President Donald Trump just kicked nuclear policy into high gear...

President Donald Trump just kicked nuclear policy into high gear...

Last month, the president signed a sweeping set of executive orders that could change the future of American energy.

The directives included a national energy emergency declaration... and a mandate for the Nuclear Regulatory Commission to streamline new reactor approvals within 18 months.

And they instruct the Department of Energy to rebuild domestic uranium supplies.

Make no mistake – this is a full-on mobilization of federal energy strategy. The move couldn't come at a more critical moment.

Electricity demand from AI data centers is skyrocketing. Grid operators are warning of multi-gigawatt shortfalls.

In short, Washington needs fast, scalable energy solutions. And that's great news for one nuclear-energy company in particular...

Oklo (OKLO) specializes in what's called small modular reactors ('SMRs')...

Oklo (OKLO) specializes in what's called small modular reactors ('SMRs')...

SMRs are more compact, cheaper, and faster to construct than conventional reactors. They're also becoming more and more common in the United States.

Trump doesn't just want to speed up reactor approvals and stock up on uranium. He's also calling for the development of SMRs on federal lands and military bases.

That's exactly what Oklo is doing. Its SMRs are designed to be mass-produced, factory-built, and ready to plug into high-demand areas. They're a perfect fit for hyperscale AI campuses and remote industrial operations.

Oklo's flagship design, the Aurora reactor, is already under regulatory review. Once approved, it plans to use Aurora to supply power to a large-scale AI campus.

And the company has multiple other deployment agreements in place.

Oklo's state-of-the-art tech could be exactly what the government needs...

Oklo's state-of-the-art tech could be exactly what the government needs...

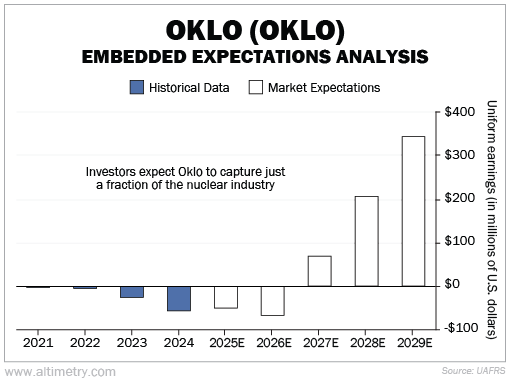

And yet, Wall Street is treating this business like nothing more than a science project. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Oklo hasn't turned a profit to date... and that's a bit of a problem. We aren't in the business of buying unprofitable companies.

But it also has some of the most promising nuclear technology out there. And Trump's latest moves make it clear that a nuclear renaissance is coming.

Nuclear power is already a $39 billion industry in the U.S. But investors expect Oklo to capture less than $350 million in earnings by 2029.

That's less than 1% of today's industry... without factoring in potential market growth.

Check it out...

Oklo doesn't need decadeslong mega-projects to start turning a profit. Its model is much more efficient... think shipping-container-sized reactors that roll off a factory line.

That makes it a perfect fit for today's fast-track regulatory agenda. It should improve much faster than legacy players.

Nuclear is finally in the right place at the right time...

Nuclear is finally in the right place at the right time...

SMRs offer a clean way out of America's energy squeeze. They don't require massive grid overhauls. They're compact and easy to dispatch.

And now, they're becoming a federal government priority.

This is the world Oklo was built for.

We're seeing fast-moving regulatory reform, strong White House backing, and real-world demand from the most power-hungry sectors in history.

Traditional nuclear is notoriously slow and expensive... Oklo is neither. We expect big improvements from this maker of pint-sized reactors.

Regards,

Joel Litman

June 10, 2025

President Donald Trump just kicked nuclear policy into high gear...

President Donald Trump just kicked nuclear policy into high gear...