The Federal Reserve is still seeking ways to reduce financial risk...

The Federal Reserve is still seeking ways to reduce financial risk...

Here at Altimetry Daily Authority, we regularly discuss the importance of credit markets in economic and equity market cycles. In particular, we've talked about how the corporate cost to borrow helps dictate whether companies will refinance their debts or struggle to refinance them.

Last year, there were several times when the repurchase-agreement market, or "repo" market, didn't work like it was supposed to. Banks go to the repo market to turn long-term assets – like mortgage-backed securities or U.S. Treasurys – into more liquid assets for their businesses for a very short period of time, often overnight.

If banks can't get access to that credit, it can cause the entire financial system to seize up. And because of the increased risk, this will cause the cost for banks – and corporations – to rise.

If the corporate cost to borrow moves higher, companies will be less active in refinancing debt. This increases the potential that debt-maturity headwalls as a whole could build... and thus create a bigger liquidity crisis.

This is why it's so important that former New York Federal Reserve President William Dudley has talked about the central bank potentially creating a standing repo facility for banks. This is in an effort to de-emphasize the federal funds rate and guarantee that the Fed's interest-rate targets make it through the financial system.

Otherwise, even if the Fed is loosening credit, there could be problems in the credit markets that can force the economy into a recession.

Every year, it seems that product features that were previously considered 'premium' slowly become 'standard'...

Every year, it seems that product features that were previously considered 'premium' slowly become 'standard'...

During the early 2000s, it felt like a luxury to upgrade to a cell phone with a grainy, 2-megapixel camera. This year, it's almost impossible to find a cell phone without at least one high-definition camera... if not three or four.

In a similar vein, it's surprising when an airplane seat isn't equipped with an entertainment console or at least a USB outlet for charging your own devices.

As these features become more commonplace, the companies producing them benefit. Think of it this way – as cameras in phones shifted from being a novel luxury to a necessity, those camera producers all of a sudden had a lot more demand for their products.

The same can be said for cars, which have undergone a massive amount of "premiumization" since the turn of the millennium.

While some car features are always likely to be considered premium, such as a high-end Bose sound system or ceramic brake pads, many others are caught in the premiumization boom.

It wasn't that long ago that features like GPS and backup cameras were considered premium.

Nowadays, features like automatic parallel parking, wireless charging ports, and lane detection are receiving a lot of buzz. So it's no surprise that the providers of the hardware and software behind these features and products are seeing significant sales growth.

While many of these companies are private, small divisions of much larger corporations – or otherwise, not interesting investment opportunities – one company is at the center of the premiumization movement that's slipping under the radar...

Gentex (GNTX) is a leader in premium, technology-enhanced safety equipment, mostly for the automotive industry. The company makes "dimmable" components – items like mirrors, windows, and displays that can be darkened to diminish blind spots, reduce distractions, and better maintain privacy.

It also produces a number of hybrid camera-mirror systems to provide more reliable rear and side viewing, as well as other high-tech solutions for connecting cars to various smart devices.

Despite safety features developing substantially over the last few decades, they're rarely considered part of the "premiumization trend" in the same way high-end "bells and whistles" features are. Counterintuitively, these safety features are oftentimes adopted as the new standard at a faster rate because of how important safety is to consumers.

Although Gentex products (and the company's more premium products in particular) are finding their way into a growing number of carmakers, investors have not rewarded the company for its role in the premiumization trend until recently...

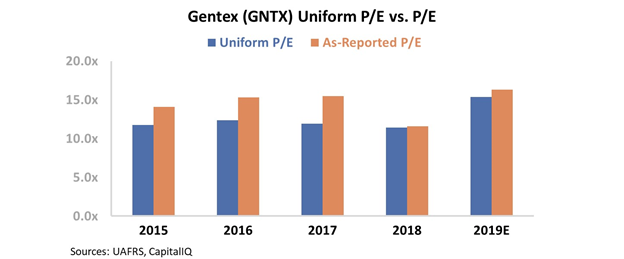

Valuations have remained below market averages for the last several years, with a Uniform price-to-earnings (P/E) ratio in the 10 to 15 times range since 2015. Uniform P/E jumped to 15 times in 2019, but still remains low.

However, part of this may have to do with the numbers most investors are looking at...

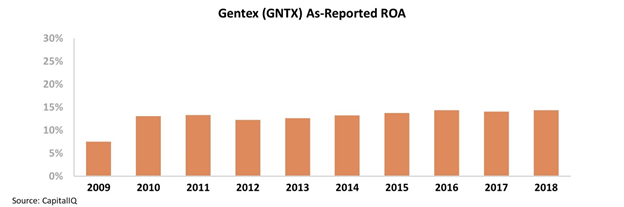

You see, when looking at profitability trends using traditional, as-reported financial metrics, Gentex looks like a company that has not improved at all within the past nine years. Over the past decade, the company's return on assets ("ROA") has stagnated around 14% – no matter what was occurring in the auto market...

While that's not bad, it makes current valuations look justified, as Gentex looks like a company with little to gain from the premiumization of automobiles. Rather than seeing returns improve like many other premium suppliers, it appears high-end safety equipment is unable to command the same high-end pricing.

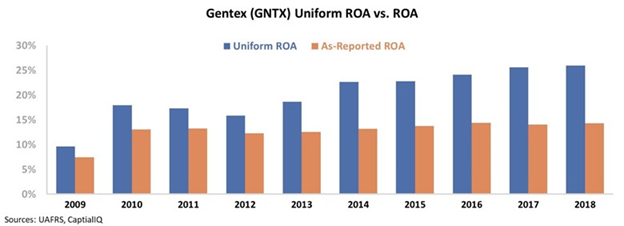

That said, Uniform Accounting data show a fundamentally different story for Gentex. Once we make the proper adjustments to the company's financial statements – adjusting for misleading treatment of items like goodwill, R&D capitalization versus expensing, and the treatment of noncash stock option expenses – we can see this trend's real impact.

Rather than seeing returns plateau around 14% since 2010, Gentex has continuously expanded its ROA from just 10% in 2009 to a peak of 26% in 2018... nearly double what as-reported metrics would have you believe. As you can see, the difference has grown over time...

When looking at the company's performance on a Uniform basis, Gentex clearly fits in the pattern with other premium parts makers.

The market appears to be missing the company's dominant position in a specific part of the premiumization market, which is unlikely to fade as demand for these safety features continues to grow.

Patterns like this may be unrecognizable when using misleading as-reported accounting metrics, but they become clear with the proper adjustments under Uniform Accounting... And when the market wakes up and realizes what it's been missing with Gentex, it will likely be too late.

Regards,

Joel Litman

January 9, 2020

The Federal Reserve is still seeking ways to reduce financial risk...

The Federal Reserve is still seeking ways to reduce financial risk...