In order to understand industry trends, it's important to look beyond the news channels...

In order to understand industry trends, it's important to look beyond the news channels...

Here at Altimetry, we try to engage with a diverse crowd when it comes to our friends and colleagues. We personally know people who have jobs ranging from the medical and pharma fields, aerospace, advertising, social media, skin care, as well as the oil and gas world.

We check in with them from time to time to get first-hand opinions on the industries they work in. Often, they tell us trends we may have missed in the echo chamber of finance – with CNBC, Bloomberg, and Fox Business repeating the same things over and over again.

Last week, we checked in with a friend who manages a successful travel brokerage company for businesses and wealthy clients. He taught Joel everything he knows about how to navigate the games that airlines and hotels play in the travel industry.

This friend had an interesting take on how the coronavirus pandemic is permanently changing the travel industry. According to him, 50% of travel brokers will likely be out of business by the time the pandemic is over. He looks forward to taking advantage as a "survive and thrive" candidate.

Another big theme he sees happening is spurred on by the "At-Home Revolution." Now, people want to stay in hotels and places with kitchenettes so they can cook for themselves. And he doesn't think this is only a short-term trend due to social distancing... but that it will remain sustainable as people are looking to work from home around the world.

People living this lifestyle have been termed "digital nomads" (we discussed this concept in the August 13 Altimetry Daily Authority). And one place our friend sees this lifestyle change is in the cruise ship business. Cruise line operators who can't adapt will struggle, and those who can revolutionize their business and survive will do well.

One way the digital-nomad trend will change the cruising world is the concept of residences on cruises...

One way the digital-nomad trend will change the cruising world is the concept of residences on cruises...

This is when people forgo traditional lodging and travel around full-time on cruise ships. Cruises have even created residential cruise ships solely for those who want to live entirely onboard.

Our friend in the travel brokerage industry thinks cruises can survive by pivoting more to this business model, where operators focus more on long-term travelers than week-long vacation goers. The companies that convert to this type of setup will be more likely to survive and thrive once the pandemic recedes. This type of business model is also likely more resilient during downturns, as these cruise lines will have recurring revenue regardless of vacation demand.

Recent cruise line upstarts have entered the industry touting affordable options for residences. Condos can be bought for as low as $155,000 and extend well into the millions of dollars. Some cruises even offer passengers the option to vote on future destinations through mobile apps. This allows for much more freedom than the typical rigid, point-to-point cruise experience.

As we mentioned earlier, the idea of digital nomads has picked up steam during the pandemic. People have realized they can work from anywhere... and we're likely to see increases in these traveling workers after the pandemic recedes.

One cruise line that seems set to benefit from the idea of more permanent residents is Carnival (CCL). It's the largest cruise line in the world, with roughly 12 million annual passengers.

Not only that, with assets like Cunard Line – with its high-end Queen Mary 2, Queen Elizabeth, and Queen Victoria that are built for this type of luxury long-term stay – Carnival is already positioned for the digital nomad.

The company also has an incredibly loyal and "sticky" customer base. Despite uncertainty due to the coronavirus, more than 60% of 2021 bookings are new rather than rollover from cancelations.

Carnival not only has the ability and customer base to pull this off, but it also has a strong capital structure... especially when compared to its nearest competitor Royal Caribbean (RCL).

Royal Caribbean is in a much more precarious liquidity position. We can see how much by looking at the company's Credit Cash Flow Prime ("CCFP").

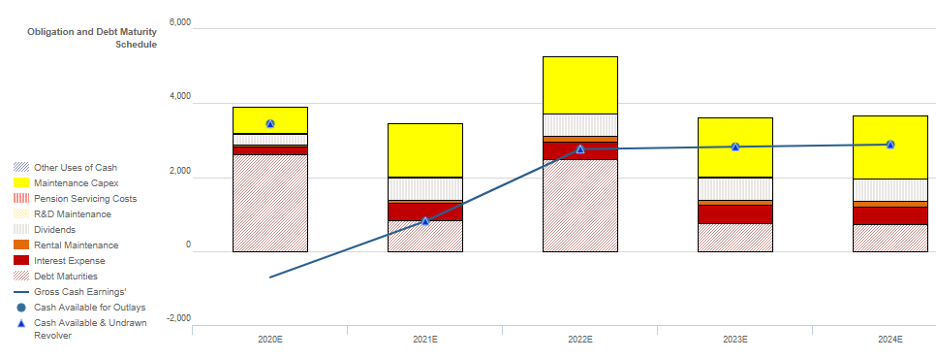

The chart below explains Royal Caribbean's credit risk. It compares the company's obligations (stacked bars) each year for the next seven years against its cash flow (blue line), plus cash on hand at the beginning of each period (blue dots).

The bottom bars are the ones that are least easy for the company to "push off," and include things like debt maturities and interest expenses. The higher bars are obligations that are more discretionary, such as maintenance capital expenditures ("capex") and share buybacks.

The CCFP analysis shows that Royal Caribbean will run into trouble immediately. While it has some freedom to cut capex this year, its cash position falls below interest expenses in 2021. This means it will need to access the credit markets to refinance very soon... And it means that Royal Caribbean is in no position to build out any kind of residential fleet.

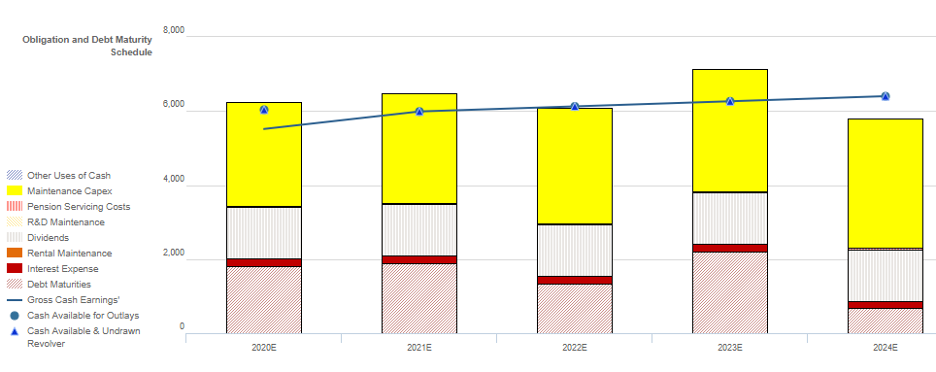

By comparison, Carnival has a healthy CCFP. The company only needs to manage its capex spend to navigate its current obligations. Additionally, Carnival has a recovery rate of more than 350% – highlighting that it should have easy access to the credit markets if needed. This rate is the percentage where defaulted debt can be recovered by selling assets, so a recovery rate of more than 100% means all debt is covered.

And higher rates generally mean easier access to the credit markets, as creditors are less worried about losing their investments. You can see Carnival's breakdown below...

Carnival should be set up well to survive and thrive, thanks to its strong capital structure and superior positioning of its business model. In the wake of the pandemic, those companies who can manage credit concerns will emerge stronger.

For Royal Caribbean, the outlook coming out of the recession appears to be dire, even while Carnival can likely take advantage of shifting trends toward remote workforces and the digital-nomad lifestyle.

Regards,

Rob Spivey

September 11, 2020

In order to understand industry trends, it's important to look beyond the news channels...

In order to understand industry trends, it's important to look beyond the news channels...