Equity investing doesn't stop in the markets...

Equity investing doesn't stop in the markets...

When people think of "equity investing," most think of stocks. In reality, it means that anytime you own a stake in an asset where you get all the "upside" from its cash flow streams, you actually have ownership.

Aside from public equities, this also includes private-equity investments, owning your own small business, as well as venture and angel investing. You can have ownership in a number of ways.

And then, there's another form of equity investing: real estate. People don't often think of it that way, but real estate investing is someone taking an equity stake in an asset.

As regular Altimetry Daily Authority readers know, our stance on real estate as an investment isn't always a positive one.

For many people, tying your capital up in one asset like a multi-family home or other real estate investment is bad diversification... and may not yield the returns you can get just by owning the market.

That being said, real estate investing can generate impressive capital gains if you can:

- Have professionals who know what they're doing to guide you through the process...

- Do it in a passive way that doesn't require you to be a real estate expert and full-time operator, and ...

- Get an opportunity to invest in a diversified way.

When done right, it's a great income generation strategy thanks to the leverage inherent in the business model and the steady cash flow streams.

For most people, the above three criteria have been out of their grasp. But now, that may be changing...

This evening, my friend and colleague Dr. Steve Sjuggerud of Stansberry Research is hosting a free event, where he'll share his real estate investing strategy... as well as an investment opportunity that's been off-limits to ordinary investors until recently.

And right now, he believes it's the No. 1 way to get started in the sector.

Steve has a great track record of finding winning investment ideas in the stock market for his readers. But in terms of his own money, the vast majority of it's invested in real estate.

During the event, he'll walk you through his own investments... including homes he bought and flipped... tax certificates that paid him 18%... raw timberland... and everything in between.

It's not all the time that I'll come out in support of a real estate investing strategy... but this is one that's definitely worth listening to.

The event is tonight at 8 p.m. Eastern time, and it's completely free to attend. You'll need to save a spot, so register right here.

Some industries are finally starting to recover from coronavirus...

Some industries are finally starting to recover from coronavirus...

States began shutting down more than three months ago at this point, and we're finally starting to see parts of the economy bounce back.

Goldman Sachs Equity Research has been publishing a weekly report that shows how different metrics are faring over time, separated into "Stay at Home" and "Back to Normal" categories.

While most back-to-normal categories are still lagging, and many stay-at-home segments are charging ahead, the effect is starting to equalize.

The June 10 report highlights that video-chat apps are still leading the way with 809% year-over-year growth, while airline bookings are still down 85% from June 2019.

As a plus, one back-to-normal segment saw positive year-over-year growth the week of June 10 – Redfin homebuyer demand.

In past weeks, segments like mortgage applications and the Starbucks (SBUX) app also saw positive year-over-year growth – showing that things are trending back to normal.

We recognize that some segments will be structurally changed by the "At-Home Revolution," while many others will eventually return to normal.

The recent news that 24 Hour Fitness is filing for bankruptcy and the realization that many people never used their memberships to begin with both signal that gyms might take a while to recover... if they ever do.

As we said in the June 2 Altimetry Daily Authority, the commercial real estate industry will have to rethink its entire structure.

And now that there's a precedent for sending new film releases directly to the home screen, even movie theaters are at serious risk.

On the other hand, restaurants, hotels, and the travel industry are chomping at the bit to get back to business.

Unless virtual reality makes a lot of progress quickly, there's no substitute for traveling.

Though these segments have been hit hard in the short term, demand will inevitably recover as the pandemic recedes.

Just as we saw in the wake of 9/11 or any time a major cruise ship disaster happens, the blow to the industry is transitory.

But despite the historical precedent for an eventual bounce back in travel-related companies, not all of them are priced for a recovery today.

One example is Hilton Grand Vacations (HGV). It's the timeshare portion of Hilton's (HLT) business that was spun off in 2017.

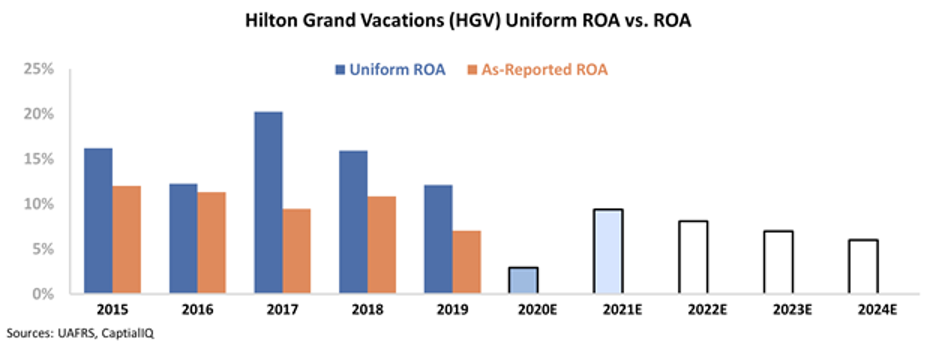

Historically, Hilton Grand Vacations was a strong business – with its Uniform return on assets ("ROA") remaining above 12% in each year since 2015. That's twice the long-term corporate average.

Unsurprisingly, 2020 is expected to be a difficult year.

The chart below shows Hilton Grand Vacations' historical profitability in terms of Uniform ROA (dark blue bars) compared to what analysts expect in the next two years (light blue bars), and what the market is pricing in at current valuations (white bars).

As you can see, expectations are for Hilton Grand Vacations' Uniform ROA to fall to 3% in 2020.

The 2020 figure should come as no surprise... but what is surprising to us is current market expectations. At current valuations, investors expect Hilton Grand Vacations' Uniform ROA to be cut in half permanently.

On the surface, there doesn't seem to be any reason that timeshare businesses would be disrupted more than traditional hotels or other vacation properties if the company is able to survive... Unless the market knows something that we don't and is concerned that Hilton Grand Vacations may go under.

By looking at the company's credit profile using our Uniform Accounting metrics, we can assess the likelihood that Hilton Grand Vacations will be able to pay all of its obligations in the coming years – and therefore, whether the business will be able to survive.

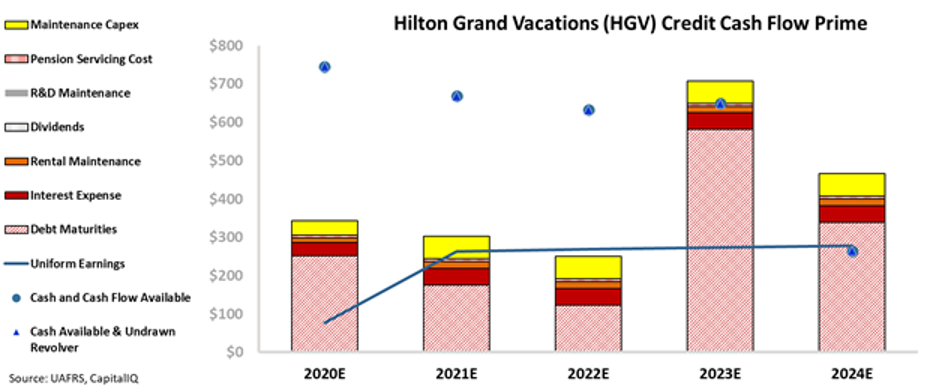

We call this a "Credit Cash Flow Prime" analysis. This compares Hilton Grand Vacations' Uniform Cash flows relative to its annual operating obligations and debt requirements.

The chart below highlights Hilton Grand Vacations' cash flows before obligations (blue line), its cash flows combined with cash on hand at the beginning of any period (blue dot), and the company's real obligations – in terms of debt maturities, interest expense, rental obligations, and maintenance capex needs (stacked bars).

When Hilton Grand Vacations' obligations exceed all its cash flows and cash on hand, that means the company will need to either cut obligations or raise capital to avoid a cash crunch. If cash and cash flows consistently exceed obligations, there's no issue.

Despite expected weak cash flows in 2020, Hilton Grand Vacations has a significant cash reserve on its balance sheet that it can rely on in the short term.

Additionally, should Uniform cash flows bounce back to normal within the next few years – as we would expect, and contrary to forecasts – the company would be able to service the majority of its obligations on cash flows alone.

Lastly, although it has a significant $580 million debt maturity coming due in 2023, Hilton Grand Vacations has plenty of time to improve its operations or refinance that maturity as necessary. Historically, the company has consistently refinanced its debt maturities.

Hilton Grand Vacations doesn't look like a business destined for bankruptcy anytime soon... meaning that investors are likely being too bearish. And as it begins recovering in line with other hotel and travel properties, the company could see its stock price rise significantly.

Regards,

Joel Litman

June 24, 2020

Equity investing doesn't stop in the markets...

Equity investing doesn't stop in the markets...