Everyone knows Nvidia (NVDA) is an AI superstar...

Everyone knows Nvidia (NVDA) is an AI superstar...

Shares of the chipmaker are up 200% over the past year. Pretty much all other AI stocks follow its lead.

Nvidia's chips are the gold standard for running AI models, partly because of CUDA... its best-in-class programming platform. CUDA is pretty much a requirement for developing AI software.

Most of the market is waiting with bated breath for Nvidia's latest earnings, set to release after today's close. It's one of the biggest Wall Street events of the season.

And even outside the immediate circle of AI darlings, investors have largely caught on...

One layer out, businesses like Digital Realty Trust (DLR) and Constellation Energy (CEG) help support the AI boom. These companies build the data centers that host AI and the utilities that power those data centers.

Digital Realty Trust is up 58% in the past year, while Constellation Energy is up an astounding 160%.

The market is "all in" on the first two layers of the AI revolution. So as we'll explain today, for the biggest gains... you have to look further out.

With so much attention on AI, investors need to get creative to find under-the-radar investments...

With so much attention on AI, investors need to get creative to find under-the-radar investments...

And one of the best hidden opportunities is in consulting.

Consulting firms don't make any AI models or the chips that power them. Instead, they help other companies use AI intelligently.

Industry giant Boston Consulting Group ("BCG") expects AI to turbocharge its business this year. CEO Christoph Schweizer recently told the Financial Times that he expects AI to represent 20% of revenue in 2024. He believes that number will reach 40% by 2026.

BCG is a strategy consultant – which means it helps companies think about how to use tools like AI.

There are also companies like Tata Consultancy Services (TCS.NS)... a publicly traded consultant that specializes in IT implementation.

Tata helps companies actually stand up AI tech. Its services will be crucial as everyone fights over pieces of the AI pie.

The company is ready to implement AI for its IT clients. Of its more than 600,000 employees, more than half are trained on AI.

With shares only up 16% in the past year, the market is just catching on to Tata's potential...

With shares only up 16% in the past year, the market is just catching on to Tata's potential...

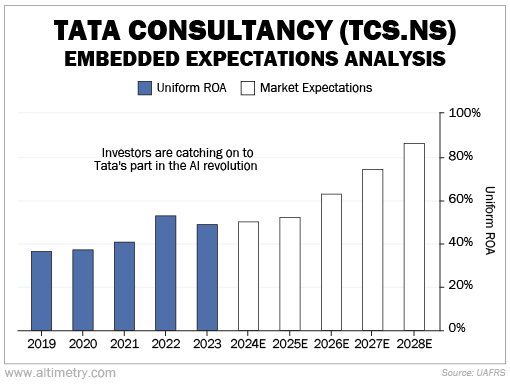

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Tata has already earned a Uniform return on assets ("ROA") of 40% or more since 2021. That's more than three times the corporate average... And the market projects returns will double by 2028.

Take a look...

As you can see, the market has lofty expectations for Tata. We think its AI-driven results will continue to impress... and investors will continue to bid up the stock.

That said, there's an issue. Despite only being up 16% in a year, Tata is expensive today.

It currently trades at a 32 times Uniform price-to-earnings (P/E) ratio. That's well above the 20 times corporate average.

That's why we're so excited about another top consulting firm...

That's why we're so excited about another top consulting firm...

It's a well-established business with a very similar structure to Tata. Uniform returns have been 40% or higher since at least 2019.

And with a 22 times Uniform P/E ratio, it's a much more reasonable price.

We first recommended this "recession resistant" consulting giant to our Hidden Alpha subscribers last year. We're already sitting on a small gain... and it's still well below our buy-up-to price today.

This stock could soar triple digits as the AI revolution plays out.

And the best part is, it's just one of several "hidden AI juggernauts" in the Hidden Alpha model portfolio. Learn how to access all our top recommendations right here.

Tata is setting itself up to be at the center of the AI-implementation industry. We expect returns to explode.

And there are plenty more soon-to-be AI blockbusters... if you know where to look.

Regards,

Joel Litman

May 22, 2024

Everyone knows Nvidia (NVDA) is an AI superstar...

Everyone knows Nvidia (NVDA) is an AI superstar...