Earlier this month, we highlighted a conversation with a first-hand expert in the travel industry...

Earlier this month, we highlighted a conversation with a first-hand expert in the travel industry...

Our friend had told us how more people are booking stays in places with kitchenettes or places to cook in when they travel. This way, folks feel more like they could "live" where they're vacationing.

And as The Economist recently explained, the rise of "staycations" is another large trend taking place. These are local trips people take, generally within driving distance of their home. With the coronavirus pandemic making international travel harder than ever, staycations are the sole option for many folks. And thanks to this trend, the resiliency of hotels and other accommodations has been stronger than that of airlines.

I've noticed this during my current trip to Turkey. In August, my family and I decided to take a trip to Istanbul and spend much of the second half of summer here... and we may stay through the fall as well. We're currently staying in Çeşme, on the Aegean coast.

The hotels here are full. In past years, they would be filled with British, German, or other international travelers... But this year, they're packed with Turkish nationals who don't want to leave the country.

Right now, the budget hotels are benefitting the most as people try to cut costs. However, even more expensive hotels are largely surviving off their ability to tap into local demand in place of foreign demand.

And we can see the disparity in performance between airlines and hotels in the severity of the revenue drop for both industries. Airline revenue fell 91% in the second quarter, while hotel revenue only fell 70%. This is still a significant drop... but, it would be much worse without the help of local travelers. Hotels are already starting to bounce back... and look primed to recover much faster than airlines will.

When taking staycations, folks have many lodging options to choose from...

When taking staycations, folks have many lodging options to choose from...

There's a plethora of different hotel brands out there, running from low-cost motels to expensive luxury resorts. For example, Waldorf Astoria and Conrad are popular choices at the higher end of the spectrum... while DoubleTree, Hampton Inn, and Homewood are common budget-minded choices.

While that may look like a significant range of options, Hilton (HLT) owns all the above brands. Hotels have been surviving this recovery because they benefit from the "illusion of choice." And as regular Altimetry Daily Authority readers know, this can be a powerful and effective strategy...

Consumers enjoy feeling like they have the ability to shop around for different products. But when it comes to hotel options, most roads eventually lead back to Hilton, Marriott (MAR), or Wyndham Hotels & Resorts (WH). Even though only a few companies own many of the hotel brands, consumers can still purchase many different styles of accommodations.

The illusion of choice isn't a way to trick consumers... but rather a strategy to achieve higher returns. It provides the facade of competition and reduces the effect of pricing pressures.

It also allows businesses to spread the costs of operations among multiple brands through economies of scale. This aids businesses and consumers, as hoteliers can tailor to specific customer needs.

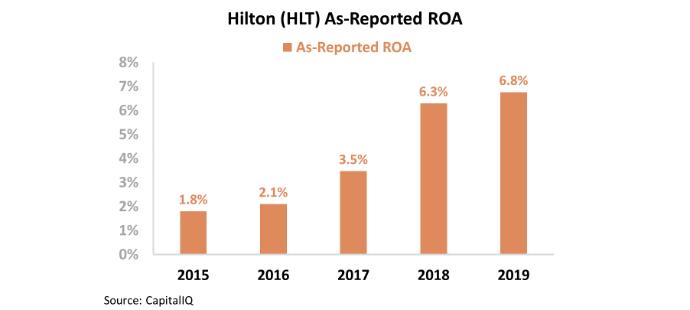

However, even with the illusion of choice and the move to an "asset light" business model, it appears that Hilton hasn't been able to sustain high returns. The company's as-reported return on assets ("ROA") has improved since 2015, but was still only 7% last year. This is only slightly above cost-of-capital levels, and well below corporate averages. Take a look...

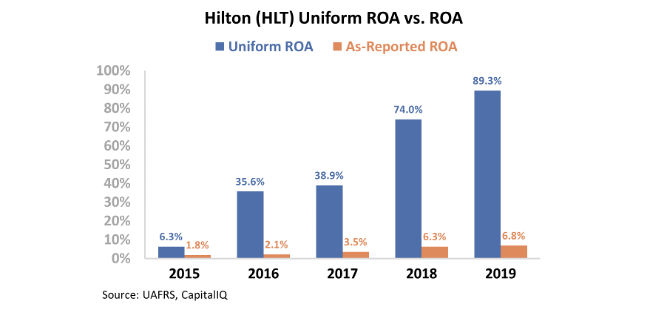

However, this picture of Hilton's performance is inaccurate... It's pulled down by distortions in as-reported accounting. Due to GAAP's treatment of goodwill and intangibles – among other distortions – the market has been misled on Hilton's profitability.

Instead, Uniform Accounting shows soaring profitability. Hilton has embraced the illusion of choice and a new franchising model, which has caused its ROA to improve from 6% in 2015 to a massive 89% last year.

As the company has pushed more of its hotels to franchisees as opposed to owning locations outright, it has become more asset-light, which helps boost its profitability. Hilton has also sought to push new hotel growth to be more franchisee-focused. This further boosts profitability, as Hilton gets a fee from franchisees, without having to tie up capital in additional real estate. When looking at the company's real returns, it's clear that this strategy has worked.

Now that we've seen prior performance, it's important to look at valuations and expectations. To understand the market's assumptions for Hilton, we can use the Embedded Expectations Framework.

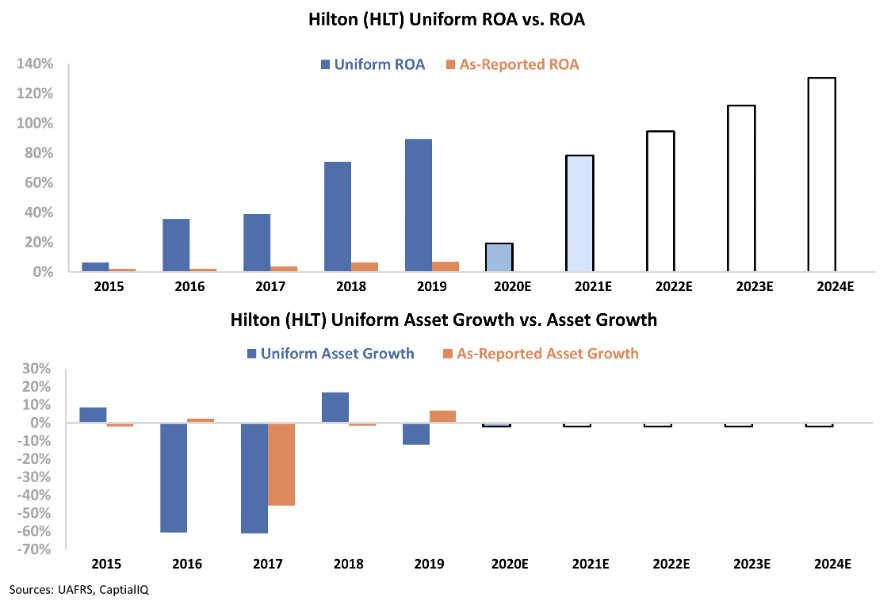

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Right now, sell-side analysts are predicting Hilton's Uniform ROA to fall off a cliff to 19% this year amid headwinds caused by the coronavirus pandemic. Then, analysts are projecting the company's Uniform ROA to rebound to 78% next year – that's roughly between 2018 and 2019 profitability levels.

After 2021, the market is pricing in a resumption of the multiyear growth period that Hilton saw from 2015 to 2019... It's projecting that the company's Uniform ROA will climb to 140% in 2024. This is a massive leap in profitability levels in a short amount of time.

Investors might look at this and think that even with more staycations, it will be hard for Hilton to grow its ROA so fast. However, looking at the company's execution with its franchising model, that doesn't appear to be as much of a stretch... as long as it can keep up that franchising growth.

Traditionally, the hotel and airline industries will rise and fall in tandem. And yet, Uniform Accounting has shown the hotel industry may be on a much different path than airlines this year.

While airlines may have a long road to recovery, staycations and the illusion of choice are keeping hotels like Hilton afloat... and help justify what initially appear to be lofty market expectations.

Regards,

Joel Litman

September 22, 2020