Dear reader,

It's been tough living in a post-Game of Thrones world. Nothing makes a long day pass by faster than knowing you'll be stepping into the world of Westeros after.

However, one of cable network HBO's newest shows, Succession, recently caught my attention...

For the uninitiated, Succession is the story of a billionaire media mogul deciding who should take over as the next CEO of his conglomerate. Don't worry, there are no spoilers ahead... unless you count the ones from the real world.

While the Roy family and its Waystar Royco media empire are fabricated, there are elements of truth woven through the whole narrative.

For instance, the family's wealth and dysfunction are loosely based on some of America's notorious media families, specifically the Murdochs (News Corp) and to a lesser extent, the Redstones (Viacom).

The Roy family's intellectual rival, the Pierce family, most emulates the Sulzbergers of the New York Times fame.

With all of these interesting real-life connections, it's fun to corroborate the storyline to actual events.

More impressively, the show does an excellent job laying out the current media landscape in the U.S.

Logan Roy, the patriarch in his last few years of control at the helm of Waystar Royco, is considering his options. Should he just keep on running the company until he ends up six feet under, hoping the business doesn't also collapse? Should he sell to a competitor? Should he step down and let an outsider run the firm? Or should he let the family continue his legacy?

Towards the beginning of the second season, Logan looks around at his family and closest acquaintances and says, "In three or four years' time, I think there will only be one legacy media operation left. Well, I say let that be us."

Poignant, pointed, and accurate. The media industry is undergoing heavy consolidation.

With the amount of free and digital media circulating every day, traditional subscription-based print publications – what Logan would call "legacy media operations" – are struggling to maintain their readership bases.

The trend in the industry appears to be media companies with shallower pockets putting up with declining profitability until they run out of cash and then selling to a bigger company with extra cash.

This "consolidation" effort has only left a few players standing, and most of them have begun running out of options.

The real-life media industry truly is at a critical point – and Logan Roy is most likely right. Perhaps not his three- or four-year time horizon, but the industry is heading towards a one-or-two-player industry.

Roy is right about something else too – it's probably the real-world equivalent of his own company.

News Corp (NWSA) is the real-life Waystar Royco. Founded and led by Rupert Murdoch, the media conglomerate has amassed an impressive collection of assets...

Even after splitting into two companies in 2013 – wherein the legacy News Corp business was renamed 21st Century Fox – the current News Corp owns media assets across the globe but focuses mainly in the U.S., Australia, and the U.K.

Most notably, News Corp owns Dow Jones & Company, which owns the Wall Street Journal, MarketWatch, and Barron's. It also owns the New York Post, publisher HarperCollins, and News Corp Australia – which controls Fox Sports Australia.

Given its impressive set of assets, News Corp is considered one of the greatest survivors in the media industry. And because of its resilience, investors have taken note.

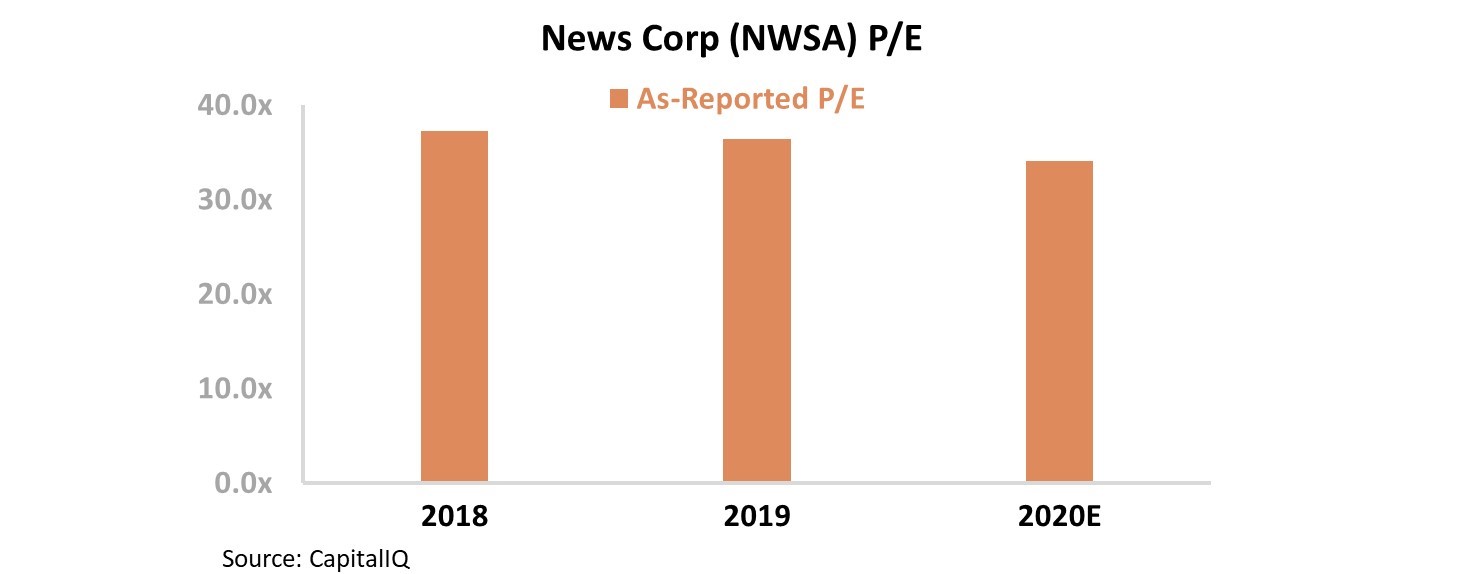

On an as-reported basis, News Corp looks like an expensive stock. The company's price to earnings ("P/E") ratio is 35, which is well above corporate-average levels near 20. Take a look...

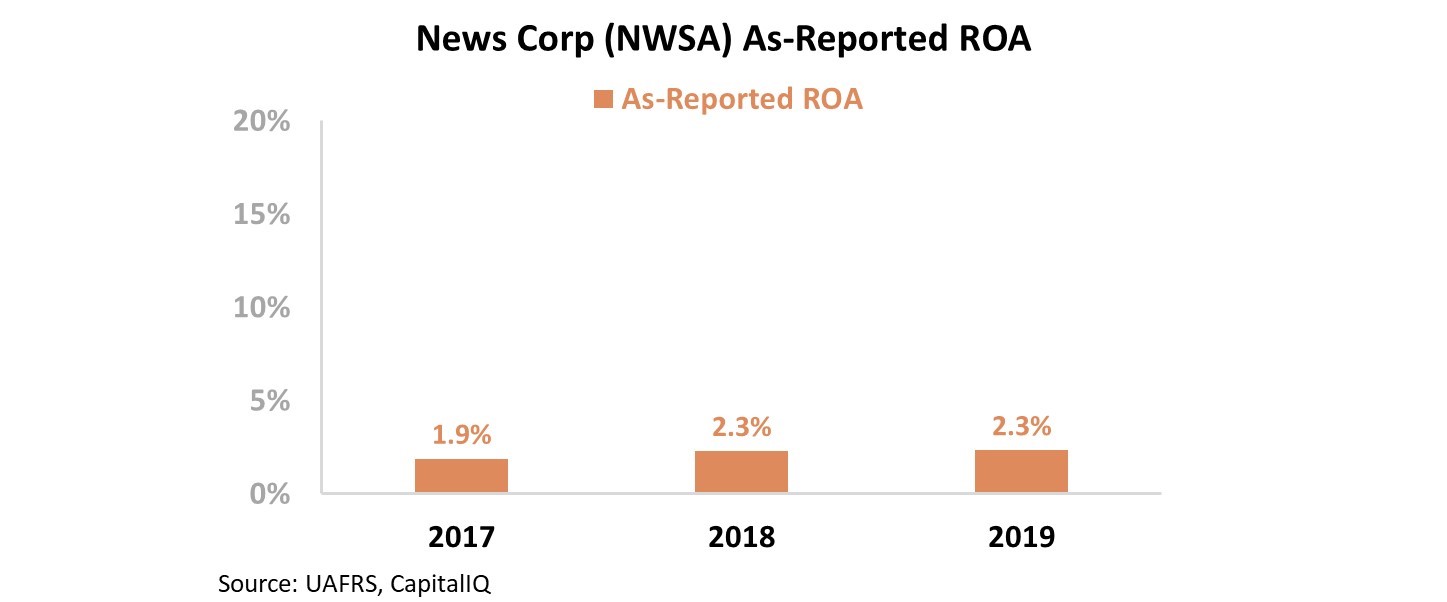

And when looking at traditional accounting metrics like return on assets ("ROA"), it looks like it is only a matter of three or four years before News Corp is out of business. The company's ROA has maintained levels around 2% for the past three years.

A 2% ROA is well below long-term averages of 6%, and it's not even enough to pay investors and debtholders. There's no reason a company with such weak returns should demand high valuations, regardless if it's a survivor.

The problem is, this doesn't tell the real story...

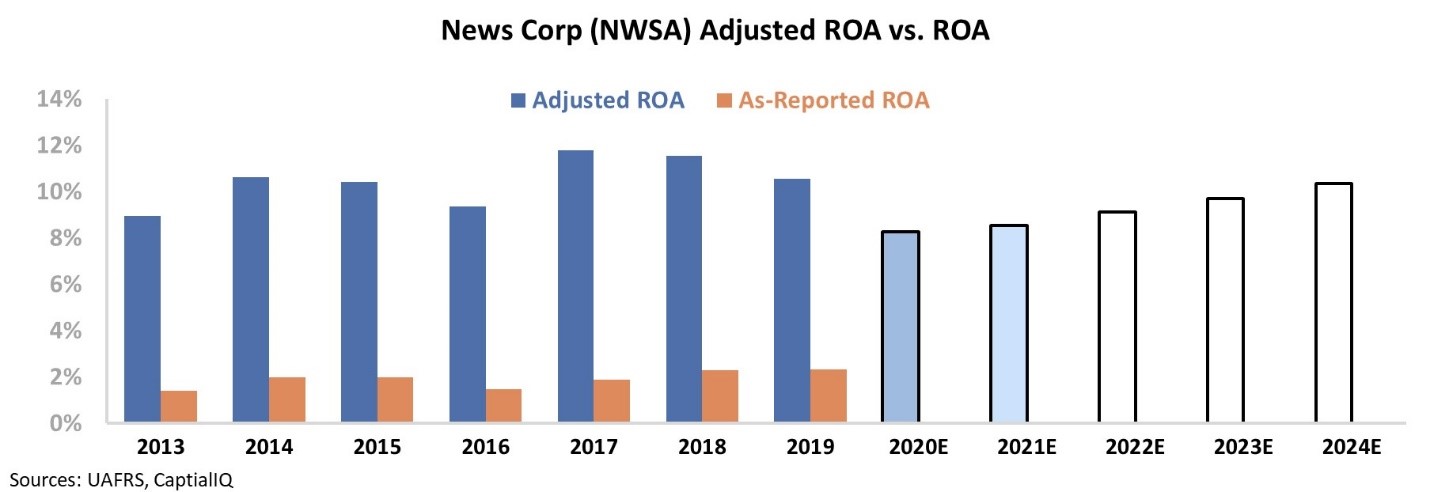

You see, media conglomerates like News Corp typically consolidate less expensive assets as part of the business strategy. When a company repeatedly makes acquisitions, its books are filled with goodwill... which can distort a company's real profitability.

Once we apply our Uniform Accounting metrics – adjusting for inconsistencies like treatment of goodwill, stock option expenses, and operating leases – the real story begins to reveal itself for News Corp. Since splitting off from the legacy business, the company has maintained it ROA in the 9% to 12% range, above long-term corporate averages.

At these levels, it makes sense why investors are willing to pay a premium. The company has stable, strong returns, and it is poised to maintain this position in the long term based on its collection of assets.

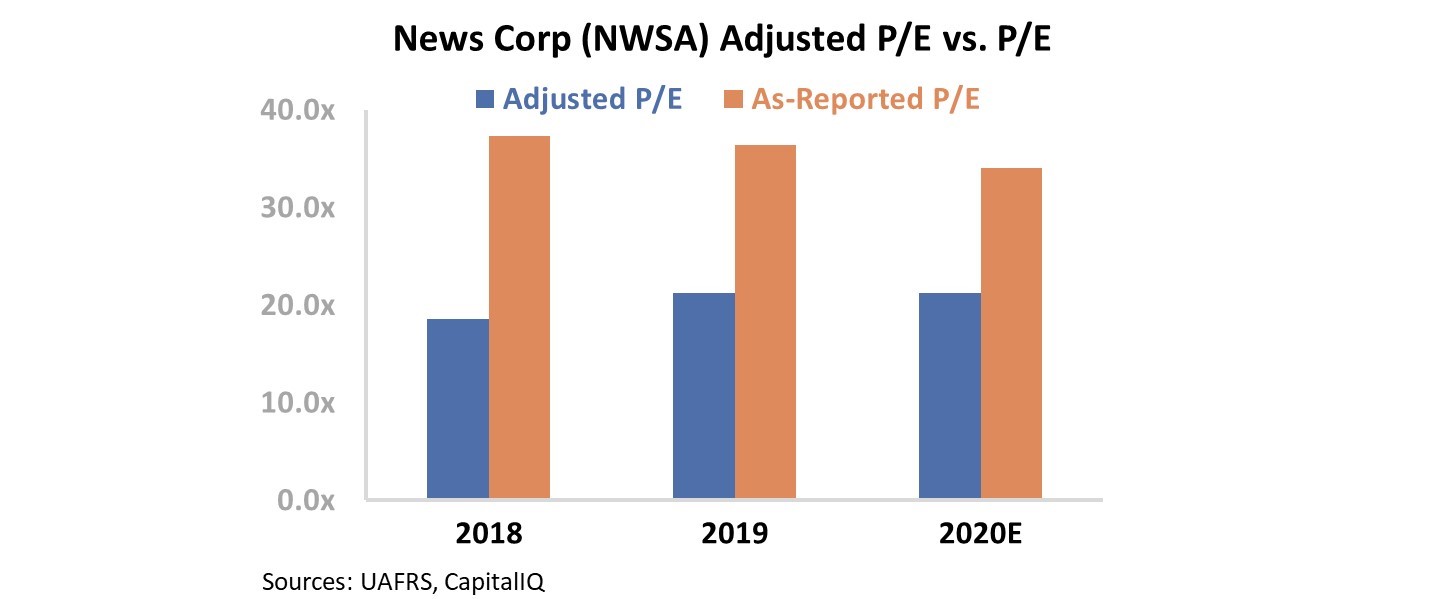

Similarly, using Uniform metrics, we can see that News Corp is not as expensive as investors might think...

In reality, News Corp trades near corporate averages. At these levels, the company shouldn't be considered in the same category as the rest of the failing legacy media industry.

Uniform Accounting shows us a more accurate account of corporate performance. Make sure you're equipped with the best information possible.

Regards,

Joel Litman

November 6, 2019