We hope you weren't planning on surviving the coronavirus pandemic by harvesting nickel and copper...

We hope you weren't planning on surviving the coronavirus pandemic by harvesting nickel and copper...

Last week, many people tuned into U.S. Federal Reserve Chairman Jerome Powell's testimony in front of Congress to hear information on the U.S. economy and what the Fed plans to do to mitigate the economic damage of the pandemic. If you were paying attention, you may have heard an interesting bit of trivia...

The Fed is short on coinage.

Hearing that by itself, you might think there's been a run on silver dollars or gold coins from the U.S. mint, as people rush to buy precious metals in the wake of the Fed flooding the economy with cash and with the uncertainty about the pandemic.

But the real issue is with significantly less in-person commerce. Simply put, coins aren't moving around the U.S. banking system. Generally, coins are used in-person at stores and other venues, and then deposited at banks. They then re-enter the banking system and are redistributed.

With the economy shut down, that's not happening... So there's a shortage of regular coins in the system. This affects the economy, as it disrupts in-person commerce even further... or squeezes margins as businesses round up to the next dollar when giving change to their customers. With margins already as thin as they are for many retailers, that can be the difference between businesses making a profit or a loss.

As an aside, you wouldn't be at fault for wondering if there could be a run on precious coins. While our macroeconomic analytics here at Altimetry don't point to any near-term risk of inflation, plenty of people are concerned that with the influx of currency by central banks across the globe providing liquidity, inflation will soon be rampant.

This is part of the reason why gold is at multiyear highs in terms of returns. Many people also are calling for silver to follow it.

If you're concerned, global asset manager Sprott is hosting its Natural Resource Symposium next month. Sprott brings together some of the best folks in the industry for its annual conference... and I'll be presenting there also! (Of course, not on precious metals.)

Normally, the event requires you to travel all the way to Vancouver, Canada to attend. But this year, due to the pandemic, Sprott has made it a lot easier to join... It's going to be entirely remote.

If you're interested, you can learn more – and register – right here.

We're always chasing the next thrill in the movie theater...

We're always chasing the next thrill in the movie theater...

Over the past 120 years, movies have continued to evolve to meet the consumers' rising expectations. One of the first ever films screened was The Arrival of a Train, debuting in 1896 to an enthralled audience.

While the tales of audience members running out of the theater scared of the oncoming train were exaggerated, people were nevertheless entranced by the 50-second clip.

While The Arrival of a Train may have been enough for moviegoers in late 19th-centruy France, studios soon had to up their game to continue drawing in an audience. Over the decades, technicians added sound, color, and improved effects to the cinematic experience.

However, developments also came to watching films outside of the costly theater. Beginning with the VHS and Betamax, studios have sought to get movies into living rooms as well as theaters. Today, we can stream thousands of films straight to our living room with streaming options like Netflix (NFLX) and Disney's (DIS) Disney+.

Before 2020, this has left movie theaters in a race to draw in viewers with exciting new spectacles, to get customers to not choose to wait and watch movies at home. However, this year has caused a once-in-a-generation disruption to the industry...

In yesterday's Altimetry Daily Authority, we talked about how some companies will only see short-term disruptions from the "At-Home Revolution." However, industries such as the movie theater business will see significant changes from the pandemic.

To ensure the successful release of their feature films in development, studios have been releasing some productions directly onto streaming platforms – thus side-cutting the theater entirely. Two successful launches with this model include Trolls: World Tour and Universal Pictures' King of Staten Island.

Just last week, movie theater company AMC Entertainment (AMC) announced plans to reopen many of its cinemas on July 15. However, it'll be a long road to returning to profitability... As one of the largest national establishments, AMC is hit especially hard by moviegoers' inability and unwillingness to watch films outside their own homes.

When looking at AMC's bonds, it's clear that debtholders expect a challenging future for the theater chain. Current yields for AMC's debt are between a large spread of 13% to 30%. Yields this large can only mean investors are anticipating bankruptcy.

However, stockholders see a much different picture of AMC's strength...

Chinese conglomerate Wanda holds a large percentage of AMC stock, so investors believe that an influx of funds will keep the theater chain afloat. We can see this in AMC's stock price, which has seen a significant move towards pre-pandemic levels.

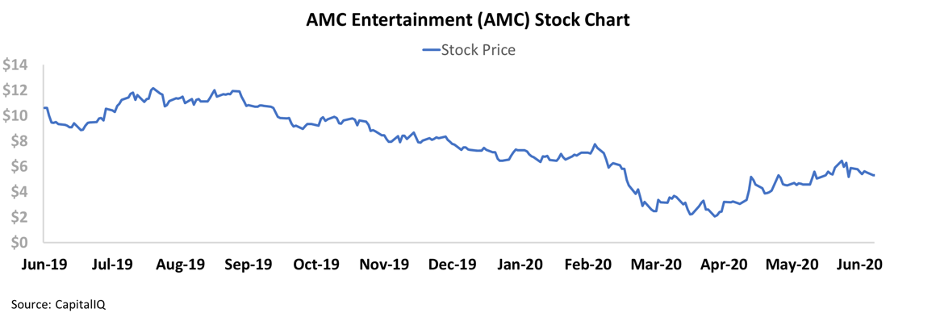

As you can see in the chart below, AMC shares have hovered around $5 to $7 since December, with a recovery this month from the losses in March and April.

There's clearly a difference of opinion between the bond holders – who see only downside risk – and the equity holders – who are looking at upside potential. So how at risk is AMC for bankruptcy?

Through Uniform Accounting, we can look at the company's credit fundamentals to get a better idea...

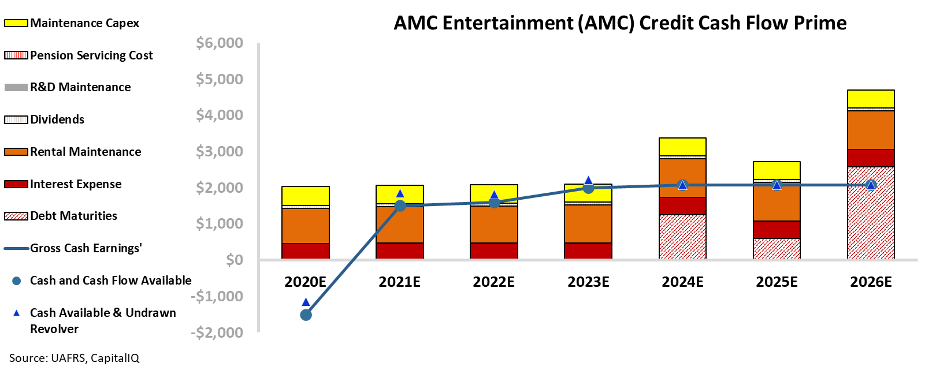

We'll use our "Credit Cash Flow Prime" analysis to compare AMC's Uniform Cash flows relative to its annual operating obligations and debt requirements.

The chart below highlights AMC's cash flows before obligations (blue line), its cash flows combined with cash on hand at the beginning of any period (blue dot), and the company's real obligations – in terms of debt maturities, interest expense, rental obligations, and maintenance capex needs (stacked bars).

In this type of analysis, when a company's obligations exceed all its cash flows and cash on hand, that means the business will need to either cut obligations or raise capital to avoid a cash crunch. If its cash and cash flows consistently exceed obligations, there's no issue.

As you can see, because of its massive cash flow declines and sizable yearly obligations, AMC will be unable to survive another year without significant outside assistance from Wanda.

If the company receives no outside help, the debt is right and the equity holders have a high potential to be burned. However, if AMC is saved, then the equity holders will be vindicated... and the bond yields will return back to normal levels.

As an investor, these mismatched assets are an opportunity.

Investors who buy AMC's bonds would take in a 13% to 30% yield, depending on the bond. As long as AMC doesn't go under, these investors would also have significant capital appreciation potential – as the company's bonds are trading between $0.36 to $0.89 on the dollar.

And to hedge out the risk of bankruptcy, investors could sell short AMC shares at the right ratio to the bonds (adjusted for volatility).

Remember, AMC equity investors are still clearly betting on everything being OK... while their credit counterparts are expecting catastrophe. Meanwhile, savvy investors who play both sides take in a sizable coupon on the company's debt while waiting for either a bankruptcy or the "all clear."

For the hedge-fund managers or those investors who regularly put on these type of trades, it's a classic "heads I win, tails I don't lose" situation – since either AMC's stock investors or its debtholders are wrong.

With our Uniform credit analysis, we're able to see the disconnect between AMC's stocks and bonds... and understand how it's possible to take advantage.

Regards,

Joel Litman

June 25, 2020

We hope you weren't planning on surviving the coronavirus pandemic by harvesting nickel and copper...

We hope you weren't planning on surviving the coronavirus pandemic by harvesting nickel and copper...