Clean energy is among President Joe Biden's biggest priorities...

Clean energy is among President Joe Biden's biggest priorities...

Before the geopolitical conflict in Ukraine caused a dramatic spike in the prices of hydrocarbons, one of Biden's main goals was to prioritize renewable energy investments.

Wherever possible, the Biden administration has pushed for greener energy and whatever tools possible to reduce pollution with the advocation of the Green New Deal. This congressional plan lays out a plan for tackling climate change.

Biden has pushed for large parts of his infrastructure bill to focus on green energy investment, including unsuccessfully pushing for the United States Postal Service (USPS) to move from gas-powered to electric vehicles.

In some ways, the Green New Deal has some of the hallmarks of President Franklin D. Roosevelt's ("FDR") New Deal program of the 1930s, which is often associated with massive federal government intervention through public works projects and financial regulations.

Thanks to the New Deal and World War II government spending, the U.S. managed to claw itself out of the Great Depression. And today, the legacy lives on.

FDR established the Tennessee Valley Authority ("TVA") as a federal corporation in 1933 to provide power across the Southeast during the Great Depression. Today, it's the third-largest electricity provider in the U.S., providing power to nearly 10 million people throughout the region.

TVA announced earlier this month that it would invest $3.5 billion to transition from old coal power plants to new natural gas power plants.

While some people are happy that TVA is moving to less pollutive energy sources, its plan doesn't necessarily align with Biden's goal of truly clean and renewable energy.

Thanks to TVA's structure, it's unlikely the Biden administration can do anything...

Thanks to TVA's structure, it's unlikely the Biden administration can do anything...

TVA is federally owned, but it's managed independently by a board of directors. Many of those on the board were appointed by President Donald Trump and are less enthusiastic about investing in green energy.

While Biden may not be thrilled, another group is excited about TVA's efforts.

TVA's announcement has been heralded as a new wave of investment for the companies that build natural gas power plants.

A prime example of one of those companies is Quanta Services (PWR). The construction and engineering company provides specialty contracting services and delivers infrastructure solutions for electric and gas utility, pipeline, and energy companies.

TVA's plans mean more spending on infrastructure, which creates the space for power plant builder companies like Quanta Services to step in.

In 2021, Quanta Services generated 74% of its revenues from projects with electric and gas companies, and now it's ready to take a piece of TVA's $3.5 billion energy transition budget.

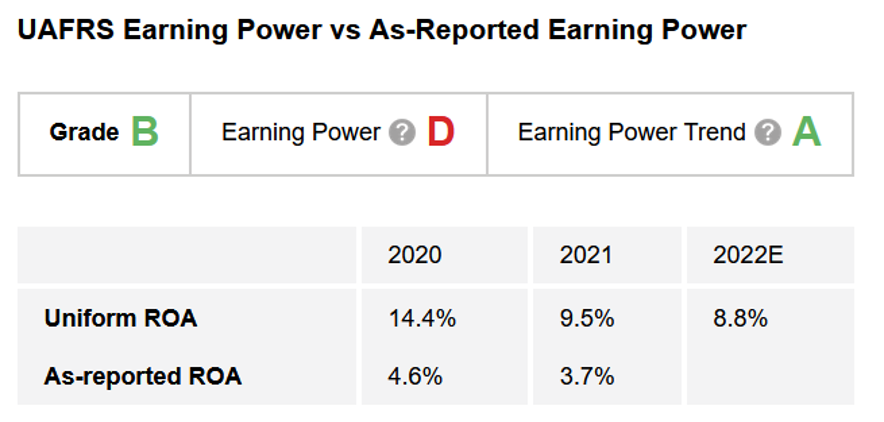

The Altimeter, which shows users easily digestible grades to rank stocks on their real financials, shows that this potential infrastructure spending would be great for Quanta Services.

Even though Quanta Services has a low "D" Earning Power grade, as Uniform return on assets ("ROA") is below corporate averages at 9% in 2022, we see the company has a strong "A" Earning Power Trend grade. This is because Uniform earnings per share are forecast to jump from $4.15 in 2020 to $6.25 in 2022, thanks to higher spending on all the infrastructure it supports.

So as companies like TVA start to spend more on building power plants, Quanta Services is projected to see more profitability.

Does this mean Quanta Services is a buy?

Does this mean Quanta Services is a buy?

The Earning Power Trend grade might be good news for the investors of Quanta Services. But this doesn't automatically mean Quanta Services is one to buy, as the market might already be pricing this in. We also need to see the valuation of the company.

Subscribers to The Altimeter can see how Quanta Services is valued based on Uniform Accounting and if the story is correctly priced by clicking here. Using The Altimeter, you can see how its stacks up with other power customers and among more than 5,000 other U.S.-listed companies.

Regards,

Rob Spivey

March 31, 2022

Clean energy is among President Joe Biden's biggest priorities...

Clean energy is among President Joe Biden's biggest priorities...