Dear reader,

There is a type of investment that's riskier than the S&P 500, and has performed worse on average than the stock market. It also regularly requires investors to use debt to buy it – amplifying its risk.

Yet most Americans have more money locked up in this asset than they do in stocks.

I'm talking about the housing market.

Since starting Altimetry, we have fielded many questions about investing. One that often comes up is about real estate... Specifically, whether people should invest in the stock market or in housing.

To be clear, this is not a question about whether someone should buy or rent the home they're living in... That is a very different discussion. That decision revolves more around personal needs and motivations. My focus today is about real estate in terms of investment properties.

Investing in real estate is fraught with misunderstanding. Many investors do not approach real estate with the same methodology as equities.

The Federal Reserve reports that 51.9% of Americans own stocks, either directly or as part of a fund. This is a significant number, with more than half of Americans either saving for retirement through a 401(k) or owning a portfolio through a broker such as Fidelity or E-Trade.

However, homeownership in the U.S. is significantly higher – at 64.8% as of the third quarter of 2019. After reaching all-time peaks just above 69% leading up to 2007 before the burst of the housing bubble, homeownership has retracted back to historical levels.

Renting a home or buying one is a hard decision that many Americans struggle with every day. Factors include the length of stay, the hidden expenses related to owning a home, and the tax benefits to having a mortgage. However, people also weigh the investment potential into this decision... which could be costly.

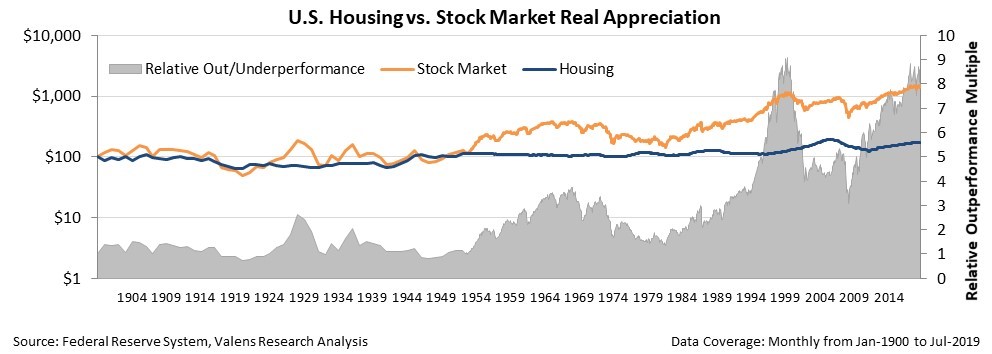

At face value, real estate has been a poor investment. Historically, the stock market has consistently outperformed real estate, with greater outperformance closer to the present day. If an investor were to invest $100 into the U.S. housing market in 1900, he would have $174.11, adjusted for inflation. However, if that same investor had invested in the stock market, he would have $1,506.25... a return almost nine times higher.

Furthermore, choosing to invest in real estate comes with risks not usually present in equity investing.

When investing in the stock market, some people choose to invest on margin to improve their returns. By borrowing money, they use leverage to magnify their gains. For example, if I invested $100 of my own and borrowed $100 to finance a stock purchase, I would have to pay back the $100... no matter how the stock performed. If my security doubled to $400, I would have tripled my money – taking home $300 after paying back the $100. However, if the stock lost 50% of its value, I would lose all of my investment... because I would only be left with $100 to pay back my broker.

Margin trading is inherently risky, so many investors don't trade with leverage. However, when choosing to purchase a home, people use leverage by taking out a mortgage. Under typical mortgage terms, a homeowner pays 20% of the home's value as a down payment. In other words, the typical homeowner is leveraged on a five-to-one basis... meaning the gains – or losses – are magnified fivefold.

Of course, if that $174.11 return on $100 invested was leveraged by five times, it would look like a better gain... but it still wouldn't exceed the stock market's return. And the stock market's return is without any leverage.

Not only is investing in real estate riskier because of the leverage it requires, but it also causes significant concentration of risk. When you buy the S&P 500, you are buying 500 of the most diversified businesses in the world – with global exposure and sector diversification.

If the economy of Chicago, Fort Lauderdale in Florida, or Phoenix slows, some individual companies in the S&P 500 might be impacted... but the overall market won't be.

On the other hand, if you invest in real estate in one of those areas and that market struggles, your concentrated investment will be directly impacted – just like in 2008 when housing prices fell dramatically.

In Phoenix, the average price of a home did not recover above the 2006 peak until June 2018. Compare that with the stock market... the S&P 500 recovered beyond its 2007 peak in 2013, and is now up almost 100% from those levels.

Not only do individuals investing in real estate lock in likely lower returns, greater risk from leverage, and greater risk from concentrating their investments... they also are investing in a market with greater competitive disadvantages than the stock market.

Professional real estate investors spend their lives researching how to profit off real estate transactions. They are actively engaged in conversations in these markets on a regular basis, they understand the legal implications of different investing structures, and they are locked into changes around zoning and development plans. These investors have a strong informational advantage in many areas that do not need to be disclosed to the public in a timely basis, because of the local nature of their connections.

Of course, equity markets also have professional investors... but for the most part, information needs to be disclosed to everyone at the same time, to keep the markets fair. This isn't always the case for real estate markets. So investors who aren't committing their entire time to investing in real estate are also entering a market where they have less complete information than the stock market.

The ironic thing about non-professionals who invest in real estate as opposed to the market to get real state exposure is that you can actually get this exposure – with lower risk – in the stock market...

There are 32 real estate investment trusts ("REITs") in the S&P 500, along with homebuilders and firms like McDonald's (MCD) – a business that is as much a real estate company at this point as it is a restaurant company. By buying the S&P 500, investors get real estate exposure and the rest of the benefits of investing in the stock market.

For individuals, the decision to rent or buy the home they live in is a personal one. However, unless you are a professional investor, there are big factors that would argue for investing in the stock market before buying real estate only for investment reasons.

Regards,

Joel Litman

November 4, 2019