You should pay attention to the good news on inflation...

You should pay attention to the good news on inflation...

As measured by the consumer price index ("CPI"), inflation only rose by a modest 0.3% in August. That's good news for American consumers.

The slight increase in August represents a significant slowdown from what many were calling "rampant" inflation. Inflation last month was lower than July's 0.5% month-over-month increase – and the August CPI was far lower than what analysts expected.

This demonstrates the transitory nature of inflationary pressures.

Those who've read Altimetry Daily Authority's articles over the past few months know that we have been pounding the table that this inflationary pressure was transitory from the beginning.

But there are many investors on the other side of the debate. These investors are concerned that the rising prices are a direct consequence of federal stimulus and may be longer-lasting.

To their credit, the entire business world has been waiting for months for any sort of proof that this inflation is temporary. After all, the Federal Reserve made a bold decision to focus on employment and growth, placing less emphasis on curbing inflation.

But the recent data may give the inflation alarmists some food for thought. It is no coincidence that inflation has begun to cool just as commodity prices have started to fall.

A fair degree of inflation was driven by the rapid, unsustainable appreciation of various asset classes and production inputs.

We already see that many of these prices, driven by supply chain disruptions, are beginning to moderate.

Do not be fooled by supply chain disruptions masquerading as inflation...

Do not be fooled by supply chain disruptions masquerading as inflation...

Lumber, while still inflated, has fallen to a third of its pandemic highs. We see a similar arc with used car prices, which have fallen by $2,000 over the past two months.

But remember that there are still dozens of supply chain cost components that have not yet rounded the curve.

For example, shipping costs remain high. But once the container shipping business makes a full recovery from the pandemic chaos, those costs will fall, directly impacting the prices of almost everything sold around the world.

We are now learning that one other crucial asset class is returning to reasonable levels.

That asset class is iron ore. It is the second-most traded commodity after crude oil and a critical input for the entire global economy.

Total steel output fell by 8.4% compared with a year ago and is expected to fall further. The culprit is a rapid worsening of China's economic outlook and a sudden slashing of manufacturing activity, hence falling steel demand.

That's great for consumers of iron ore and will help claw back the price increases we've been seeing.

However, it will be a headwind for the producers and sellers of iron ore.

Most people familiar with the industry might immediately think of the big international ore miners like BHP (BHP), Rio Tinto (RIO), and Vale (VALE). They will certainly be experiencing pressure. But there is another player closer to home that's worth discussing.

That company is Cleveland-Cliffs (CLF).

Cleveland-Cliffs used to be a pure-play ore miner, along with the other aforementioned names.

But it has since pivoted to become a vertically integrated steelmaker. It owns everything from the mines to the final fabricated steel that gets sold for various uses worldwide.

Based on The Altimeter, it looks like Cleveland-Cliffs' vertical integration didn't happen a moment too soon...

Based on The Altimeter, it looks like Cleveland-Cliffs' vertical integration didn't happen a moment too soon...

As a steelmaker, Cleveland-Cliffs was never harmed by the sudden spike in input costs because it owned all parts of the process.

Falling ore prices won't harm the Ohio-based company for the same reason. Rather than being tossed around by the tumultuous commodity market, management can focus on operational efficiency, smart acquisitions, and growth.

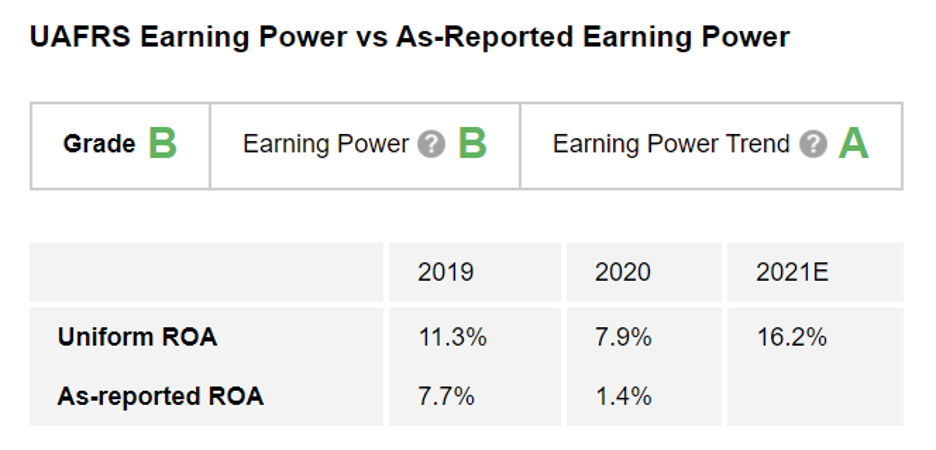

Hence, Uniform ROA is expected to rise to multiyear, double-digit highs for 2021. That sort of productivity is rare among commodity businesses.

Cleveland-Cliffs only earns a "B" for productivity despite its relative strength because the commodity business is far less lucrative than many others.

But the steel producer earns a resounding "A" grade for Earning Power Trend because of its resilience to supply shocks and its newfound vertical integration.

Moreover, the market doesn't appear to recognize the strength. Cleveland-Cliffs also earns an "A" grade for both valuations metrics.

Check out the full Altimeter grades for Cleveland-Cliffs:

At Altimetry, we use Uniform Accounting to identify potential gems in the rough before these stocks are picked up by the investing community and rocket higher...

At Altimetry, we use Uniform Accounting to identify potential gems in the rough before these stocks are picked up by the investing community and rocket higher...

We also know when to recommend or avoid a particular stock from decades of experience conducting "fundamental forensics" on companies of all sizes.

Our monthly newsletter Altimetry's Hidden Alpha details our large-cap, safe stock recommendations with major upside potential ahead...

And our repeatable process, accounting insights, and deep fundamental research have led us to average returns of 43% in the Hidden Alpha portfolio.

If you aren't already subscribed, you can learn more about Hidden Alpha – and how to gain instant access to the full portfolio of open stock recommendations – by clicking here.

Regards,

Joel Litman

September 30, 2021

You should pay attention to the good news on inflation...

You should pay attention to the good news on inflation...