When Federal Reserve Chair Jerome Powell first hiked interest rates in March 2022, folks worried he was too late...

When Federal Reserve Chair Jerome Powell first hiked interest rates in March 2022, folks worried he was too late...

Inflation had already hit 8.5%. The unemployment rate had fallen to 3.6% – about as low as it gets. The economy was way too hot. And the Fed finally realized it had to step in.

Since then, the central bank has raised rates faster than any other time in history. Fifteen months and 10 rate hikes later, the federal-funds rate has climbed 5%.

The only other time we've come close to this fast of a rate-hike cycle was from 1988 to 1989. Back then, the Fed raised rates about 3.25% in 14 months.

If you look at the data surrounding our economic health, you might not know we've gone through a rate-hike cycle of epic proportions. Sure, inflation has started to come down. It dropped from 6% in January to 4.9% in April.

But that's still way above the long-term target of 2%.

The Fed doesn't just pay attention to inflation when thinking about the economy. It follows a "dual mandate" – a 2% inflation target and a 4% to 5% unemployment target.

The unemployment rate is still around 3.7% as of May. That's unsustainably low.

Back in January, we predicted the Fed would keep hiking rates. We were right... and there's still a 20%-plus chance of another increase this month.

Even with all the headlines about banks getting taken down by short sellers, the economy still looks pretty hot. But as we'll explain today, the façade is starting to crack. And the situation could change quickly from here...

Both consumer and corporate balance sheets have been healthy for years...

Both consumer and corporate balance sheets have been healthy for years...

That's part of what was keeping the economy cooking.

Before COVID-19, a lot of credit metrics showed companies had plenty of liquidity. Similar metrics showed consumers weren't overstretched, either.

Pandemic-era stimulus meant corporate and consumer balance sheets were even more flush with cash. Those same policies also helped folks refinance debt and push maturity dates further into the future.

It generally takes some time for interest-rate hikes to make their way through the economy. Debt doesn't all reprice at once just because the Fed raised interest rates by 25 basis points.

As debts mature and borrowers refinance – and as floating rates rise – borrowers slowly start to feel the pain. And this time, cash-filled balance sheets added some padding.

It might take even longer for higher rates to hit home... but they will eventually.

And the data is finally confirming that this economy isn't bulletproof after all...

And the data is finally confirming that this economy isn't bulletproof after all...

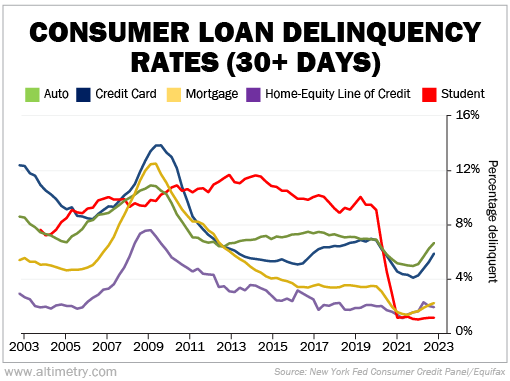

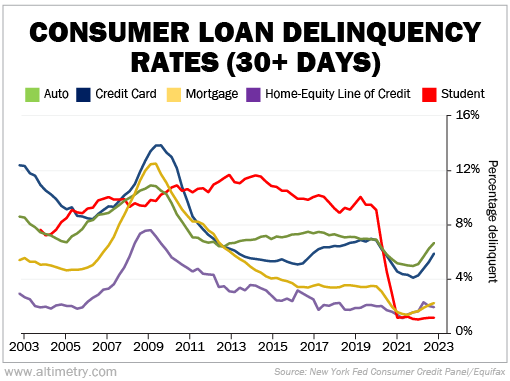

Just look at the following chart. It shows the percentage of consumer loans that are at least 30 days delinquent in any given period, for every first quarter in the past decade.

Across many types of consumer loans, delinquency rates have been creeping up for a few quarters. That's true of credit cards, auto loans, and even mortgages. Overall delinquency rates remain historically low, but they're on the rise...

This is the first clue that borrowers have fallen on hard times. These folks don't just go from healthy to defaulting. First, they delay payments to buy time. We're seeing that in the first cut of data... More payments are at least a month late.

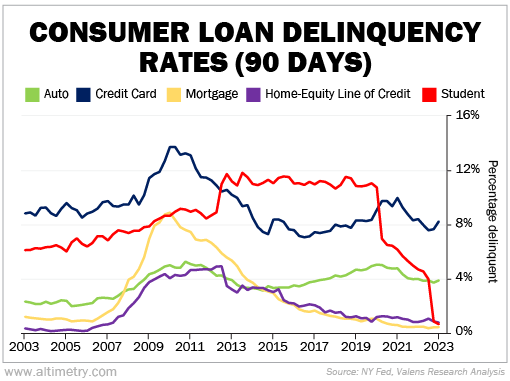

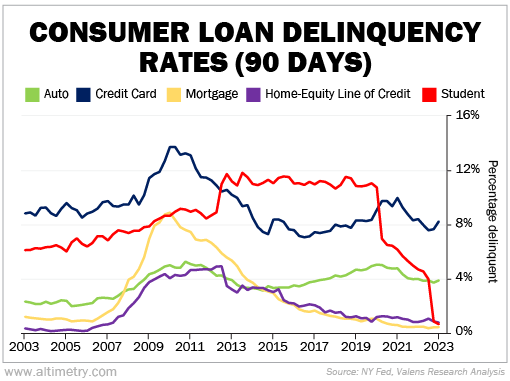

What was at first only modest issues with repayment is getting worse. Consumer stress is really starting to show in some areas...

As you can see in the next chart, loans that are more than 90 days delinquent are approaching the point of no return. Lenders are starting to worry they might never get paid back.

Ninety-day delinquencies for credit-card loans are rising. Delinquencies in auto loans, which were falling steadily for years, have started to plateau before a potential rise.

Take a look...

Notice that while delinquencies are on the rise, they're rising from a historically safe place. Across almost every type of loan, delinquencies are below pre-Great Recession levels.

This is what we mean when we say folks had "historically strong balance sheets." Consumers have been so awash with cash that for the most part, delinquencies and defaults have remained very low.

But high interest rates are starting to take their toll. There's no denying it.

The same is true in the corporate world...

The same is true in the corporate world...

Commercial and industrial (C&I) loan charge-offs are on the rise... a sign that the Fed's rate hikes are working. But they're also rising from historically low levels.

For the past three recessions, C&I charge-offs reached at least 0.6% before we officially hit a downturn. The rate is about 0.3% today.

We're not telling you all of this to make you worry. We don't expect this small rise in delinquencies to send us into a recession tomorrow.

Rather, we're letting you know that the Fed's actions of the past 15 months are finally taking hold in the economy. When people can't pay back their debts, it leads to credit destruction. We're starting to see that in earnest now.

Things can move fast from here in the credit world. We'll keep an eye on the credit markets – both credit availability (lending) and corporate and consumer credit health.

In the meantime, we certainly don't think stocks are about to take off. Credit issues are building. We're still stuck in a range-bound market... and we're likely at the higher end of the range right now.

We'll let you know if anything changes, for better or for worse.

Regards,

Rob Spivey

June 12, 2023

When Federal Reserve Chair Jerome Powell first hiked interest rates in March 2022, folks worried he was too late...

When Federal Reserve Chair Jerome Powell first hiked interest rates in March 2022, folks worried he was too late...