This industry hasn't changed much over the years...

This industry hasn't changed much over the years...

Many jobs have been radically altered with the rise of industrialization and automation... But debt collection is still carried out using archaic methods. In an industry that has refused to embrace technology, a great deal of collections are still carried out by calling up debtors and threatening them.

Over the past six months, policymakers and average citizens have become increasingly concerned about the amount of outstanding consumer debt, as collectors look to continue using old tactics to see money repaid.

No one wants to get a call from the collectors who have no understanding of a family's financial situation or inability to pay during a pandemic. A large part of the reason Congress is looking to authorize a second round of stimulus checks is to keep Americans solvent.

The past few months have seen a huge influx of cash from venture capitalists into the debt collection industry. Rather than a blank calling strategy, startups are looking to leverage data to focus on making back repayable debt. Then, these more efficient debt collectors can save time on the redeemable debt... and not further pressure a delicate system.

Late last month, market-research firm CB Insights highlighted startups that are seeking to make the collections industry "more consumer-friendly, flexible, and efficient." Companies like PRA Group, who follow the traditional model of buying distressed debt and hound debtors, better watch their backs...

Furthermore, as Congress continues to debate the scope of debt forgiveness, collection companies need to stay nimble to successfully navigate the space.

While the current times seem like a good opportunity to invest in the debt collections market, disruption is coming for this stubborn industry. Investors should keep an eye on startups in the space to look to break in, as the traditional players continue to use outdated techniques to make a return.

Credit is the lifeblood of the economy...

Credit is the lifeblood of the economy...

As regular Altimetry Daily Authority readers know, we've frequently repeated this point. Without credit, companies can only invest based on the cash flows they generate... but with it, they can accelerate investment when opportunity presents itself.

As important as future investment, credit gives businesses the freedom to refinance or borrow. Without access to credit, companies have to make tough decisions on asset allocation, and even can seize up and disappear if they default on debt they can't refinance – destroying productive capacity.

This leads to an overall economic contraction. For almost every recession other than the one we've seen in 2020, credit crises have been the cause.

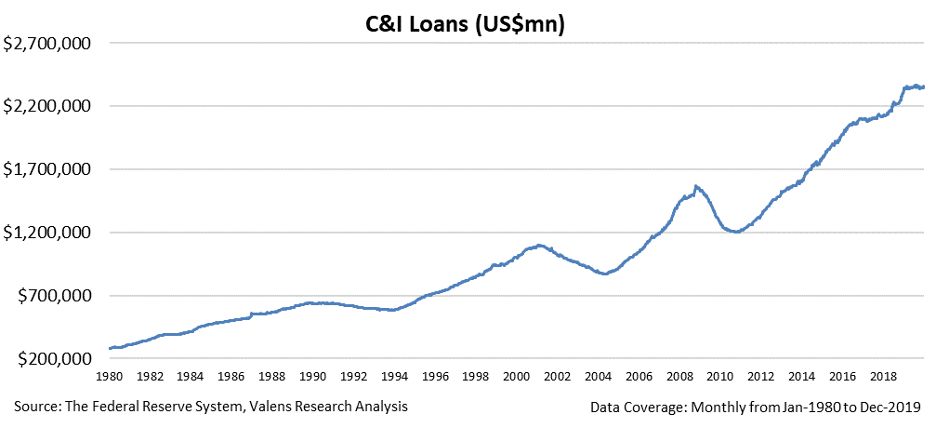

One key metric we analyze to understand the availability of credit is Commercial and Industrial (C&I) loan growth trends. This helps us understand the direction of bank borrowing, as opposed to corporations borrowing in the market by issuing bonds.

C&I loan growth is a great indicator of when economic activity will accelerate. It's also vital for measuring the general pulse of the credit markets. Like the economy as a whole, C&I loans tend to improve for long periods and decline for short, but dramatic bouts. Loan growth is usually in line with economic growth, because it fuels that overall growth.

The chart below shows C&I loans from 1980 to the end of last year. As you can see, it reached short-term peaks in 1990, 2001, and 2008. All these years line up with economic troubles...

In the early 1990s, the economy entered a recession as inflation rose due to continual increases in the federal funds rate. Coupled with an oil price shock, this sent the economy into a short recession.

The early 2000s also saw a recession due to the bursting of the tech bubble, telecom debt-driven spending, and then the 9/11 attacks. Finally, 2008 saw one of the worst recessions in U.S. history due to the mortgage crisis and the end of the housing bubble.

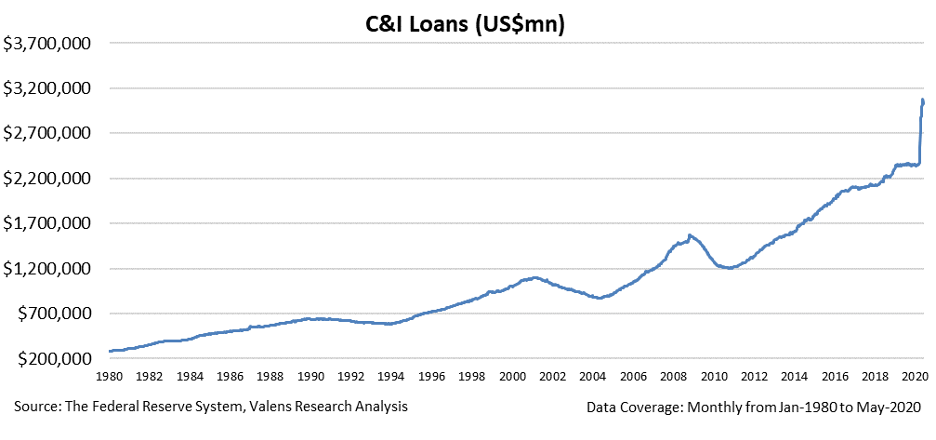

Luckily, despite the current environment, C&I loans are continuing to rise to new highs. Borrowers were able to access a massive influx of money made available since the coronavirus pandemic struck, as central banks and governments everywhere have understood the importance of flooding the economy with liquidity to prevent a credit crunch.

This has been a historic rise... Loans have increased by nearly 25% in a matter of months.

When the pandemic began, many people believed that corporations wouldn't have enough money to survive. Companies undergoing a demand shock would default due to their lack of cash. Economists and investors alike feared consumers would hoard savings, and therefore many businesses would see huge losses in revenue.

This has happened to some extent, but businesses will be able to survive the short-term loss in revenue thanks to easy access to credit.

As the above chart shows, credit has been relatively easy to find. The Paycheck Protection Program, Main Street lending, and bank lending commitments under revolvers and relationship lending have been able to keep businesses afloat.

Companies have borrowed significantly... and more important for the economy, they could borrow aggressively to survive. This is why we haven't seen broader waves of defaults so far.

This may have adverse effects for companies three to five years from now, when these businesses need to refinance... But it's also a necessary step for survival right now.

As long as companies can borrow enough to not default, they should be able to make it past this short-term drop in demand. Then, the hope is that cash flows begin to increase again. At that point, companies can refocus their borrowing on growing the business and managing refinancing.

Regards,

Joel Litman

August 10, 2020

This industry hasn't changed much over the years...

This industry hasn't changed much over the years...