Hedge funds and asset managers are competitive businesses...

Hedge funds and asset managers are competitive businesses...

Fund managers are always trying to beat the market and outperform each other. However, there may be more to running an asset management business than superior returns...

There's an old adage among asset managers that goes:

If your client likes you, he'll keep you around forever. However, if your client doesn't, he'll keep you only as long as your performance beats the market.

The moment the wind turns, clients move on to greener pastures. And that means it isn't only returns that asset managers need to worry about... but customer service as well.

One company that may need to be reminded of this adage is Bridgewater Associates. It's the largest hedge fund in the world and had $138 billion in assets under management as of earlier this year.

Legendary investor Ray Dalio founded the firm in 1975, and its flagship fund has an annualized return of more than 10% since 1991. However, as Bloomberg recently explained, some troubles are brewing...

First, the flagship fund is down more than 18% this year. Not only does this lag the market, but it also falls below other large hedge funds. Bridgewater's computer models weren't prepared for a pandemic or the response from central banks across the globe. By the time Bridgewater changed its models, the damage was done.

This nosedive was coupled with less facetime from Dalio, as he has focused more on promoting his book and repairing his image after bad press surrounding the firm's culture. Because of this, investors pulled out a net $3.5 billion in the first seven months of the year.

Questions have also been raised about how Bridgewater treats its employees. The firm's known belief in "radical transparency," where "no punches are pulled" on feedback to colleagues, rubs many employees the wrong way and makes investors uncomfortable with its press.

Bridgewater has also faced allegations of paying employees different salaries based on gender. The former co-CEO sued Bridgewater over alleged gender discrimination, and the current head of research has voiced concerns over unequal pay.

Additionally, the firm has made it hard for employees to move on after they leave. When two former employees tried to start their own hedge fund, Bridgewater brought on false legal cases to slow them down.

Moreover, the firm's strict policies for departing staff means that, in some cases, employees need to ask Bridgewater's permission before joining a new company.

Given Bridgewater's poor treatment of current and former employees, it's no wonder some investors are pulling their money out. More important, the idea of treating your investors well so that they don't leave at the first sign of bad news goes just as far (if not further) with employees. As Bloomberg highlights, it's not just clients who can turn fast on an asset manager they don't like. With employees unhappy, it looks like Dalio has a mutiny on his hands.

What Bridgewater may need is a new way of looking at its business...

What Bridgewater may need is a new way of looking at its business...

To fix longstanding cultural issues, a company often requires a completely new outlook. Perhaps Bridgewater should consider accomplishing this by using a platform like Workiva's (WK).

Workiva is a Software-as-a-Service ("SaaS") company that creates a platform for its clients to manage reporting across finance, accounting, risk, and compliance. The platform also uses data integration and preparation tools to enable companies to fund broader insights about how they're performing and how they operate.

All of these functions could help a company like Bridgewater get its house in order. While Bridgewater isn't a current customer, Workiva does have some large organizations as clients...

Alphabet (GOOGL), Delta Air Lines (DAL), and Slack (WORK) all use the platform. Additionally, municipalities like Pittsburgh and Seattle are Workiva clients.

They all use the holistic view that Workiva provides in order to better understand and improve their operations, much like Bridgewater may need to.

That said, even with some large clients, Workiva doesn't appear to be gaining the scale that might give Bridgewater or some of these larger firms the confidence to really invest in the company's offerings. Software firms that can't turn a profit aren't guaranteed to be around for the long term – meaning that standardizing on their offerings can be a dangerous gamble and big bet on their future.

Workiva's Uniform return on assets ("ROA") has only recently inflected into positive territory. And yet, returns are forecasted to fall back into negative territory over the next two years. That doesn't sound promising.

Due to Workiva's underwhelming profitability metrics, it's no surprise that credit-ratings firms like Moody's (MCO) believe that the company may have trouble paying off its obligations. Due to this perception, Moody's rates Workiva as a high-yield "Ba2."

However, the reality is much different. To see why this rating may be wrong, we can look at the firm's Credit Cash Flow Prime ("CCFP").

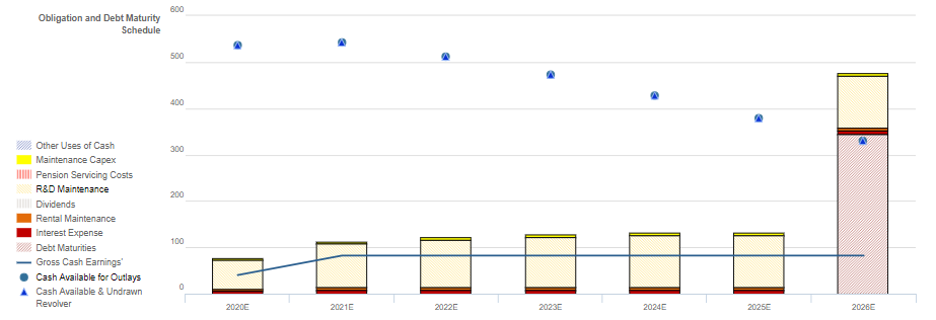

The chart below explains Workiva's credit risk. It compares the company's obligations (stacked bars) each year for the next seven years against its cash flow (blue line) and cash flow plus cash on hand at the beginning of each period (blue dots).

The bottom bars are the ones that are hardest for Workiva to "push off," with costs such as debt maturities and interest expense. The higher bars are obligations that are more discretionary, like maintenance capital expenditures ("capex") and share buybacks.

Moody's is focusing too much on cash flows. Because of Workiva's sizeable research and development (R&D) maintenance costs, the firm's cash flows are projected to fall short of all obligations in all years going forward.

However, this isn't a problem... Workiva has more than $500 million in cash on hand, and the combination of the firm's cash flows and cash on hand should be able to cover all expenses through 2025.

The first year Workiva is expected to have any trouble in is 2026, when the company faces a significant $345 million debt maturity headwall. However, Workiva has five years to either refinance or increase cash flows.

Because of all this, Valens Research – the firm that powers Altimetry – rates Workiva as a "XO" (equivalent to "Baa3") credit. Although only two notches above the Moody's rating, it brings Workiva out of high-yield territory.

Moody's isn't looking at Workiva's holistic debt profile. Although Workiva has a large debt maturity and weak cash flows, it also has a long runway and a large amount of cash on hand.

As the CCFP shows, Workiva should have no problems paying its obligations over the next five years... and the company shouldn't suffer from a riskier, high-yield credit rating.

Regards,

Rob Spivey

October 8, 2020

Hedge funds and asset managers are competitive businesses...

Hedge funds and asset managers are competitive businesses...