When the 'Tiger Cubs' talk, we listen up...

When the 'Tiger Cubs' talk, we listen up...

As regular readers know, this group consists of former Tiger Management employees who now run their own funds. They're some of the smartest and most successful investors of the past decade and a half.

These folks founded more than 50 of the world's top hedge funds, including big names like Viking Global, Maverick Capital, and FrontPoint Partners.

The latter is famous for its successful bet against subprime mortgages during the 2008 financial crisis. And it's featured in Michael Lewis' bestselling book, The Big Short.

FrontPoint isn't the only famous one on the list, though...

There's also Tiger Global, which was founded by Chase Coleman III in 2001.

Coleman is praised as one of the smartest and wealthiest Tiger Cubs. As of this past April, Forbes named him the 251st richest person in the world.

Tiger Global makes big, concentrated, and thematically focused bets. It specializes in Internet, software, consumer, and financial technology investments.

One of its most successful strategies was to invest in private startups like Facebook before the venture-capital world grew to what it is today. And it went just perfectly... for a time.

Valuations were going up. Everybody was excited about these high-growth companies, regardless of their profitability.

But after a rough 2022, investors are souring on the fund's strategy... as it's now scrambling to find liquidity. Today, the fund has a portfolio of privately held companies worth more than $40 billion.

And it's looking to cash in before it's too late...

As we'll show you, pressure is mounting on private-company valuations. There's a clear sign that these companies are waiting for things to get better... and they may be running out of time.

Private investments can't hide their weakening valuations forever...

Private investments can't hide their weakening valuations forever...

For quite some time, private fund managers were able to hide their weak performances.

These investments aren't valued and revalued constantly like stocks are. They're valued only when there's a sale... which doesn't happen all that often. (This is a process called "marking.")

Private managers have more discretion on whether or not to mark their investments when the going gets tough. That's because they don't have to sell...

And today, there's a clear sign that private investors are scared about their holdings' valuations: Nobody's selling.

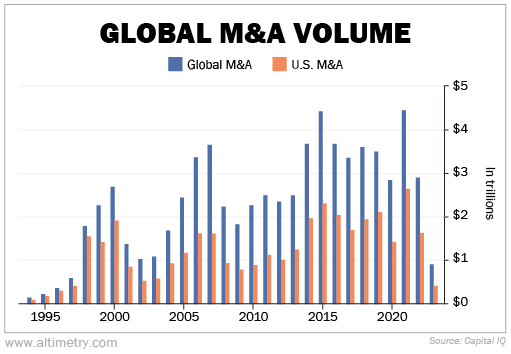

Mergers and acquisitions (M&A) activity has been falling both in the U.S. and abroad.

As you can see in the chart below, global M&A volume reached an all-time high in 2021. But over the past two years, it has fallen off a cliff.

Check it out...

Global M&A volumes were down 35% in 2022. And 2023's start to the year was the worst first quarter for M&A since 2009... during the lows of the Great Recession.

With less M&A activity, owners of private businesses face a tough market. There just aren't as many exit opportunities as before.

Interest rates are high, and access to credit is restricted. It's more difficult – and more expensive – for potential buyers to fund these big acquisitions.

Less demand for businesses means lower valuations to attract buyers. Considering today's financial environment, this situation isn't going to get better anytime soon.

Private markets have been booming for years. But now, this trend is starting to unwind in the face of higher interest rates – much like what happened with Blackstone (BX) and its venture-capital investments.

Don't get caught holding the bag...

Don't get caught holding the bag...

You don't have to manage a big hedge fund to be able to invest in private businesses. There are secondary market websites that let you buy private-company stocks.

However, savvy investors like Coleman are trying to find ways to quietly exit some of these private investments. They're looking to cash in before the private market takes a nosedive...

So if you're thinking of being a part of that trade, be mindful of who's probably on the other side. Just because private companies' valuations haven't fallen, doesn't mean they're doing well.

Don't forget that the current owners have more discretion over marking valuations down... if they don't sell.

From where we stand, jumping into the private markets is the last thing you want to do today.

Regards,

Rob Spivey

June 21, 2023

When the 'Tiger Cubs' talk, we listen up...

When the 'Tiger Cubs' talk, we listen up...