This is especially relevant during the coronavirus pandemic. Many businesses are hoping their profitability levels quickly return to where they were prior to coronavirus. In the meantime, the strategic use of debt can help companies bridge the gap and sustain themselves as stay-at-home restrictions continue.

The U.S. Federal Reserve has taken extreme steps to keep businesses afloat by buying immense amounts of corporate bonds – even high-yield ones near the risk of bankruptcy – and creating the Main Street Lending Program. However, we still haven't seen fully equal access to the credit markets.

Prior to the pandemic, only around 60% of debt issuances were from companies with more than $1 billion in revenues. As Bloomberg explained late last month, this number has skyrocketed. Today, 78% of borrowers are extremely large companies.

In the current market environment, it's necessary for all companies to have access to credit markets in order to stay afloat. Now, many small companies may face problems related to liquidity due to big corporations dominating the debt markets. This could lead to the largest companies surviving the pandemic and then thriving from the reduced competition.

Smaller firms often are at greater risk of default due to an inability to secure funding. As such, banks and other lenders feel much safer when they loan to larger companies with more scale. And this desire for larger clients has increased as the pandemic has exacerbated liquidity issues.

For small companies to come out of this crisis successfully, they need to fight for their portion of funds that the large companies aren't taking up... or their survival could be at stake.

During recessions, the large-versus-small dynamic becomes particularly apparent in the hardest-hit industries...

During recessions, the large-versus-small dynamic becomes particularly apparent in the hardest-hit industries...

Many smaller companies either struggle immensely... or can't survive and subsequently disappear. Meanwhile, larger firms are able to grow their business as more market share opens up, and savvy ones purchase other assets and companies at depressed prices.

This happened when economic uncertainty during the 1980s adversely affected bank stocks. The banks with rock-solid balance sheets or the size to offset losses were able to "survive and thrive..." which kicked off the wave of consolidation that reached its peak in the 2000s.

We saw similar trends with tech stocks in 2000. Many companies went public before the tech bubble burst and saw their share prices fall immensely, with plenty of tech startups closing shop. However, some of the larger firms were able to make strategic decisions and made it through the downturn. For example, Adobe (ADBE) purchased six companies between 2000 and 2003, allowing it to come out of the bubble stronger than ever.

The same pattern emerged in 2008. Homebuilders and other businesses with exposure to the industry all suffered as the housing bubble burst. In spite of the widespread pain, some companies were able to take advantage of the changing market... and emerge from the recession as winners.

This is in part due to the breadth of the homebuilding market – different parts of the industry saw a recovery at different times. For example, homebuilders with exposure to wealthy clients benefitted, as these were the only folks able to borrow for mortgages. Companies making larger houses and mansions thus had better visibility of demand before banks really opened back up.

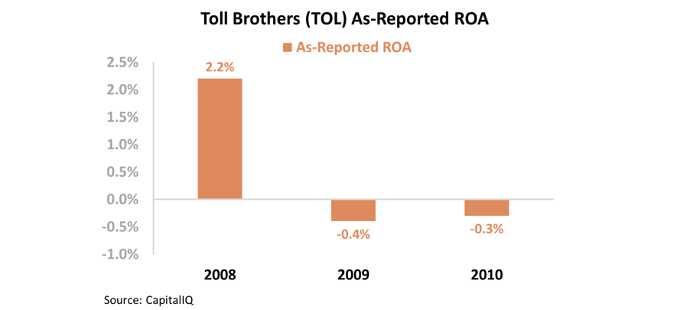

One company focused on more upscale homes back in 2008... and is still doing so today: Toll Brothers (TOL). However, contrary to the headlines, GAAP metrics show that the firm still struggled during the recovery from 2009 to 2010. According to the as-reported numbers, Toll Brothers saw its return on assets ("ROA") fall into negative territory in 2009 and 2010...

As-reported numbers tell the story that Toll Brothers, even while building luxury homes when this was the only part of the market that was "open," was still susceptible to the financial hardships of the broader industry.

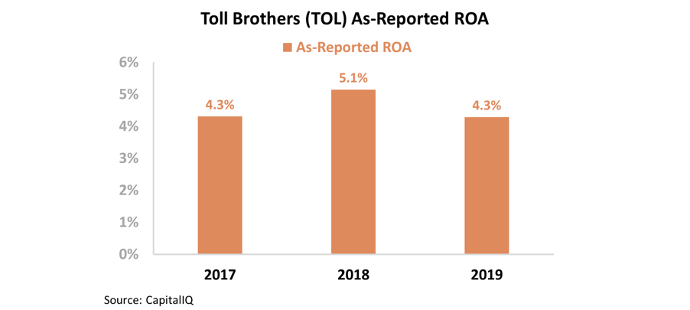

Given its historical performance in the wake of the last recession, investors might be wary in the current pandemic-induced downturn. Toll Brothers' returns aren't negative anymore... but they've been roughly flat over the past few years. Take a look...

But the real issue is that the as-reported metrics have been understating Toll Brothers' profitability for more than a decade. Stock option expenses and other distortions are underrepresenting the firm's earnings and asset base.

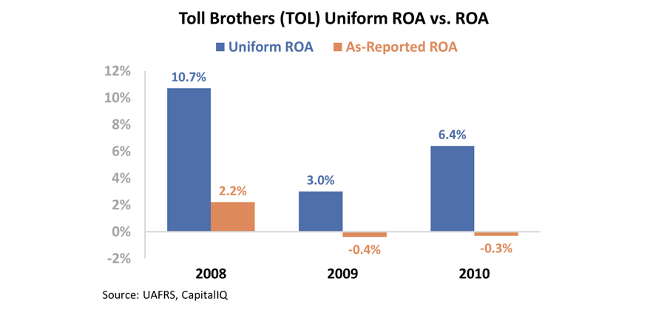

The company's Uniform ROA didn't turn negative during the Great Recession. Profitability levels did fall, but much less than the rest of the homebuilding industry or the firm's as-reported metrics would have investors believe. Take a look...

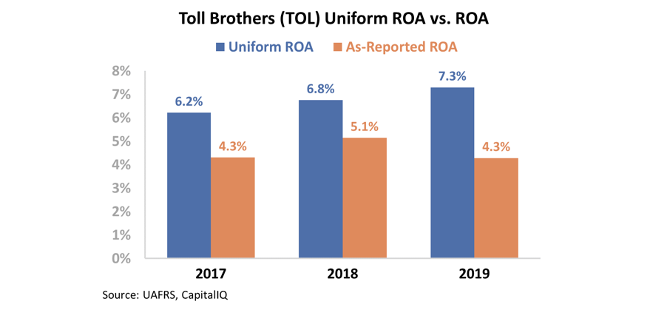

GAAP accounting has also understated Toll Brothers' recent returns. The company's as-reported ROA shows volatile profitability and relative stagnation over the past three years. But Toll Brothers' Uniform ROA is much different – returns consistently improved from 2017 to 2019.

As-reported metrics falsely grouped Toll Brothers in with other homebuilders back in 2009 – making it appear that the company saw its ROA inflect negative... when it had in fact survived and thrived. Even better, Uniform Accounting shows how Toll Brothers has grown its profitability in recent years.

As the pandemic escalated, many investors have predicted hard times for homebuilders. Given all the economic uncertainty, potential buyers may not want to make such a big investment in a home. It's easy to then paint a broad brush and assume all homebuilders will perform extremely poorly.

However, Toll Brothers may be able to buck the trend again. The company has been successful before... and has the opportunity to repeat history today. And considering that the "At-Home Revolution" has people not just thinking about moving into the suburbs, but also looking for bigger homes to make room for the world of working at home, Toll Brothers is a company to keep an eye on.

Regards,

Joel Litman

September 8, 2020

P.S. Today's issue marks the one-year anniversary of Altimetry Daily Authority. What's your favorite issue or topic? We're looking to refresh some of our readers' favorite articles in September as a thank you for your continued reading and interest.

It has been exciting to build Altimetry with you – our readers and partners in this journey. Send us an e-mail with your thoughts to [email protected].

Here at Altimetry, we've frequently discussed the

Here at Altimetry, we've frequently discussed the