Dear reader,

We received some great responses to our article from Monday on real estate investing: The Most Common Investment in the U.S. is a Bad One.

One of our readers' questions came from Jacob S., who asked...

I would be interested in Joel's analysis of housing appreciation verses stock increases if he were to include rents in the case of the home (and I assume dividends in the case of the stocks.) Quite a few assumptions would need to be made, but I'd be interested to see how he would arrive at as close of an apples to apples result as possible.

I say this because my personal investment strategy has been, in addition to stocks, to own and rent desirable (trophy-like) condos/homes. Generally, the combination of operating expenses and depreciation result in the income being nearly tax free.

Plus, it is a predictable and consistent retirement income source. The date of death basis value step-up make it a viable generational wealth transfer vehicle too since my children can reload their depreciation base if they continue to hold the assets for rental.

It sounds like Jacob has built an impressive business. From his question, Jacob has done the following:

- Found some great locations/homes

- Financed them appropriately

- Regularly found solid tenants who pay their rents with low vacancy rates

- Managed the tax impact of cash flows very well

- Built sound relationships with service providers – like plumbers and electricians – that guarantee reasonable costs and timely responses when his tenants have issues (or he happens to have the skills to personally maintain the properties himself)

- Possibly found and partnered with a real estate management company to handle some of these things for him

- Considered all this for generational estate planning

The fact is, if you have the time, skills, and wherewithal to build a real estate business like this, all I can say is that this is fantastic. I can only applaud Jacob and those like him who can build such a business.

In the past, I've personally owned real estate for rent. I remember spending innumerable hours finding the right service providers, examining locations, monitoring interest rates for refinancing, and doing a host of other things. I eventually sold the property because of the time involved. It felt more like a job than an investment.

And that's the important point to note... Real estate in this context is truly a business. It's not simply an investment.

The fact is that most people don't have all the skills and the time necessary to build a real estate business outside of their own careers or professions.

So to the point of Jacob's question, we do need an apples-to-apples comparison to help us gauge investment opportunities against one another.

When we compare investing in the stock market with investing in real estate, we want to compare similar levels of resources absorbed. We need to recognize and fully grasp the obligations that real estate investing businesses can incur.

For the right investor – with the right framework and the right skill set, contacts, and other assets, and who is willing and able to invest the time and effort – real estate can be a great business opportunity.

However, for most investors, passive real estate investing provides a much lower return for the average real estate investment than what passive investing in the stock market has provided... by quite a large margin.

On that note, our next reader question allows us to provide a bit more context for just why that is. As Erich K. commented...

Housing has gone up only 78% since 1900? That's just crazy!

It's a reasonable reaction... Our data on this come directly from the U.S. Federal Reserve. On an inflation-adjusted basis, passive real estate investing simply does not provide the returns that the general stock market provides for passive investors.

Let's look at a specific example to illustrate just why this is the case...

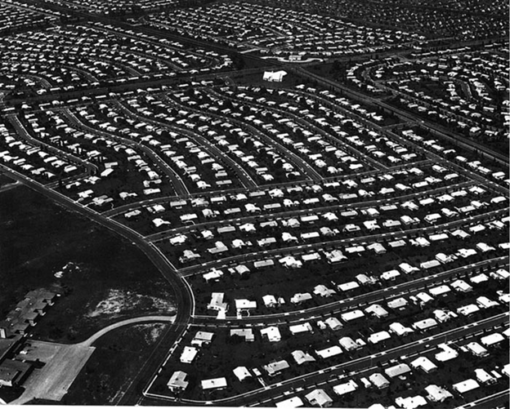

Below is a picture of Levittown, New York, in 1948. This was one of the first suburban towns in the U.S. that was built after World War II, where cookie-cutter homes sold for as little as $8,000 (equivalent to roughly $90,000 today, inflation-adjusted).

Source: Building the American Dream: Levittown, NY.

We use Levittown as an example because it represents a best-case situation of a passive real estate investment for comparing with a passive investment in the general stock market.

Levittown is located in wealthy Nassau County in Long Island, a popular locale for New York City commuters.

It has excellent schools – according to GreatSchools ratings, they range from 7 to 9 on the national scale. According to other school report cards, the schools get an "A."

Levittown has convenient access to multiple Long Island Rail Road train stations within a short drive for commuters who want to travel into the city.

All in all, Levittown still has characteristics that make it a compelling place to live, with high demand for its homes.

According to Zillow, the median value of a home today in Levittown is $440,200. That means that after inflation, over 71 years, the price of an investment in a home in Levittown has risen by 389%.

But is this return really that impressive? It represents only a 2.26% annual real return.

We chose Levittown to illustrate this example for two reasons... First, it's one of the few examples we can point to of a consistent community to examine over a long time period.

We also chose it – and gave all those details about the quality of the location – because we didn't want anyone to think we were cherry-picking a bad real estate situation.

For example, we're not using communities around Detroit... where the dependence on a single industry created serious trouble for real estate values in the entire area.

My hometown of Waterville, Maine, was heavily dependent on textile and paper industries. When the Hathaway shirt company closed its plant and a few of the paper mills moved out of town, real estate values suffered.

In fact, I think the price of the home I grew up in 30 to 40 years ago in Waterville has gone up in value less than 70% or 80% to today... And that's a nominal figure, with inflation!

Now, let's take a look at Levittown in 2004... As you can see, it hasn't changed that much since 1948.

Source: New York Times.

So, by using Levittown, we're choosing a location that has favorable characteristics that should support investment appreciation.

The problem is, when you invest in a house, you're investing in just that. It's not a business... It's not growing... And it doesn't produce any services or gadgets or other outputs of a business.

Ten years later, it's just land and a house. Fifty years later, it's just land and a house.

We can easily forget that ownership in the stock market means ownership in businesses. It's not just a store of value... It's ownership in something that is actively creating value.

For instance, let's take just one company from the S&P 500 Index... PepsiCo (PEP).

Pepsi isn't one of the best U.S. stocks over a long time frame, and it's not one of the worst. It's actually just a good single business that's representative of the companies in the stock market as a whole.

While Levittown real estate is up 389% over the past 70 years, Pepsi stock is up 5,971% on an inflation-adjusted basis in only the past 50 years.

How has this stock been able to rise so dramatically over the past 50 years versus real estate? Because Pepsi didn't have to continue to be just Pepsi.

In 1969, the company's only real brand was Pepsi. Jump to today, and a person who invested in Pepsi in 1969 now owns 25-plus brands.

You might be surprised to know that buying Pepsi shares in 1969 would mean you now own a piece of the multibillion-dollar Frito-Lay empire that controls Lays, Doritos, Fritos, Cheetos, Ruffles, and Tostitos.

That investor would also control Mountain Dew – a billion-dollar brand in its own right – along with Gatorade, Tropicana, and Aquafina.

And let's not forget that a little over 20 years ago, Pepsi spun out its ownership of the Yum Brands portfolio. Any investor in Pepsi received shares of the Yum Brands companies, which then included KFC, Taco Bell, Pizza Hut, and Long John Silver's.

By the way, the nearly 6,000% return that we pointed out above didn't even capture the additional return of the Yum Brands portfolio since it was spun off.

That brand also spun off a $16 billion subsidiary itself in 2016, Yum China, which controls Yum Brands' strong China portfolio.

For an investor to get that compounding in Pepsi, all he had to do was own the stock. He never had to do anything other than continue to live his life and then check back in 50-plus years.

Investing in the U.S. stock market is investing in 500 of the biggest and best businesses in the world.

For an investor to have accomplished a similar return in real estate, he would have had to be an active participant in the real estate business. That means countless hours, additional risks, significant expertise, portfolio management, and actively prospecting for new real estate assets to acquire and manage.

And that's before we even get into the fact that, for the average investor, the return he would get for the time invested would trail the returns he would get from just investing in the stock market.

When put in that context, while being a professional real estate investor may be right for some... the most common investment in the U.S. is a bad one for most investors.

Regards,

Joel Litman

November 7, 2019