The year is almost over... Yet the biggest health care deal of 2022 is just getting underway.

The year is almost over... Yet the biggest health care deal of 2022 is just getting underway.

If you missed it, biopharmaceutical giant Amgen (AMGN) recently announced it's acquiring orphan drugmaker Horizon Therapeutics (HZNP).

Horizon has a track record of buying and licensing drugs before they take off... like Krystexxa for gout, and Tepezza, which treats a rare eye disease.

Now, the tricky thing with Horizon is that its drugs treat rare diseases. As a rule, it's better to have more customers rather than fewer. So folks might think that a company selling drugs for niche applications could struggle to make a lot of money.

Major pharma companies disagree.

Before Amgen scooped up Horizon, it was in a bidding war for the biopharma company with other big players like Johnson & Johnson (JNJ) and Sanofi (SNY)... as well as another undisclosed company.

Early bids were kept under wraps, although we know all companies were offering cash. In other words, it was a level playing field. Horizon was able to accept the highest bid.

Ultimately, Amgen closed the deal for $116 per share. That comes to about $28 billion dollars total. At this price tag, it's the biggest biopharma deal of 2022.

Horizon has to be happy about its big payday. And its investment bankers are, too... The bigger the deal, the more money they make.

And Amgen shareholders should be celebrating, too...

And Amgen shareholders should be celebrating, too...

That might not be obvious at first glance. You see, a bidding war is great for the acquired company and the bankers... not so much for the acquirer.

Bidding wars can be dangerous. The winner can end up paying more than it wanted to – possibly even more than it should. This is known as the "winner's curse."

Savvy Amgen shareholders should be wondering what this deal means for their investment.

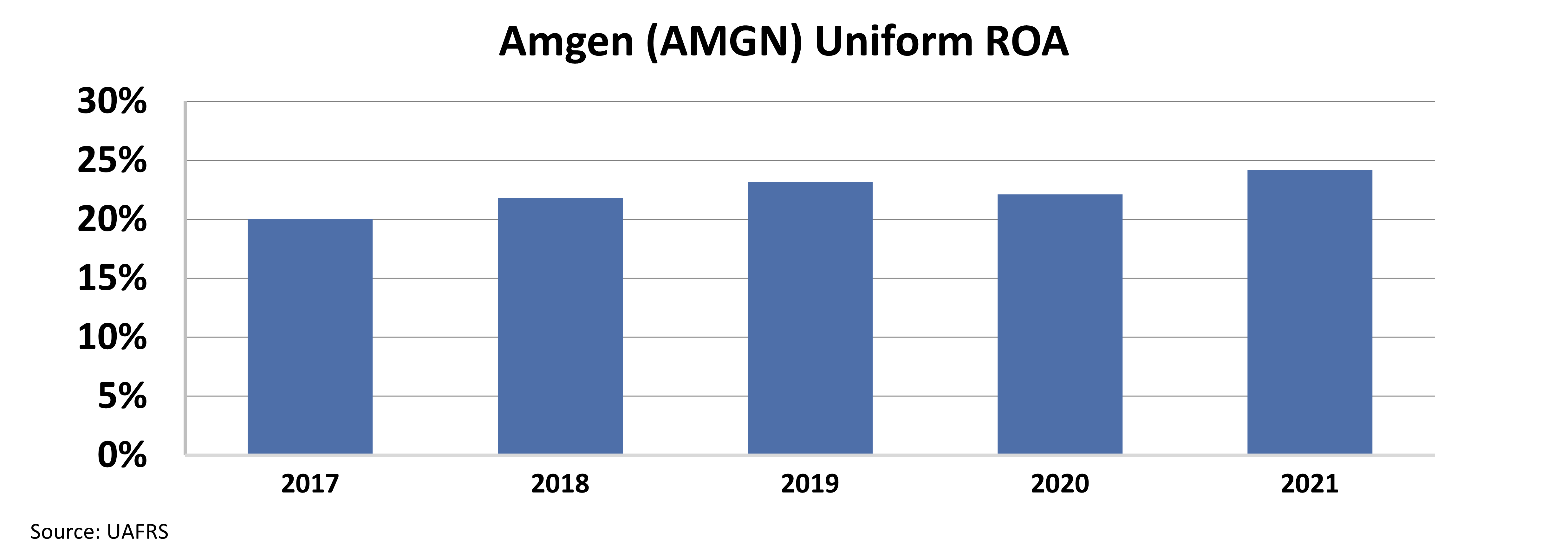

Amgen is a solid business. In the past five years, its Uniform return on assets ("ROA") improved from 20% to 24%. That's double the 12% corporate average.

Take a look...

The key to a good deal is that it should help the acquiring company make more money. Typically, that either means it helps improve returns... or it maintains returns at a much larger scale.

Here's where things get interesting with the Horizon deal...

Here's where things get interesting with the Horizon deal...

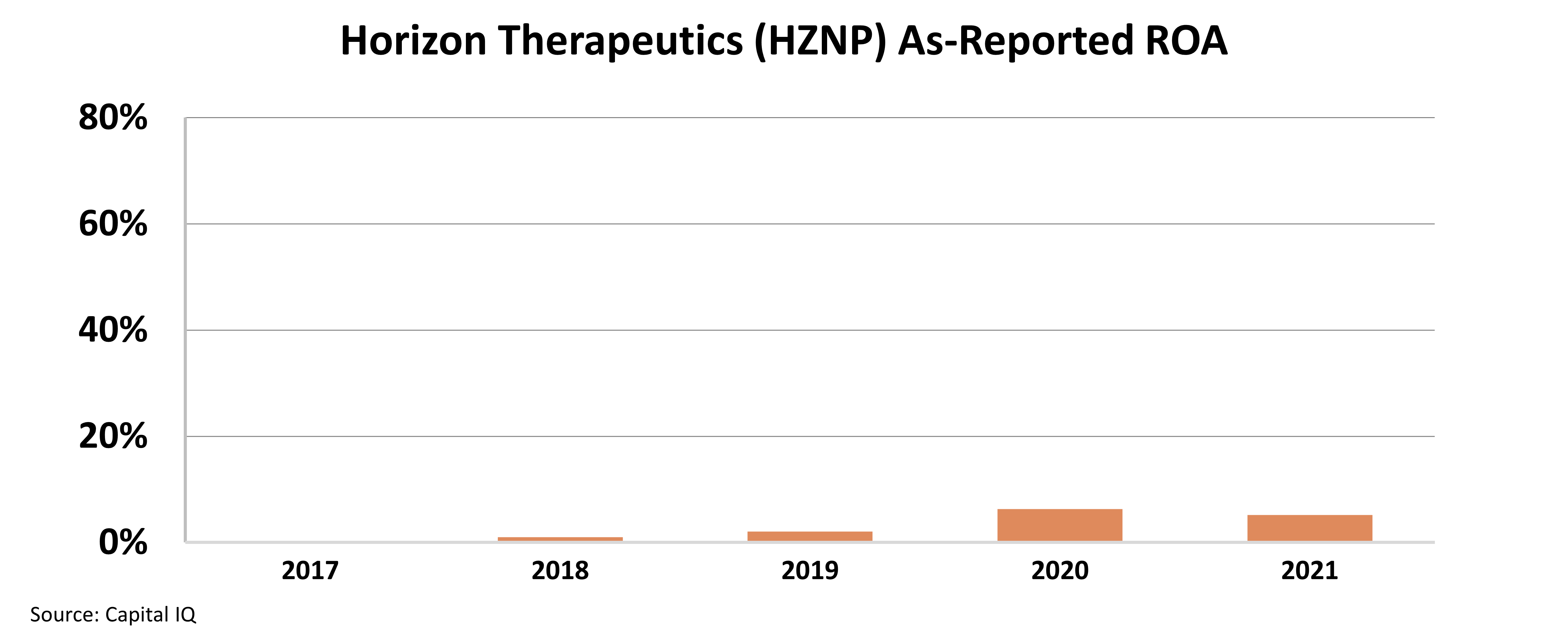

As-reported numbers make it look like Amgen bought an awful company. Horizon's as-reported ROA capped out around 6% in the past five years.

Check it out...

If you only saw Horizon's as-reported figures, you'd think the orphan drug business was a bad investment. It looks like Amgen spent about $28 billion to lower its ROA.

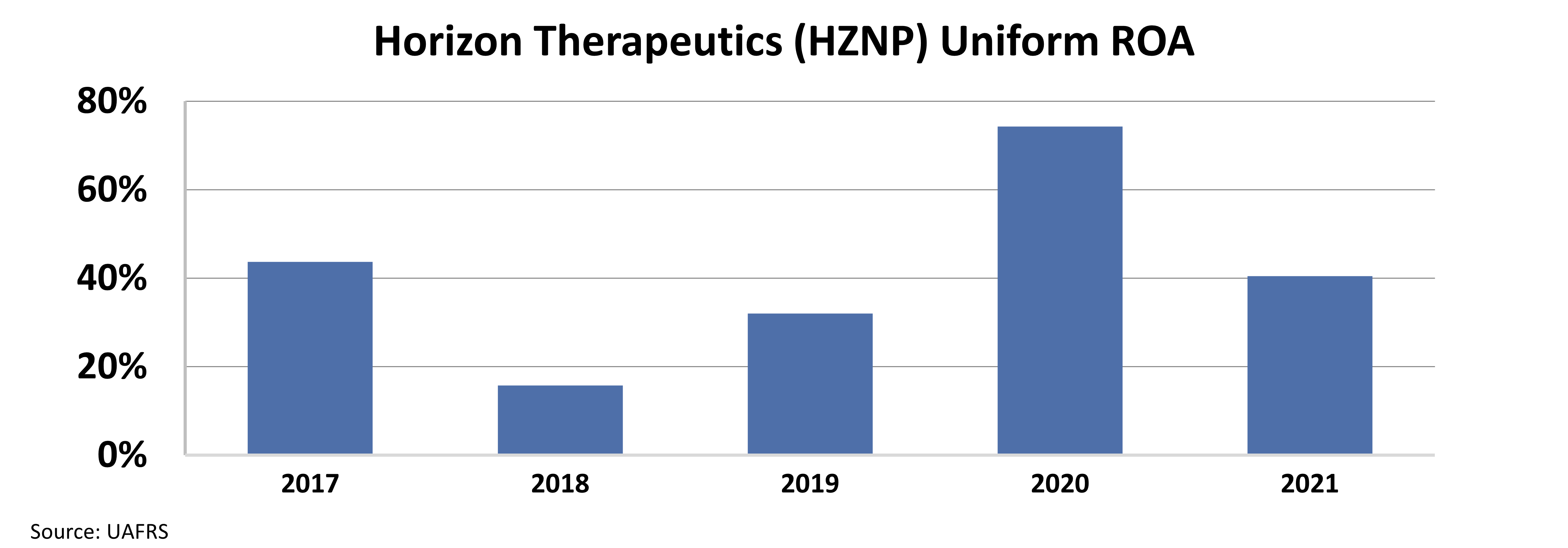

Thankfully, investors can breathe easy. Even though Horizon's drugs don't have a huge market, they're incredibly profitable. Horizon's best asset is its ability to buy drugs with high odds of being successful at cheap prices.

That strategy has led to an average Uniform ROA of about 40% in the past five years...

As it turns out, Amgen made a fantastic deal. It got its hands on a business twice as profitable as its own.

That explains why there was a bidding war in the first place. Horizon is a massively profitable business. These pharma giants knew it.

Amgen's profitability should be on the rise as the deal closes. Shareholders can enter the new year confident in the company's latest purchase.

Plus, Amgen's Uniform price-to-earnings (P/E) ratio is only 15 times today. That's less than the 20 times corporate average. (The P/E ratio measures the value of a company's stock price against its earnings.)

Amgen is trading for cheap today... And it just made a deal that should send profitability soaring. If you haven't bought shares yet, you might want to take a closer look.

Regards,

Joel Litman

December 21, 2022

The year is almost over... Yet the biggest health care deal of 2022 is just getting underway.

The year is almost over... Yet the biggest health care deal of 2022 is just getting underway.