So far, the biggest economic news of the quarter has nothing to do with inflation...

So far, the biggest economic news of the quarter has nothing to do with inflation...

It has nothing to do with the Federal Reserve's latest interest-rate decision, either.

Instead, it's chip behemoth Nvidia's (NVDA) better-than-expected fourth-quarter earnings report, released just last week.

Thankfully for investors, Nvidia blew expectations out of the water. It announced yet another quarter of record revenue... which grew an astounding 265% year over year to $22.1 billion. Meanwhile, earnings per share for the period exploded 765% to $4.93. Both numbers came in well above analyst projections.

Nvidia's stock is up another 17% since the company reported earnings. It continues to be the bedrock of the current market rally, accounting for 15% of the gains in the S&P 500 Index since 2023.

While we agree Nvidia's results deserve investor attention, things are getting out of hand...

Today, we'll discuss why investors are so bullish on Nvidia... and why they might want to get out while the momentum is still good.

Nvidia had first-mover advantage in artificial intelligence ('AI')...

Nvidia had first-mover advantage in artificial intelligence ('AI')...

As we discussed last summer, it's not just Nvidia's chips that are so valuable. It's also the company's programming platform, CUDA. CUDA lets developers interact directly with graphics processing units ("GPUs"), which are used to power complex analytics like AI.

Currently, CUDA is the best solution out there for these systems. Anyone who wants to design a best-in-class software for AI has to use CUDA.

And since Nvidia designed CUDA, it can only be used on Nvidia's GPUs. As a result, the chipmaker has become the backbone behind all major chatbots and AI systems, including OpenAI's ChatGPT and Google's Bard (now known as Gemini).

Nvidia also benefits from having very high switching costs...

That's because much of the software in the current AI ecosystem has been designed to use its chips.

And with the industry growing so quickly, spending the time and money to rewrite this code for different chips could be the difference between staying ahead of the game and falling behind.

Nvidia has capitalized on this opportunity to strengthen its moat. It has some of the fastest chips on the market, and they're compatible with a wide variety of software.

However, with dominance comes leverage over price... and some tech giants have grown tired of this relationship.

Nvidia has been raking in cash, and now they want a piece of the pie, too...

Nvidia has been raking in cash, and now they want a piece of the pie, too...

Big players like Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), and Microsoft (MSFT) have been developing their own chip and programming solutions.

This is similar to what they did when cloud servers took off...

When the cloud became a central part of these companies' businesses, they stopped buying servers directly from big sellers like IBM (IBM) and Dell Technologies (DELL).

Instead, they designed their own cloud servers to their own specifications. Amazon, Alphabet, and Microsoft then turned those cloud servers into some of the biggest server businesses on Earth.

At the very least, this could mean that four of the "Magnificent Seven" tech companies stop using Nvidia's chips.

And if they decide to sell their chips to other companies, it could mean demand for Nvidia's chips will come way down.

The media frenzy around Nvidia, of course, has blinded the market to these very real pressures...

The media frenzy around Nvidia, of course, has blinded the market to these very real pressures...

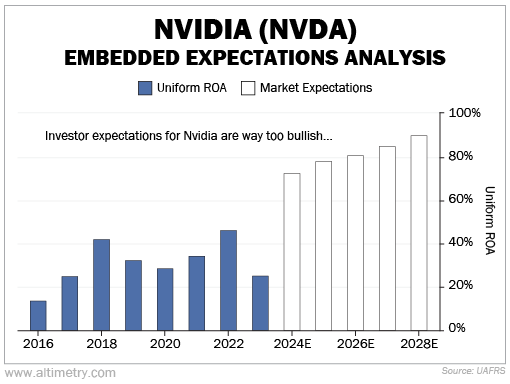

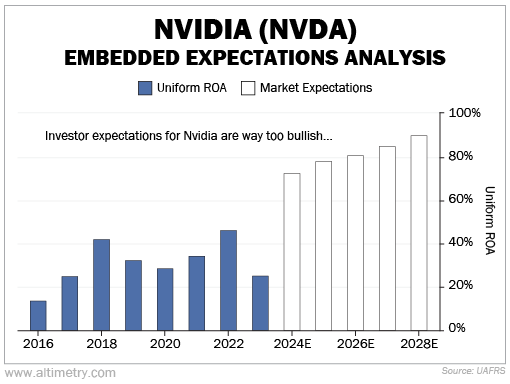

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Nvidia's Uniform return on assets ("ROA") has been at least 25% for the past seven years. It climbed as high as 46% in 2022... and now investors expect it to double from there.

As you can see, the market is pricing Nvidia's Uniform ROA to skyrocket to 90% by 2028...

No semiconductor company has ever sustained these kinds of returns. And if you want to argue that Nvidia's CUDA software is why investors are so bullish, you'd still be disappointed...

Software companies do tend to generate a higher ROA, as it takes fewer assets to sell software than chips. Even still, it's rare for software companies to earn those kinds of returns forever.

Nvidia needs to dominate the entire chip industry – forever – to justify today's valuations...

Nvidia needs to dominate the entire chip industry – forever – to justify today's valuations...

The AI chip market is projected to more than double by 2027, reaching a valuation of roughly $140 billion. And the market assumes Nvidia is going to win it all.

It's not pricing in the potential risks that come with major tech companies looking to move their chips in-house. As we said earlier, that could massively impact demand for Nvidia's chips.

While growth may very well be coming for Nvidia, this level of optimism seems far too extreme.

Investors should tread carefully.

Regards,

Joel Litman

February 29, 2024

So far, the biggest economic news of the quarter has nothing to do with inflation...

So far, the biggest economic news of the quarter has nothing to do with inflation...