The coronavirus pandemic is forcing even the most analog tasks to go digital...

The coronavirus pandemic is forcing even the most analog tasks to go digital...

For the large plane makers like Airbus and Boeing (BA), delivery is everything. Building an aircraft takes significant time and investment for these firms, so they require some upfront payment from customers. However, more than half of revenue and a large portion of cash are only transferred upon delivery.

This means manufacturers are always looking for ways to speed up deliveries and earn revenue.

The final step of the process for any delivery is a detailed in-person inspection by the airline or airplane leasing firm, to ensure there are no flaws in the airframe. This can mean dozens of engineers crawling over an airplane and looking at every detail involved.

However, during the pandemic, deliveries have been paralyzed. As inspectors were unable to travel and physically inspect each plane, nothing could be signed off for delivery.

As usually happens when a business runs into a problem collecting revenue, a radical solution emerged. While traditional airplane inspection is a highly manual procedure, Airbus has developed a way to move the process online through drone flybys and ultra-precise measurement tools to inspect every surface for flaws.

These measures haven't completely replaced the inspection process. Even in the best of times, the final signoff could take months as manufacturers and customers ensure that everything is accounted for.

But as airframe manufacturers look to get the process of delivery started again while travel is limited, these breakthroughs could remain relevant for years to come... and even become standard operating procedures to help speed up the process.

It's more proof that the benefits of the "At-Home Revolution" will be here to stay... even for big industrial equipment.

We received some interesting responses regarding independent contractors...

We received some interesting responses regarding independent contractors...

We recently asked readers what they thought about the world of independent contractors, and our e-mail inbox was a mixed bag. As Randy wrote:

I think there is a very misunderstood factor in the WFH world, and that is "Home". Where is that? Well, it is anywhere a high speed internet connection is available and with the widespread, and growing, access to internet, I think "Home" will be redefined. Thus, I would wager WFH will soon be WFW, Work From Wherever.

Millennials are not buying homes like previous generations and Working from Wherever could be a few weeks in Barbados, then a stint in Singapore, followed by a stay in Vegas, essentially anywhere reliable high speed internet is available. As 5G rolls out, it will exacerbate this trend. Millennials are already somewhat minimalists and they value "experiences" over "things", thus a nomadic existence with no deep roots will become more of a lifestyle trend.

We will see transportation and lodging industries adapt to this mega-trend, and when they catch on, the WFW will become a long term sustainable lifestyle.

For many in the midst of the WFH world, it has meant work from anywhere – or as Randy says, "WFW."

Here at Altimetry, Joel has found himself working in Massachusetts, New Hampshire, Florida, and even in Turkey. I've found myself operating on the Maine shore, on Lake George and Lake Otsego in upstate New York, and at my home office in Boston, among other places.

While Randy's observation of a "tech-enabled nomad" is a viable potential option for some, you don't need to even go that far...

A good friend and colleague who owns and runs a market research firm based in New York has relocated permanently to Nashville. He says that once things open up, he'll just travel back to New York a few times a month on day trips, and it won't be that different from the prior work set-up.

The more comfortable people become with WFW, the more it breaks down the difference for many people between being an independent contractor and being an employee. It's likely to help accelerate the growth in the movement.

On the other hand, David observed:

The bulk of those people earn close to nothing, ca. 2-5 USD per hour for the thousands and thousands of "click workers" contracting with AMZN and others (to help with AI learning procedures).

A small minority of top experts are earning good money (software specialists are a good example).

But the standard business procedure is quite simple: Transfer work to independent contractors TO REDUCE EXPENSES. Examples:

Less rental expenses as work being transferred to private home offices. With other words: The independent contractor uses private space, private computers and often even expensive software to fulfill the tasks.

This is a fair point... Many independent contractor jobs aren't well-paying, including on platforms like Upwork. These are less sustainable job opportunities for people, other than those with high-value skill sets.

That being said, we're intrigued to see if for those top experts (such as David's example of software specialists) the "At-Home Revolution" and WFW have broken their relationship to "the firm" enough for them to go out on their own.

Those higher-value-add workers may find that working on their own as independent contractors could actually lead them to make more income than they'd make at a company... if they can find steady work.

Today, we'll examine a company that Altimetry Daily Authority reader Nancy requested...

Today, we'll examine a company that Altimetry Daily Authority reader Nancy requested...

In 2004, medical-devices company Guidant was the focus of a bidding war between Johnson & Johnson (JNJ) and Boston Scientific (BSX).

Both companies were angling for a stake in the fast-growing cardiac rhythm management market.

During the initial bidding, news emerged that Guidant was having failures with its defibrillators. The company discovered these issues in 2002 and corrected them in newer models... but it failed to inform doctors of the small but fatal risk of its older devices. The news sent Guidant's stock price plummeting.

Johnson & Johnson thus lowered its offer, giving Boston Scientific an opening. After months of back-and-forth bidding, Boston Scientific prevailed with a $27 billion purchase.

You'll often hear the phrase "winner's curse" in an auction. This translates to the winning bid exceeding the intrinsic value or true worth of the acquired asset.

Boston Scientific faced the winner's curse in a different way. Guidant's device issues ended up creating years of legal settlement suites for Boston Scientific.

Just two months after the acquisition, Boston Scientific recalled almost 50,000 Guidant cardiac devices.

The acquisition also created a corporate culture prone to rushing products to market and having to settle afterward. Boston Scientific paid out more than $100 million in legal settlements from 2007 to 2018 due to faulty products.

In early 2019, the company settled with more than 104,000 patients for $366 million, for issues surrounding its pelvic mesh products. The business culture had clearly failed Boston Scientific and led to massive fines.

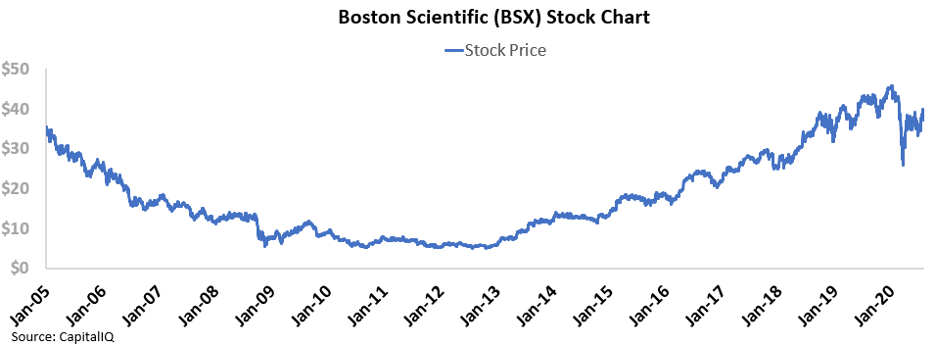

The company's stock has struggled due to these issues. BSX shares have barely risen from $36 in early 2005 to today's price around $40.

Another company that appears to have suffered from a poor corporate culture is Boeing. In 2018, the plane maker appeared on the cusp of acceleration with its 737 MAX among the most popular models in the world.

However, two fatal 737 MAX crashes occurred in late 2018 and early 2019 due to a faulty automated system. All 737 MAX planes were grounded, and Boeing has estimated the total cost at $19 billion.

Boeing had taken advantage of the phenomenon called "regulatory capture." This is when a regulatory agency acts in the interest of the company it's supposed to be regulating.

In 2005, the Federal Aviation Administration ("FAA") turned over safety certification responsibilities to the plane manufacturers themselves. Boeing essentially got to decide whether its planes were safe enough to fly, with little oversight.

Unfortunately, we can see where that got us... Just like where Boston Scientific's rushed product releases got them.

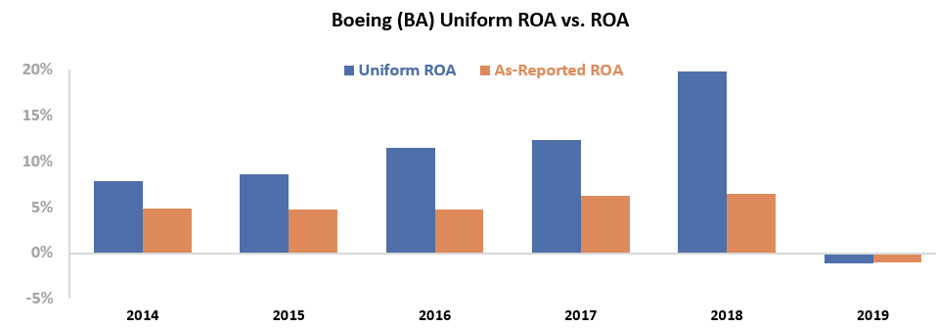

By only using as-reported metrics, investors would miss the true scale of the 737 MAX problems for Boeing. This is because GAAP standards fail to show the company's true returns.

Being's as-reported returns on assets ("ROAs") had remained largely stagnant between 5% and 6% from 2014 to 2018. In reality, over the same time frame, Boeing saw Uniform ROA expand drastically from 8% to 20%.

As Boeing scaled the 737 MAX launch, returns weren't barely rising... they were surging.

Then the catastrophic crashes caused Being's ROA to crater in 2019, as a sizeable portion of its production was halted. Based on as-reported numbers the drop was bad... but already from low levels. However, with the Uniform data, we can see how far returns actually fell...

In the meantime, BA shares fell from a high of $450 down to $300, before sliding to $100 during the pandemic escalation earlier this year...

Investors might think with this stock price drop, Boeing could be an interesting value opportunity.

To understand what the market thinks about this firm, we can use the Embedded Expectations Framework to easily understand valuations.

The chart below explains Boeing's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, the market expects Boeing's Uniform ROA to rise to 14% in 2024. These returns would be the highest in any year since 2008, with the exception of 2018.

Despite economic uncertainty and continuing issues with 737 MAX certification, markets are expecting the company's ROA to rise well above historical averages.

This appears unreasonable when considering the stiff headwinds Boeing faces. Sure, BA shares have fallen dramatically... but potential lasting corporate culture issues and incredibly high expectations should lower investor sentiment.

To make matters worse, Boeing has lost ground to Airbus with lost orders due to safety concerns. Airbus even recently surpassed Boeing as the world's largest plane maker. This was Airbus' first time in the top spot since 2011.

At first glance, Boeing may appear to be cheap after massive stock declines. However, with Uniform Accounting, investors can see Boeing is actually priced at unreasonable levels.

Regards,

Rob Spivey

August 13, 2020

P.S. Which companies do you think have suffered from ethics issues that have brought down their business? Let us know if any come to mind and we might feature your response in the coming weeks... Send us an e-mail at [email protected].

The coronavirus pandemic is forcing even the most analog tasks to go digital...

The coronavirus pandemic is forcing even the most analog tasks to go digital...