The chip race is heating up...

The chip race is heating up...

Microchips, and by extension silicon, power every electronic device on the market today.

As these chips are the foundation of all electronics, it is no surprise that the companies that design them are considered the pioneers of Silicon Valley.

But some of these early pioneers are finally beginning to show signs of pressure.

Rumblings started to grow in 2021 that Intel (INTC) was falling behind in the chipmaking race. While the tally is still being confirmed, the market hasn't been waiting for the actual counting to note the clouds over the business.

Looking at the numbers we have, it would appear Samsung Electronics' (BC94.L) chipmaking revenue will finally exceed Intel's for the first time.

By overtaking Intel, Samsung becomes the largest chipmaker globally in revenue.

A change in strategy is in the works...

A change in strategy is in the works...

The revenue dip shouldn't come as a major surprise for anyone watching this chipmaking race.

Intel has been focusing on pivoting its strategy since its new CEO, Pat Gelsinger, returned to the firm in early 2021.

Instead of maintaining the status quo strategy of building all the chips a computer needs, Gelsinger is directing the company's efforts toward a more concentrated manufacturing strategy.

The Intel CEO has been focused on making higher-value complex chips, such as the central processing unit ("CPU"), where it specializes.

The other point of emphasis has been designing the chips and building them. Being a chip foundry has been successful for competitors Taiwan Semiconductor Manufacturing (TSM) and Samsung.

By reducing Intel's diversity of innovation and focusing on its already strong footprint in manufacturing, he hopes to capture the lightning the other two companies have bottled.

Are Intel's strengths and prospects being overlooked?

Are Intel's strengths and prospects being overlooked?

With several major competitors and a shrinking market share, it makes sense that some investors are bearish on Intel these days.

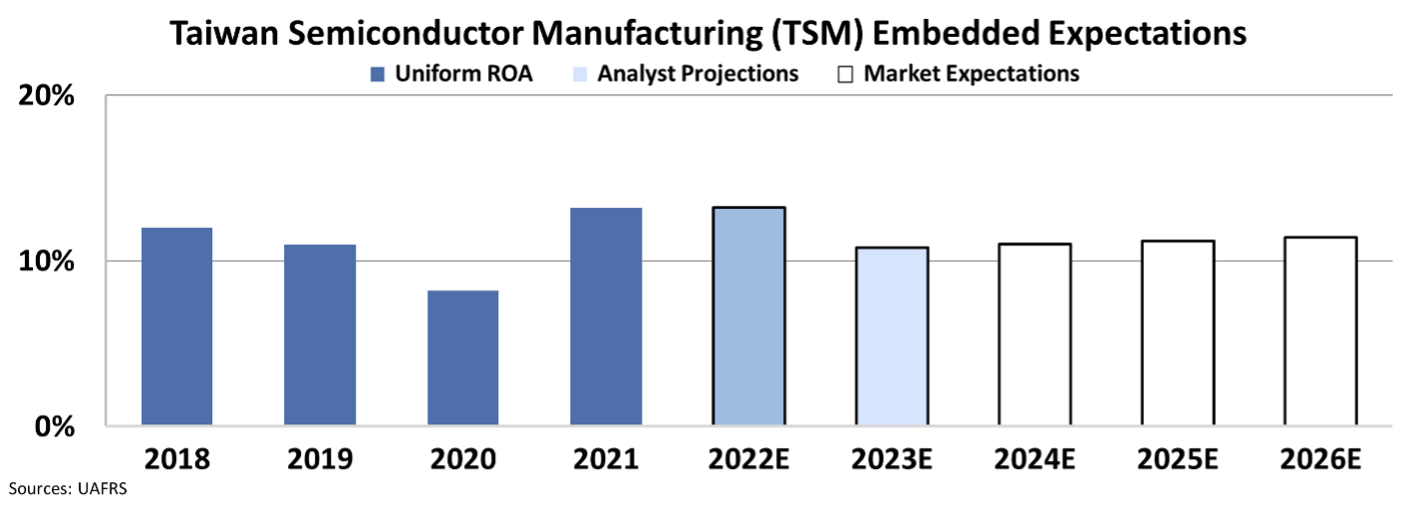

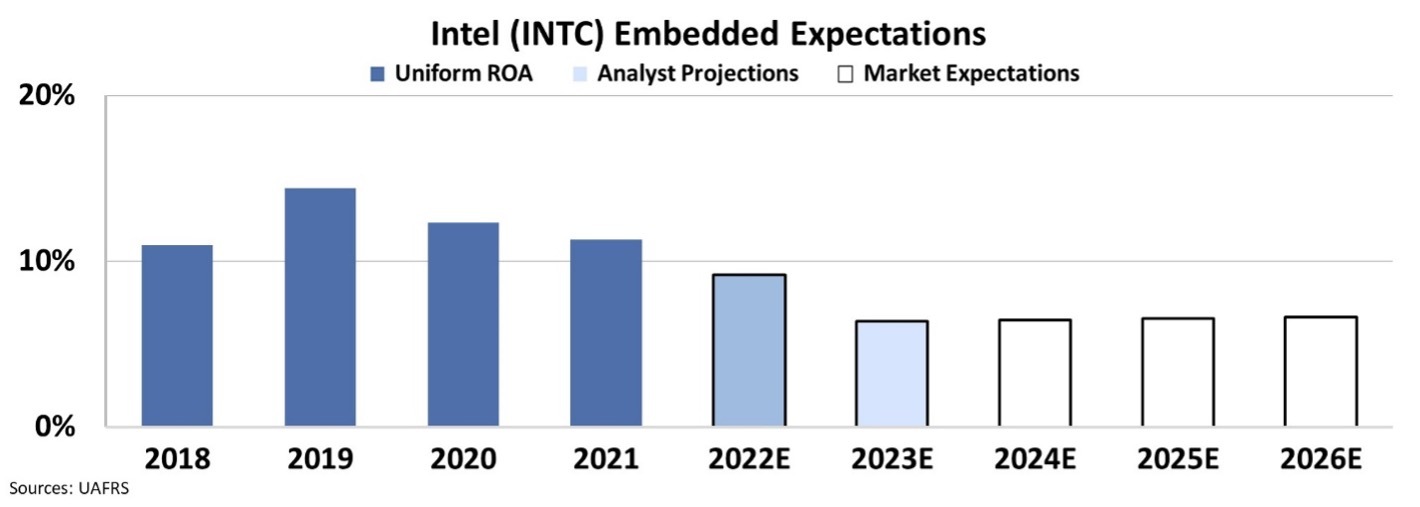

Comparing Intel to Taiwan Semiconductor through a Uniform Accounting lens shows why he's focused on this shift in strategy. If Gelsinger gets it right, Intel stock could see sizable upside.

When we look at TSM stock, its return on assets ("ROA") compared with Intel's look eerily similar, both hovering just above 10% levels.

But the story begins to pivot when we look at how the market is pricing the growth of these firms over the next few years.

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

While both businesses have similar returns, market expectations are wildly different. TSM is expected to see its returns continue to expand over the next few years, thanks to strong demand. Meanwhile, Intel is expected to see returns crater over the next few years.

There are no guarantees that Gelsinger will successfully pivot Intel to a strong chipmaker once again. But the market is already pricing in this "doom and gloom" scenario. That means Intel could very easily surprise the market with a successful pivot.

So is Intel a good stock to buy?

So is Intel a good stock to buy?

Even with a strengthened team in management, the $200 billion company could still struggle to meet the market's expectations for earnings growth.

Plus, there are far better tech stocks out there...

From our recent testing, we discovered a certain genre of tech stocks with a 96% win rate. Their winning formula has outperformed the S&P 500 Index by more than 5 times over the last five years.

In my recent video, I explain how this niche has become such a winning strategy and led us to uncover the next big tech name that Wall Street is missing...

Click here to watch the video.

Regards,

Joel Litman

February 9, 2022

The chip race is heating up...

The chip race is heating up...