This Little-Known Chipmaker Is on the Verge of a Breakout Thanks to Its 'Qualcomm Leap'

The coronavirus pandemic has even hit safe, dividend-paying stocks...

The coronavirus pandemic has even hit safe, dividend-paying stocks...

Since the coronavirus shutdown, 85 companies have suspended or canceled their dividends – the highest rate since 2001. And many of these have been blue-chip names that income investors trust.

Because of this concern, CNBC hosted Altimetry Director of Research Rob Spivey to talk about a report we wrote for our institutional clients at Valens Research on this specific issue.

Our team had identified nine names that were mostly blue-chip stocks at higher risk for a dividend cut than the market is pricing in.

We're certainly not calling for these safe companies to see their dividends slashed... But considering their debt maturity headwalls and potential cash flow constraints, investors were at a higher risk of being surprised by these names cutting their dividends than their low yields implied.

This type of analysis is a powerful way we look to use our credit cash flow analysis for equity investors. It's a key datapoint we use when analyzing high-yield companies.

The semiconductor industry is notoriously fickle...

The semiconductor industry is notoriously fickle...

This is a challenging place for investors.

In some situations, product cycles can be measured in months, not years. Investing cycles are quick, and only a handful of companies have brand power in the space.

Even Intel (INTC), the 800-pound gorilla of the chipmaking world, can't generate outsized returns. For most of the past 15 years, the company's Uniform return on assets ("ROA") has averaged around 10%.

Over their lifetimes, most semiconductor firms see ROAs that sit around 0%... or 5% at best. Sometimes they're higher, sometimes they're lower.

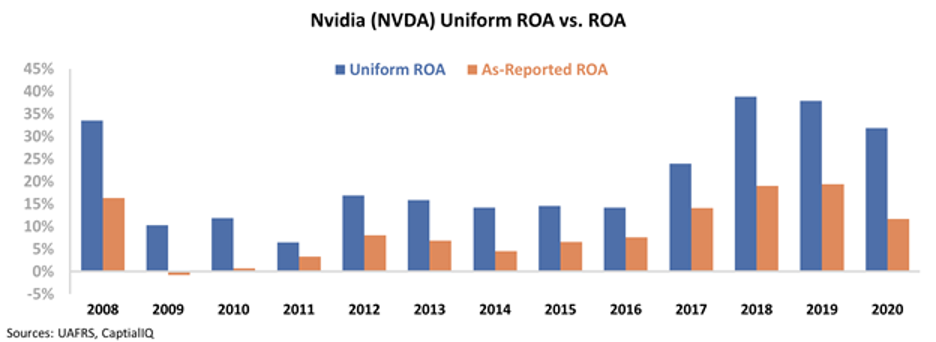

Just knowing who makes the best chips isn't good enough. While a company like Nvidia (NVDA) might have periods where its chips are in demand – like right now – it also sees plenty of times when its returns are well below 10%... And this is one of the better chipmakers.

When even an industry leader can't avoid product-cycle volatility, you know companies will have to get creative to stay resilient for long periods.

And that's just what we saw Qualcomm (QCOM) do on its way to becoming a $100 billion champion of the semiconductor industry.

Even before Qualcomm's Snapdragon became one of the most critical components of the smartphone boom, the company's unique business model kept it resilient even through cycle lows.

You see, rather than tying its entire business model to semiconductors, which fluctuate wildly as the supply-and-demand balance changes, Qualcomm licensed the use of its technology instead. It wanted to tie itself to the end product's life cycle instead.

Qualcomm was a leader in the smartphone processor category and the intellectual property ("IP") such as patents around it, so the company essentially supplied the entire industry through the 3G, 4G, and LTE cycles.

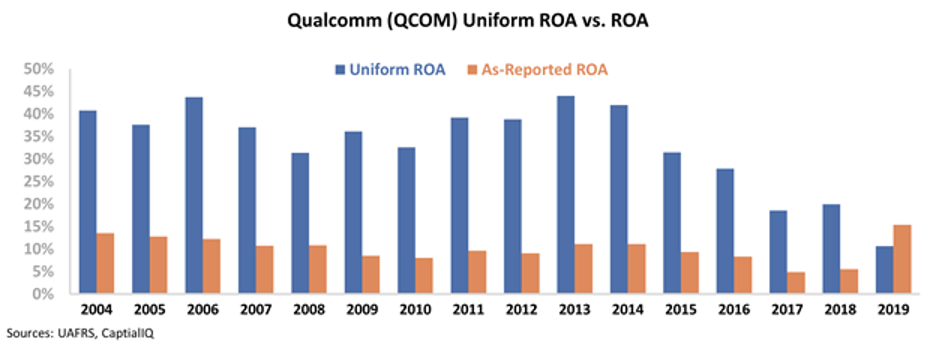

Because of its market dominance, Qualcomm was able to maintain industry-leading returns... even when some of the largest semiconductor companies were seeing their ROAs compress towards zero.

From 2004 until 2016, Qualcomm's Uniform ROA remained above 25%. Even with the company's recent decline due to Apple (AAPL) and others pushing it on its royalties, it still had an 11% Uniform ROA in 2019.

To be a great semiconductor stock, it's not enough to have great chips... you also need to own and be able to license great IP. Today, let's take a look at a company that appears to be building a similar strategy as Qualcomm did back in the early 2000s.

As its name and ticker imply, Universal Display (OLED) is a leading supplier in OLED technology used in smartphone screens, TVs, and just about every other display you can think of.

While the company is a best-in-class chipmaker, that alone isn't sufficient to create an economic moat in the semiconductor industry. Universal Display has been investing heavily to build a practically untouchable patent portfolio for the most cutting-edge, sought-after OLED technology in the industry today.

As the Internet of Things ("IoT") trend marches forward, more and more household appliances are making use of Universal Display's technology. But despite this massive tailwind, the company's recent performance looks lackluster.

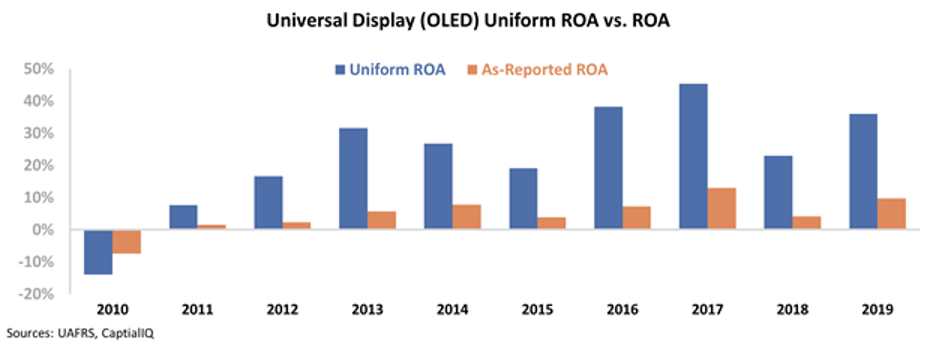

After inflecting positively in 2011, Universal Display's as-reported ROA has been decent, but not earth-shattering. In the past three years alone, the company's ROA has ranged between 4% and 13% – highlighting the volatility of the semiconductor industry.

That said, the as-reported numbers fail to reflect how Universal Display's successful investment strategy and its recent cash generation have boosted profitability.

After applying our Uniform Accounting metrics – which adjust for inconsistencies in as-reported data like the treatment of excess cash, research and development (R&D) costs, and non-cash stock option expenses – we can see that Universal Display looks like it's in the early stage of a Qualcomm-like run.

The company's Uniform ROA has exceeded 15% for the last eight years, and it reached as high as 45% in 2017. Take a look...

Looking at the real numbers, it's clear that Universal Display's massive patent investments are starting to pay off.

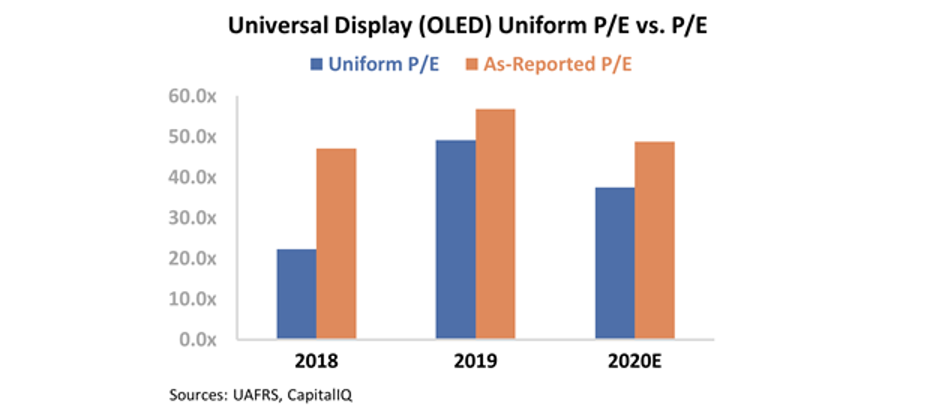

Furthermore, this helps explain why investors are willing to pay a premium for the company...

Universal Display's current Uniform price-to-earnings (P/E) ratio is around 35, which is significantly higher than market averages around 20.

At these levels, the market seems to understand the value of having a differentiated business model in the semiconductor industry. Investors wouldn't pay a massive premium for the low-return business as-reported metrics show, but they would for the next Qualcomm.

Without looking at the Uniform Accounting metrics, Universal Display might look like a screaming short... when it reality, it's probably much closer to fair value.

Regards,

Joel Litman

May 19, 2020

The coronavirus pandemic has even hit safe, dividend-paying stocks...

The coronavirus pandemic has even hit safe, dividend-paying stocks...