The coronavirus pandemic has hit many hotels hard...

The coronavirus pandemic has hit many hotels hard...

Over the past few months, we've seen steep declines in international tourism and business travel. As the Los Angeles Times reported last month, one in four hotel properties is already struggling to pay its mortgage, thus risking potential foreclosure.

Demand still hasn't recovered, and expenses continue to pile up for many smaller chains. Payments on loans taken out by hotels have also seen increased delinquencies. According to Fitch Ratings, nearly 17% of loans are more than 30 days late – up massively from the 2% number seen before the pandemic.

Under some of these loans, when a hotel is more than 30 days late on a mortgage payment, the lender can increase the interest rate by 5% until the payment is made. After 90 days, if the loan still hasn't been paid, the lender can file a notice of sale and force the hotel to sell assets to pay the loans. Situations like this have led many industry experts to believe this is just the beginning of hotel delinquencies, as the situation will continue to get worse as lenders squeeze these businesses.

These smaller hotel closures highlight how the competitive landscape of many consumer industries is going to change dramatically after the pandemic. As regular Altimetry Daily Authority readers know, we've highlighted this concept several times with our "survive and thrive" theme.

As smaller, weaker players are hit by the pandemic, large companies are better positioned to weather the storm due to their stronger liquidity positions and access to credit. These larger firms can even "roll up" or acquire some of the smaller companies within an industry.

One survive-and-thrive candidate we've previously discussed in the hotel industry is Hilton (HLT)...

One survive-and-thrive candidate we've previously discussed in the hotel industry is Hilton (HLT)...

The market appears to understand that for some of the biggest hotel chains, returns can improve and recover quickly after the pandemic. One of the big reasons for this is the "asset light" franchising model these chains operate under.

Essentially, Hilton provides the brand, design, and embedded customer base to franchisees, which then take on much of the investment risk. This also leaves franchisees with the bulk of the real estate risk during a demand shock such as the one we've seen during the pandemic.

Since the franchisees are the ones paying for rent and other operating expenses, this limits companies like Hilton and Marriott's (MAR) exposure to these issues. On the other hand, the franchisers benefit in the upside, as royalties increase when the franchisees see increased demand.

However, these franchising giants aren't the only way for investors to get involved in the hotel industry...

Investors can also put money to work in real estate investment trusts ("REITs"). These are essentially companies that own income-producing real estate for a particular industry and generally pay out their earnings as a large dividend to investors.

Today, the biggest hotel REIT is Host Hotels & Resorts (HST), which owns the properties for brands such as Marriott, Ritz-Carlton, Westin, Sheraton, W, St. Regis, Hilton, Hyatt (H), and many others. Host has more than 80 upscale hotels with nearly 47,000 total rooms.

Due to the pandemic, alongside most of the industry, Host has been forced to cut its hefty 7.5% dividend. This is a way to preserve capital so the company can meet its obligations while travel demand is low.

Host is focused on surviving in the near term... BUT unlike asset-light franchising companies, these hotel REITs have capped return potential.

The REITs have to make large investments into properties to grow their business, unlike the franchising firms. This means that their earning power is largely a product of economic cyclicality. When the travel industry is booming, they're building more hotels and thus growing earnings.

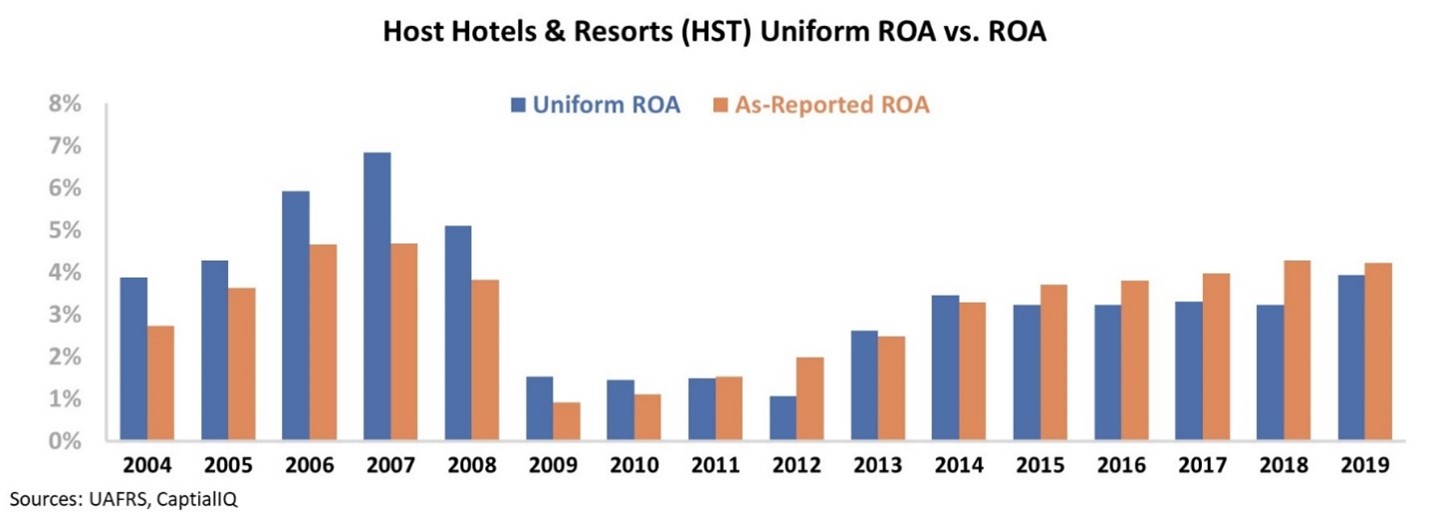

We can see the industry's cyclicality when looking at Host's Uniform and as-reported return on assets ("ROA") over the past 15 years.

Host's ROAs peaked in 2006 and 2007 at the height of the travel industry prior to the Great Recession. The company then saw huge declines during the downturn as consumers cut back on travel and vacation spending. More recently, Host's Uniform ROAs have been around 4%. While profitability has recovered from the 1% to 2% levels seen from 2009 to 2012, it remains well below the 7% levels seen just before the Great Recession. Additionally, Host's Uniform ROA has remained between 3% and 4% since 2013.

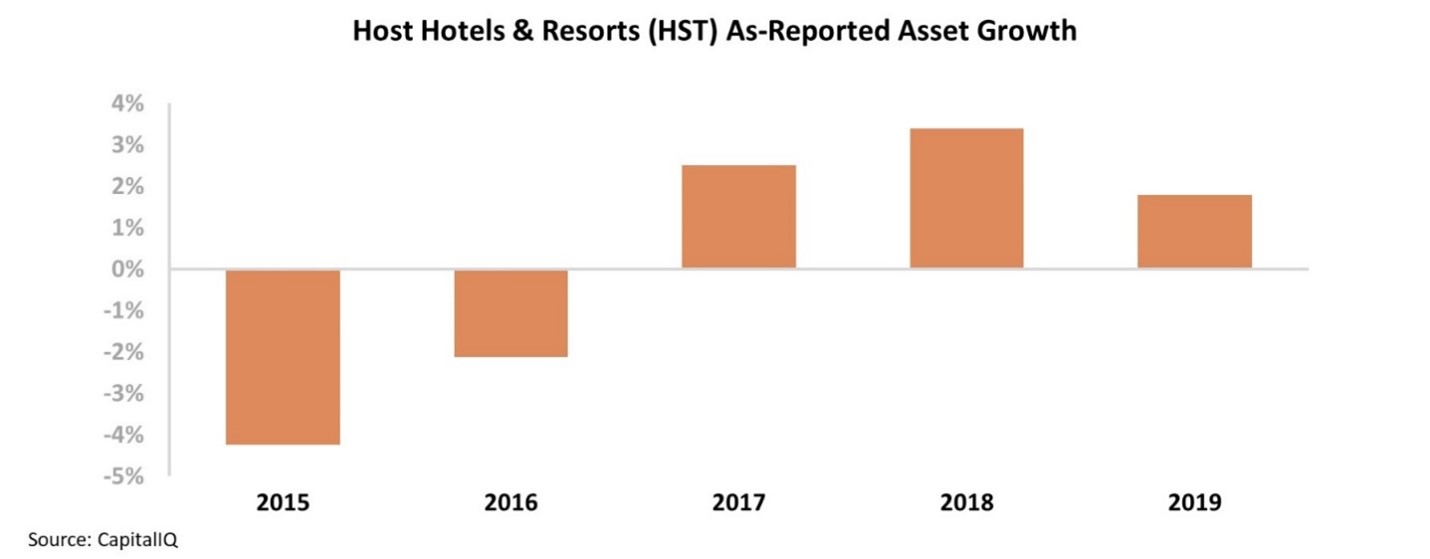

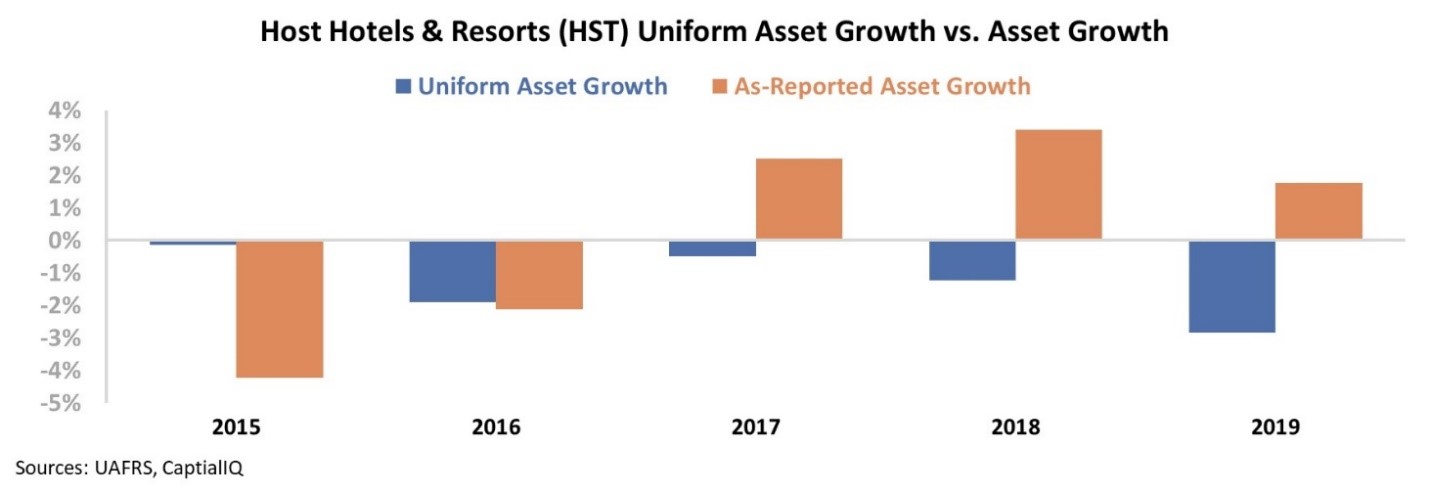

Looking at the stagnant returns, investors may wonder why Host is continuing to invest heavily in its business. Looking at the company's as-reported asset growth, this indicates Host has seen growth over the past three years...

However, due to distortions in as-reported accounting, including the treatment of property, plant, and equipment (PP&E) expense, the company's asset growth is being misrepresented.

In reality, Host's asset growth was negative. As Uniform Accounting shows, management recognized the flattening ROAs and cut back investments in the business.

That said, understanding how Host's returns have stagnated historically – and whether management has correctly noticed this and effectively controlled investment – doesn't explain if the stock is undervalued or overvalued.

To determine whether the company can continue to create value for shareholders, we can use the Embedded Expectations Framework to easily understand market valuations.

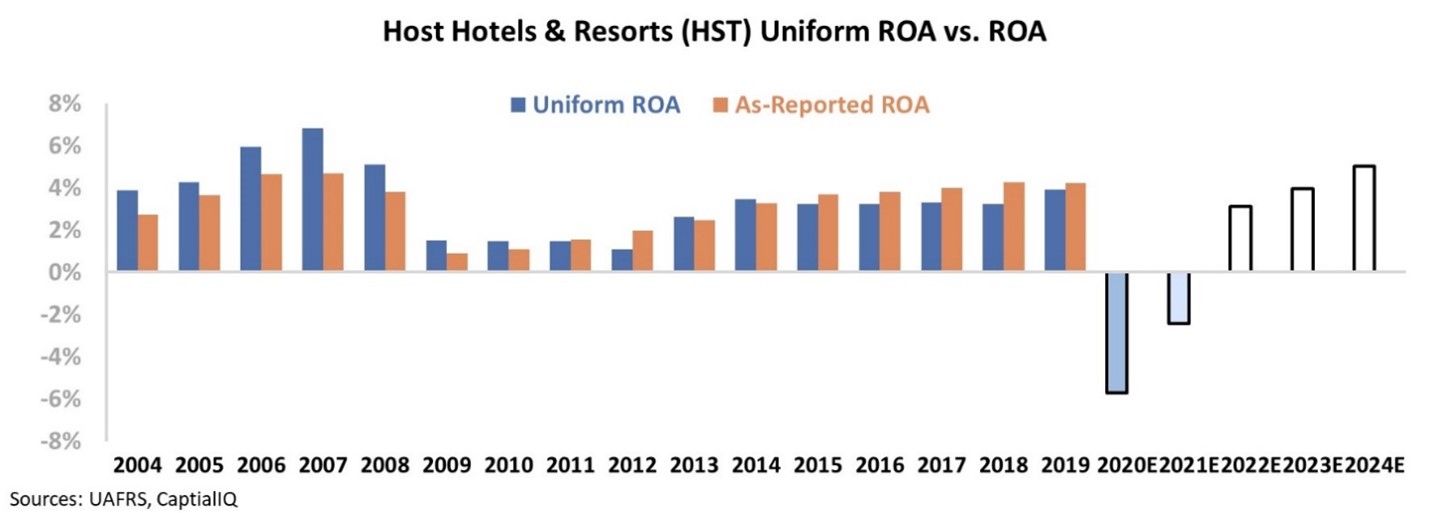

The chart below explains Host's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

While analysts expect the company's returns to collapse this year due to pandemic headwinds, the market expects ROA to expand to 6%. Host hasn't seen levels like these since before the Great Recession.

The market is failing to recognize how hotels may not all recover at a constant rate, and that capital-intensive businesses like Host will likely take longer to recover. Coming out of the pandemic, Host doesn't benefit from the same tailwinds as franchising companies... and is still heavily exposed to the cyclical demand cycle.

Even if Host scoops up high-quality assets from smaller, failing players, it still has the asset intensity of a traditional hotel business. And as we've seen historically, this industry can take a while to recover.

Ultimately, high market expectations may be too bullish considering the historical profitability trends of the hotel industry. Again, hotel REITs don't possess the same competitive advantages of the franchising business model.

Continued investment into fixed assets means Host takes on a higher degree of risk and is exposed to the long and cyclical travel demand cycle. If the company can't reach historical highs as market expectations would suggest, the stock might be in for downside ahead.

Regards,

Rob Spivey

October 7, 2020

The coronavirus pandemic has hit many hotels hard...

The coronavirus pandemic has hit many hotels hard...