the business usually is.

Apollo is one of the very biggest PE firms. It's in the same tier as top players like Blackstone (BX), KKR (KKR), and Carlyle (CG). These franchises have dominated the PE landscape with their massive scale.

And as Coleman knows, even great franchises stumble sometimes... and the truly great ones always find a way to rebound.

If Apollo can survive this rough patch, it should return to normal profitability...

If Apollo can survive this rough patch, it should return to normal profitability...

That's what Coleman and Tiger are counting on. Meanwhile, the market doesn't seem to think Apollo can recover.

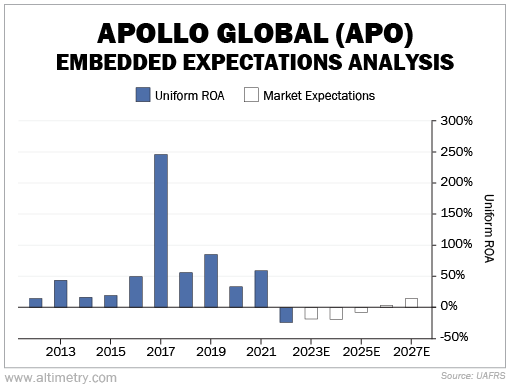

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, investors believe Apollo's Uniform ROA will only rebound to 14% by 2017... barely above the 12% corporate average.

Returns haven't been that low since 2012, when Apollo was still recovering from the Great Recession.

Take a look...

In other words, investors think that Apollo's string of successful years is coming to a close... for good.

Remember, most of its losses stemmed from rising interest rates. The Federal Reserve has signaled that we're nearing the end of its rate-hike cycle, which should help stabilize the business.

Apollo is a world-class franchise that has dominated PE for a decade...

Apollo is a world-class franchise that has dominated PE for a decade...

This is likely a key reason why Coleman is deviating from his normal VC investments. He has a chance to buy an excellent PE firm at a steep discount.

There's more to the story... Tomorrow, we'll share a business transformation that's likely giving Tiger Global even more confidence in Apollo.

In the meantime, this is a good reminder that the market is prone to overreaction... particularly in a shaky market. When great franchises get beaten up, do some digging to determine if something has truly changed.

Apollo still seems like the great business it always has been. When it overcomes short-term pressures, Tiger Global will reap the rewards.

Regards,

Joel Litman

August 29, 2023

Tiger Global hit a rough patch recently...

Tiger Global hit a rough patch recently...