Cathie Wood is supposed to know everything about investing in innovation...

Cathie Wood is supposed to know everything about investing in innovation...

The founder of tech-focused investment management firm ARK Invest, Wood rose to fame during the "meme stock" era. She used her ARK Innovation Fund (ARKK) to buy up shares of high-flying tech companies like Zoom Video Communications (ZM), Tesla (TSLA), and Coinbase (COIN).

These were high-risk, speculative investments... and they worked well for a time. ARKK was up roughly 150% in 2020. However, Wood's performance had more to do with being in the right place at the right time than her investing chops.

ARKK's returns have been abysmal for the past two-plus years. The fund is down 73% since its peak in early 2021. Worse yet, Wood continues to make bad bet after bad bet.

Today, we'll look at what went wrong with her worst trade of the year – one that lost her a near triple.

Earlier this year, Wood said she thought artificial intelligence ('AI') would help create the next $1 trillion company...

Earlier this year, Wood said she thought artificial intelligence ('AI') would help create the next $1 trillion company...

She was right... only she got the company completely wrong.

Wood thought software companies like UiPath (PATH), Twilio (TWLO), and Teladoc Health (TDOC) would be the next to break the $1 trillion barrier.

Right around the same time, she sold her position in semiconductor designer Nvidia (NVDA).

Wood argued that Nvidia was too expensive when the stock was trading at about $160 per share. She sold her stake from November 2022 to January 2023.

Nvidia's market cap breached $1 trillion at the end of May, if only briefly. The stock is up about 165% year to date, and it's all thanks to AI.

Over the past five years, AI and cryptocurrency became dual surging areas of demand for graphics processing units ("GPUs")... one of Nvidia's specialties.

The company's Uniform returns averaged around 35% per year, almost three times the corporate average. It grew revenue by an average of 23% per year through the end of its last fiscal year.

Now, longtime readers know we're the first to point out that chip companies tend to earn ROAs below 10% over their life cycles. So the question here is how Nvidia generates such strong returns.

The answer lies in its secret weapon, CUDA...

The answer lies in its secret weapon, CUDA...

CUDA isn't a chip. It's basically a programming platform. It allows coders to design systems that interact directly with GPUs. These GPUs are used for complex analytics like AI or crypto.

The most important thing to know is that CUDA is currently the best solution out there for these systems. Anyone who wants to design a best-in-class software for AI has to use CUDA.

And since Nvidia designs CUDA, it can only be used on Nvidia GPUs.

Nvidia is what's known as a "fabless" semiconductor company. That means it doesn't have any chipmaking facilities of its own. It focuses on design, then outsources production. The company has created an asset-light business model by tying its chips to software.

This gives Nvidia a significant competitive advantage... at least, until someone can develop better open-source software that's compatible with any GPUs.

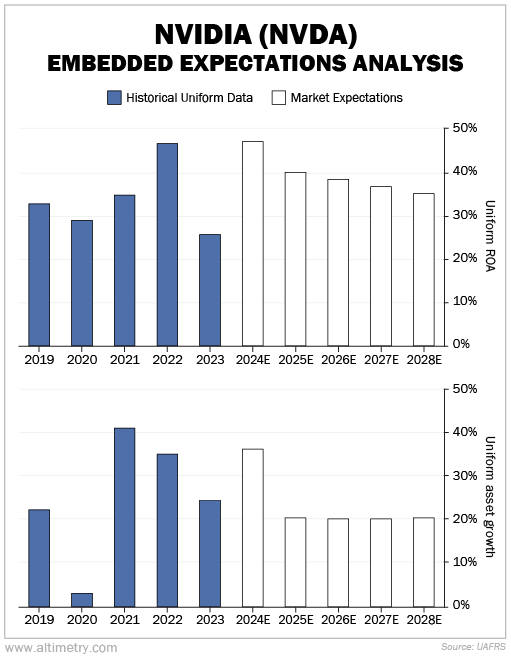

So Nvidia isn't your average chipmaker. And yet, Wood thought shares were way overpriced at the beginning of the year. We can see why she was wrong through our Embedded Expectations Analysis ("EEA") framework.

We'll start by looking at Nvidia's stock price back in January. From there, we can calculate what the market expected from the company's future cash flows. We then compare that with our own cash-flow projections.

That tells us how well Nvidia has to perform in the future to be worth what the market was paying for it in January.

At roughly $160 per share, investors thought Nvidia's Uniform return on assets ("ROA") would stay around 35% through 2028... along with 20% annual growth, which is slightly below its performance for the past five years.

Here's what it looks like...

These expectations aren't unreasonable at all... and we don't need the benefit of hindsight to tell us that.

These expectations aren't unreasonable at all... and we don't need the benefit of hindsight to tell us that.

Nvidia isn't your average chipmaker. Its strong competitive advantage from CUDA and its asset-light business model put it at the top of its industry.

Wood completely missed the boat. If she really understood what companies would "win" in tech, there's no way she would have called Nvidia expensive in January.

It's a different story today, though. After nearly tripling, Nvidia is undoubtedly expensive.

This is just another sign that ARKK isn't the innovative fund it's made out to be. It got lucky in 2020... and has proven time and again that it can't make consistent calls.

While Nvidia is a great company, we'd wait for some of the hype to cool off before buying in. And as for ARKK, look for other places to park your money.

Regards,

Joel Litman

June 8, 2023

Cathie Wood is supposed to know everything about investing in innovation...

Cathie Wood is supposed to know everything about investing in innovation...