Higher interest rates have effectively frozen the U.S. housing market...

Higher interest rates have effectively frozen the U.S. housing market...

Even after falling from a multidecade high of 8.5% back in October, the rate on a 30-year mortgage is still about 7.4% today.

That's making it nearly impossible for folks to buy a new home, especially considering housing prices are still sky-high...

In the months leading up to the pandemic, the average sales price for a home in the U.S. was $383,000. It climbed to as high as $553,000 in the fourth quarter of 2022 and has only come down slightly to about $513,000 today.

Right now, the housing market is stuck...

It's bad enough that folks are struggling to buy homes. Now, nobody wants to sell them, either.

As we'll explain today, this setup is threatening to upend the U.S. housing market... and it's yet another warning for the coming recession.

Good luck buying a house...

Good luck buying a house...

Home prices are still elevated today. However, as we mentioned earlier, they are starting to come down.

That being said, folks who just bought their house within the past few years won't want to sell at a loss unless they absolutely have to.

And longtime homeowners are in no rush to sell their homes, either... Between the Great Recession in 2010 and early 2022, mortgage rates averaged less than 4%. That means there was more than a decade for folks to lock in a low mortgage rate.

Indeed, 69% of mortgaged U.S. homeowners have an interest rate less than 4% today. On the flip side, only 2.5% are paying the current mortgage rate or higher.

So not only are folks hesitant to buy homes... those who locked in cheap mortgages aren't looking to sell.

That's completely drying up the existing-home market...

That's completely drying up the existing-home market...

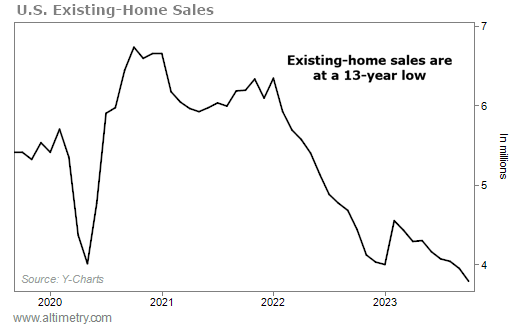

In October, existing-home sales reached their lowest level since 2010.

They slowed to 3.79 million, which is down about 15% from the prior year.

Take a look...

It doesn't look like the situation in the housing market will turn around anytime soon, either... Pending home sales just dropped to a 20-year low.

The housing market is critical to the health of our economy. Studies have shown that affordable housing helps grow employment. And home equity is one of the most important assets a household has.

If people are unable to buy a home – and unwilling to sell their home – it actually hurts folks' ability to get or switch jobs... and to access one of their largest sources of capital.

And remember, banks are far less willing to lend today than they were early in the pandemic. So this is the worst possible time for people to not have housing liquidity.

Financially strapped consumers could speed along a recession...

Financially strapped consumers could speed along a recession...

A deteriorating real estate market will make consumers less financially secure.

And when consumers aren't secure, that means they are going to spend less...

As we explained earlier this week, this could trigger a "consumer feedback loop." Folks spend less money, which hurts businesses, which then causes unemployment to rise... And pretty soon, we're in a recession.

Regards,

Joel Litman

December 7, 2023

Editor's note: Those hoping that the markets will return to "normal" next year are in for a rude awakening... Joel predicts we'll see one of the most volatile bull markets in all of financial history.

According to Joel, next year will be brutal for most investors. Those who would have been considered "financially successful" before could struggle to retire at all now that the era of easy money is over.

That's why last night, Joel and his friend and founder of Chaikin Analytics Marc Chaikin teamed up to provide a "financial lifeline" for subscribers. Their tried-and-tested approach is designed to act as a safe haven for your money... with two systems that instantly doubled their existing gains when combined.

There's still time to heed their warning – and to take advantage of four free, actionable recommendations. Click here to watch the replay now.

Higher interest rates have effectively frozen the U.S. housing market...

Higher interest rates have effectively frozen the U.S. housing market...